Did you know that 90% of the world’s millionaires have built their wealth by investing in real estate?

At some point in your life, you’ve probably heard it said that real estate is one of the best things to invest in because on both sides, commercial and residential, you’re investing in something with the confident expectation that you will receive more money back later down the road.

While it’s true that real estate can be one of the best ways to grow your wealth, the problem is that many people are missing the information and education to really do it well.

And that’s where we come in!

Our mission at XSITE Capital is to educate and encourage all who qualify to passively invest in multifamily real estate so they can take advantage of the benefits that this asset has to offer.

Regardless of your race, current resources or access, we believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

We ultimately believe that through proper education, exposure and encouragement, our investors will have an equal opportunity to grow their mind and grow their wealth, which will positively impact generations to come.

Wherever you come from, you are welcome here!

With that said, over the years we’ve adopted 5 principles that guide us forward as a team and help form long-term relationships with our investors.

Both of these principles combined make up the foundation of how we work!

We believe these two things are truly the cornerstone of any successful business and we’re committed to upholding the highest standards of honesty and integrity in all our dealings.

Honesty involves transparency and truthfulness in all interactions, from communication with customers to internal operations as a team. It establishes trust and fosters long-term relationships.

Meanwhile, integrity involves upholding strong moral principles, ensuring that actions align with ethical standards, and taking responsibility for decisions and their consequences.

Together, these principles create a foundation of credibility, reliability, and respect within the business, forming the basis for a solid reputation and sustainable success.

In business, there are of course going to be challenges that come your way.

But instead of viewing challenges as setbacks, we choose to see them as opportunities and stepping stones for the growth that we ultimately desire.

Growth mindset involves the belief that abilities and intelligence can be developed through dedication and hard work, fostering a passion for learning and resilience in the face of challenges.

Additionally, abundance mindset focuses on the belief that opportunities and resources are not finite, encouraging a mentality of collaboration, sharing, and a proactive approach to creating new possibilities.

Together, these mindsets fuel a culture of continuous improvement, adaptability, and a proactive outlook that empowers individuals and the business to thrive in a rapidly changing landscape.

We’ll be honest and say it: real estate isn’t for the faint of heart.

It requires hard work, dedication, and the motivation to KEEP GOING even when times feel hard or confusing.

At XSITE Capital, we don’t let any of those things scare us away and even in the hard times we stay on mission and laser focused with the bigger picture in mind.

That’s what it means to have tenacity. It’s about relentless determination and perseverance to pursue goals despite obstacles or setbacks.

It’s the unwavering commitment to pushing forward, adapting strategies, and remaining resilient in the face of challenges.

Tenacity is the driving force that propels individuals and businesses toward their objectives, even when the path is fraught with difficulties.

It fuels the willingness to learn from failures, adjust approaches, and keep moving forward, ultimately leading to success through persistence and resilience.

We stay the course, steadfast in our commitment to achieving our goals.

In business, when you start experiencing success, it can be easy to get caught up in your wins and forget what got you there.

At XSITE Capital, despite our achievements, we remain grounded. We listen, we learn, and we evolve. This is what it means to keep humility at the center of who you are.

Humility involves a genuine recognition of one’s limitations, an openness to learning from others, and a willingness to acknowledge and value different perspectives.

It fosters a collaborative and inclusive environment, where individuals are receptive to feedback, open to new ideas, and willing to work cooperatively towards common goals.

It’s the quality that keeps egos in check and allows for continuous improvement, making it an essential trait for building strong relationships and a healthy work culture!

And lastly, at XSITE Capital, we’re not afraid to break the mold!

We’re innovators, trendsetters, and completely unafraid to stand out in the crowd.

We constantly strive to bring fresh, innovative approaches to the table, challenging the status quo in pursuit of excellence.

In the world of business, there are a lot of people out there doing the same or very similar things to us – and that’s okay.

But we’re dedicated to doing it OUR way, in a way that serves our community of investors like never before.

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

Here are a few ways you can learn and connect with us:

Every month on the blog, you can find a new blog post that answers the questions that many people don’t talk about when it comes to investing in commercial real estate.

Our goal is to make things as simple as possible for you so that you can easily understand the benefits waiting for you on the other side.

In addition to the blog posts each month, we like to get face to face with you and provide valuable, free education.

Monthly meetups feature talks from the XSITE founders in addition to other trusted and highly sought after industry leaders to educate on various topics.

Past meetup topics have included:

All monthly meetups are totally free and anyone is welcome to join!

For all monthly meetup information, CLICK HERE.

Are you struggling with underwriting deals and evaluating potential investments? This bi-weekly underwriting class event hosted at 8pm EST on Tuesday evenings is just what you need to take your skills to the next level. Led by XSITE team member, Emanuel Awasom, this event will provide a comprehensive deep-dive into underwriting, from the basics to the most advanced techniques.

Investors of all levels are encouraged to join, from beginners looking to build a strong foundation to experienced investors seeking to refine their underwriting skills.

To register for the Underwriting Class, CLICK HERE.

Looking for more personal and professional development?

Subscribe to our exclusive LinkedIn newsletter featuring monthly stories and strategies for personal and professional growth.

Our annual e-book is another free resource that anyone can download that aims to dive deeper into one topic regarding investing in commercial real estate.

CLICK HERE to grab the 2023 copy!

We’re excited to announce the launch of ‘Multifamily 101’, our latest initiative designed to guide you from being a beginner investor to mastering the art of managing a $168 million real estate portfolio.

Multifamily 101: Your Pathway to Mastery in Real Estate Investment

‘Multifamily 101’ is not just a course; it’s a comprehensive system that provides the knowledge and tools necessary for acquiring real estate properties with ease and maximizing returns. We’re offering this transformative experience in three distinct formats:

1:1 Mentorship: Dive deep into the world of real estate investment with personalized guidance from the XSITE Capital founders themselves. Tailored to meet your individual needs, this mentorship is an opportunity to gain insights from seasoned professionals and accelerate your growth.

Group Coaching (Starting January): Join a community of like-minded individuals and learn together. Our group coaching sessions are interactive, collaborative, and focused on shared learning and growth in the realm of real estate investment.

Self-Paced Digital Course: Prefer learning at your own pace? Our digital course covers everything you need to know about multifamily real estate investing. It’s comprehensive, accessible, and designed to fit into your busy schedule.

We have a few exclusive spots remaining for our 1:1 mentorship and group coaching programs. Don’t miss this unique opportunity to learn directly from the founders of XSITE Capital and significantly accelerate your path to financial success in real estate.

Overall, we are committed to providing relevant and valuable information and education for those who are interested in experiencing financial freedom and creating legacy wealth through multifamily real estate investing.

We are glad you’re here!

– The XSITE Capital Team

As an inspiring investor, one of the greatest things that you can do for yourself to succeed in your investment journey is to commit to learning from those ahead of you.

This really goes for anything in life, but especially investing!

When you pay attention to those who have gone before you and continue to be successful in their journeys, you can potentially avoid some of the mistakes they made, implement some of the things that they wish they would’ve done, and ultimately reach your desired goals even faster than imagined.

Here at XSITE Capital, we took it upon ourselves to gather what some may consider to be million dollar advice, so that YOU can learn it and soak it in too… all for free!

We asked 10 real estate/wealth professionals the same question:

”What 1 tip would you give to your younger self before jumping into your investor’s journey?”

But before we give you that advice, we must warn you: it might not be as groundbreaking as you might expect.

Oftentimes in life, it’s tempting to breeze past all of the simple advice out there because we’re more interested in the advice that seems more complex or “more important.”

The reality, however, is that the simple advice is usually the BEST advice.

As humans, we love to complicate things and we often convince ourselves that in order to achieve our desired results, something has to be difficult, challenging, or time consuming.

What we’ve personally learned and have seen to be true from other experts in the field, is that the simple things actually add up the most.

So, take this as your sign to stop overlooking the seemingly simple pieces of advice and embrace them for what they are: impactful and important.

Now, back to that million dollar advice we promised ⬇️

Out of all of this advice, we identified two main themes: relationships and knowledge.

As investors ourselves, we can confidently say that those two things really are the key to a successful investor journey!

In our experience, the numbers (aka your results) always follow the relationships.

Can you succeed on your own? Sure.

But as the wise African proverb says, “If you want to go fast, go alone, but if you want to go FAR, go together.”

And additionally, the knowledge that you hold – both personally and professionally – can really dictate your outcomes… IF you put that knowledge into action.

You can know something, but doing it is another story.

This is why at XSITE Capital we’re so passionate about locking arms with investors to not only help them learn the ins and outs of multi-family investing, but also put that work into real action and get you on track to building your wealth.

That’s what we’re all about!

In addition to all of this amazing advice, we’re committed to making sure you have everything you need to get started with ease and confidence.

If you’re interested in more investing resources (that are also completely free), we invite you to:

➡️ Read more on the XSITE Capital Blog

The Grow Your Mind Blog is your go-to place for all things multi-family real estate education, information and resources to help you navigate your own personal journey of investing.

Each month you’ll find a new blog post, featuring content like: Why Diversifying Your Investments is a Good Thing, How Cash Flow Distributions Work, The 5 Phases of a Multi-family Deal, and much more!

➡️ Join our next Monthly Meetup

At this monthly event, we have four main goals:

While the meetup will have a specific concentration on multi-family, investors from all asset classes are welcome to attend!

➡️ Download the 2023 XSITE E-book

At XSITE Capital, we always share how real estate investing can truly change your life, but we want to show you a real life example of what’s possible.

In this e-book, you’ll learn 7 Ways Real Estate Investing Changed Dr. Kola Johnson’s Life!

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

It’s no secret that investing is one of the best ways to build wealth. Whether you’re planning for retirement, saving for a big purchase or simply looking to grow your wealth for the future, putting your money to work can be an excellent way to achieve your financial goals.

However, one of the big mistakes that people make when investing is putting all of their eggs in one basket, meaning they only make one type of investment.

For your investments to produce the biggest reward, you want to make sure they are diversified!

A common diversified investment portfolio typically includes a mixture of real estate, bonds, stocks, fixed income, etc.

In this blog post, you’ll learn why diversifying your investments is crucial and how it can help you achieve your financial goals!

First things first, let’s clarify what diversification really means.

Put simply, diversification is a strategy that involves spreading out your investments across a variety of asset classes, industries and geographic regions.

The main goal with diversification is to reduce risk by allocating your funds to a mix of assets, instead of concentrating all of them in a single stock, sector or region.

Ultimately, having a diversified portfolio will benefit you greatly in the instance of one investment underperforming, because the overall impact on your portfolio will be minimized.

As mentioned, one of the primary reasons to diversify your investments is risk management.

All investments carry some level of risk, whether it’s market risk, industry-specific risk or company-specific risk, but you can reduce the impact of these risks on your overall investment performance by diversifying your portfolio.

For example, let’s say you are heavily invested in a single technology company, such as Apple, and that company suddenly faces financial difficulties or a sudden decline in its stock price. In this instance, your entire portfolio could suffer significant losses.

On the flipside, if you spread your investments across different sectors, including technology, healthcare and real estate, a setback in one sector would have a less detrimental effect on your overall portfolio.

Next, you want to consider market volatility, which refers to how the prices of financial assets, such as stocks, bonds, commodities or currencies, fluctuate within a specific period of time.

Fluctuations occur based on economic, political or global events, such as the COVID-19 pandemic, for example, where all travel industries were majorly impacted.

When you have a diversified portfolio, you’re able to more successfully weather these market storms and reduce the amount of loss on your assets, because when one asset class experiences a downturn, another may be performing well.

This balance can help stabilize your portfolio’s overall returns and reduce the emotional stress that often comes with investing.

Although risk management is a huge reason we push for diversification, it’s not the only reason. Diversification is also a strategy for long-term growth!

Different asset classes have varying risk-return profiles, so you want to consider each of these when choosing where to invest your funds.

For example, stocks tend to offer higher potential returns over the long run, but they also come with greater volatility. Bonds, on the other hand, tend to be more stable, but offer lower returns.

By combining these asset classes and potentially including alternative investments like real estate, you can create a diversified portfolio that allows for steady growth for the long term, while also managing risk.

Overall, diversification encourages a more disciplined approach to investing. When you have a well-structured and diversified portfolio, you’re less likely to react emotionally to short-term market fluctuations and can instead stay focused on your long-term investment strategy and financial goals.

Historically, diversified portfolios have shown a tendency to provide more consistent returns over time compared to portfolios concentrated in a single asset class. This consistency is essential for investors looking to build wealth steadily and achieve their financial goals!

Always remember: successful investing is not about timing the market or picking individual stocks perfectly – it’s about creating a well-balanced and diversified portfolio that aligns with YOUR financial goals.

So, whether you’re a seasoned investor or you’re just starting your investment journey, remember the power of diversification and make it a cornerstone of your investment strategy.

It’s a tried and true approach that can help you achieve financial security and peace of mind in an ever-changing financial world.

At XSITE Capital, we believe that investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

You hear us talk a lot about how multi-family investing is a great source of passive income. This is one of the largest benefits of investing in multi-family properties compared to single family homes.

We go more in depth to all of the pros and cons of multi-family investing in this blog post, but one thing that people always wonder after learning about the amazing benefits is HOW the distributions actually work.

And that’s such a great question!

As an investor in a multi-family real estate syndication, you can expect to receive periodic payments based on the income that the property generates.

So that you can have a better understanding of what this looks like, keep reading to learn how cash flow distribution works!

Investing in a multi-family property is a BIG deal and you can expect to reap massive benefits along the way. But too often, it’s unclear what that process looks like.

At XSITE Capital, we aim to help you understand every step of the investment process, so you can confidently take action and trust that your investment is in good hands.

For a closer look into the 5 phases of a multi-family investment deal, click here, but for now we’re going to focus on what happens after you invest!

Once all capital is raised for a specific deal, the syndicator then transitions into the property management and value-add creation phase.

During this stage, the syndicator oversees the day-to-day operations of the property, including tenant management, maintenance, rent collection and expense optimization.

In addition to the day-to-day operations of the property, syndicators also typically implement a value-add strategy, such as property renovations, amenity enhancements or operational improvements to increase the property’s value and rental income.

The syndicator’s goal during this phase is to enhance the property’s performance and generate attractive returns for all investors involved.

This work directly impacts YOU as an investor, because the greater the property is, the greater results you can typically expect to receive.

Throughout the entire syndication, you will receive ongoing communication and regular updates, so that you are fully aware of what’s happening with the property and how it’s performing.

When you partner with an investment group like XSITE Capital, you can expect consistent communication that includes details about property performance, financial statements, occupancy rates and any significant developments or challenges.

In addition to regular updates about the property performance, you can also expect to start receiving regular cash flow distributions, which typically happen on a quarterly basis.

And remember: all of those distributions are a direct source of passive income for you, meaning you don’t have to be included in any of the nitty gritty, day-to-day work of the property.

That’s the beauty of multi-family real estate!

While all of this sounds great, you might be wondering… “where exactly does the money come from?”

And that’s another great question, so let’s break it down.

The primary source of income in a multi-family investment comes from the rental payments made by tenants who occupy the units within the property. Typically, multi-family properties are apartment buildings or similar entities where there are multiple tenants on-site.

This rental income, along with any other sources of payment, such as laundry facilities, parking fees, etc., forms the basis for the cash flow of the property.

Before calculating cash flow, the operating expenses related to the property must be deducted from the total income. These expenses include property management fees, maintenance and repairs, property taxes, insurance, utilities, marketing costs and any other overhead expenses associated with property upkeep and management.

The remaining amount after deducting operating expenses from the total income is referred to as the Net Operating Income (NOI), which is a key financial metric that reflects the property’s profitability before considering mortgage payments and other financing costs.

If the property was financed with a mortgage or other loans, a portion of the NOI is allocated to pay off these financing obligations and includes both principal repayments and interest payments.

Once operating expenses and debts are accounted for, the remaining amount is the potential cash flow available for distribution to all investors involved in the property.

This cash flow is divided among the investors according to the terms outlined in the investment agreement.

The distribution of cash flow looks different for every investment deal and is dependent on the structure of the deal.

Investors’ ownership percentages and the terms dictate how the cash flow is distributed. As mentioned earlier, you can typically expect to see distributions quarterly.

Some investment deals may have a preferred return, which is a predetermined rate of return that certain investors receive before the remaining cash flow is distributed to other investors.

Once any preferred returns are given, the remaining cash flow is typically distributed among the investors based on their ownership percentages in the property.

For example, if an investor owns 30% of the property, they would receive 30% of the available cash flow.

It’s important to note that the actual cash flow received by investors can vary due to changes in rental occupancy rates, fluctuations in expenses, unexpected repairs and other factors.

This is why it’s important to work with an investment group that values transparency and always communicates with you so you know what to expect at all times!

Hopefully now you have a better understanding of how cash flow distributions work once you have committed to investing in a multi-family real estate deal.

At XSITE Capital, we believe that investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

At XSITE Capital, we believe that investing in multifamily properties can be one of the greatest wealth building tools, but we also recognize that one of the main things that holds people back is knowing where to start.

Choosing to invest in a multifamily property is a huge decision that can impact your wealth – both positively or negatively depending on your choice – which is why it’s so important to do your due diligence before committing to an investment.

Investing in multifamily properties can be a lucrative opportunity for both new and seasoned investors when done correctly, so to help you grow the confidence you need for selecting properties to invest in, this blog breaks down 4 important factors to consider when choosing an investment.

The location of a multifamily property is crucial to its success because you want to ensure the property is situated in a desirable and safe neighborhood that has potential for growth.

It’s important for multifamily properties to be in areas with quality transportation, access to amenities, low crime rates and a strong job market.

When most of these boxes are checked, you can generally expect for the property to do well for years to come and that the tenant demand will remain high throughout the duration of your investment.

Additionally, when your investment property is located in a desirable area, you can typically expect rent prices to rise year after year, which means you could potentially earn even more than initially expected on your investment, which is a huge win!

In addition to location, the condition of the property is another important factor to consider when choosing which multifamily property to invest in.

If you choose a property that requires a ton of updates or maintenance, there’s a chance that your return on investment (ROI) will decrease due to the financial requirements of the updates needed.

When initially inspecting a property, you typically want to consider:

When you examine each of these areas, you’ll be able to determine if they are a one time fix or if they will require continual maintenance year after year.

From there, you can weigh the risk versus reward and clearly determine if the property is a good fit for your investment portfolio.

The entire point of investing is to put your money into a place where you will see an even greater return, but in order for that to happen, you must choose avenues that are able to provide you with that outcome.

Generally speaking, multifamily investing is able to do that! That’s why we are huge advocates of this type of investing here at XSITE Capital.

With that, however, we also recognize that not all investments are created equal and before choosing to invest in a multifamily property you need to know the financial facts, which involves the history of the property AND the forecasted income for the future.

To get a solid understanding of a property’s financial history, you want to make sure that you review the property’s past income and expenses. This will give you a great snapshot of what the property is capable of.

After that, it’s important to also consider the potential for growth!

Oftentimes, investment companies (such as us here at XSITE Capital) will buy properties with the help of investors and create a value add plan that increases the desirability of the property, thus increasing the potential for growth.

With these considerations, you can better determine your ROI and ultimately decide if the property is a good fit for you!

Next, you want to consider the vacancy rates and number of units, since these two items directly impact your ROI as an investor.

As an investor, you likely want to invest in a property that has a higher number of units so that you can expect a greater return.

It looks like this:

The higher number of units = the higher number of tenants = higher income from rent = greater return for YOU!

In addition to the number of units, you also want to explore the past vacancy rates of a property in order to understand the history of how the property has performed in the past.

Past rates can sometimes be a good indicator of the overall desirability of a property.

When investing, you typically want to be involved with a property with low vacancy because, again that means higher profits for you as an investor.

Something to remember, however, is that if a property has high vacancy rates that could be due to mismanagement, poor maintenance, outdated features, etc. and oftentimes this can be fixed with a new value add plan that new owners propose.

Because of this, sometimes you have to use your best judgment and decide for yourself if the property has potential for growth and if it does, the reward might outweigh the risk in the end!

Conducting this research on your own can be overwhelming, which is why investors often prefer to join forces with investment groups that take the guesswork of this process.

At XSITE Capital, we do just that and take our market research very seriously when choosing a property!

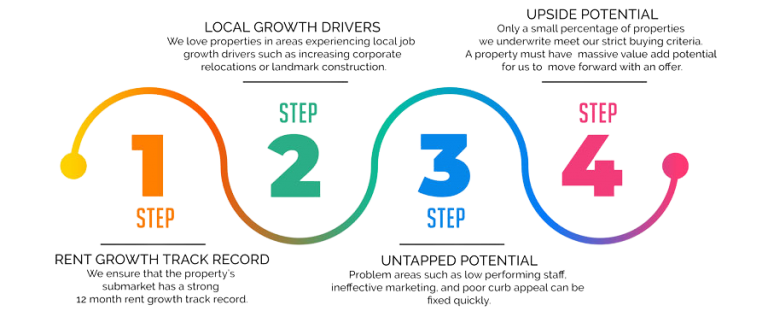

When choosing a multifamily property to add to our portfolio, we specifically look at:

Here’s a closer look at our market and property selection process:

We won’t move forward with a deal if it doesn’t meet our standards because we know our investors are counting on us!

Overall, investing in multifamily properties can be a great way to generate passive income and build wealth, but it’s always important to carefully consider these four factors before making any investment decisions.

By doing so, you can increase your chances of success and minimize potential risks!

At the end of the day, we believe that when you have the proper education and support, you can confidently start your own multifamily investment journey.

If you’re looking to start your investment journey and have the right people on your side along the way, we’re here for you.

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!

Interest rates, inflation and a recession have been the talk of the country for a large portion of 2022 and as a commercial real estate investor, it’s important that you know what each of these economic hits can mean for you and your investments.

As an investor, interest rates, inflation and a recession all play a huge role in your current and future investments so it’s important that you understand the basics of each and how exactly they all work together so you can remain confident in how you handle your money.

First things first, let’s talk about interest rates.

Throughout the year, interest rates have been ebbing and flowing and each week it seems like we’re seeing something different.

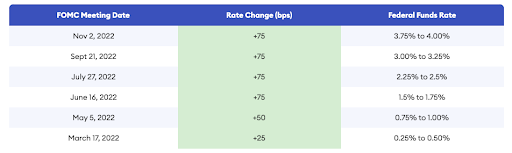

The Fed introduced its first rate hike in March of 2022 and they have continued to raise the rate from there.

As an investor, it’s important to pay attention to interest rates because they directly affect how much money you can borrow and ultimately determine how much you will end up paying back in the future.

Simply put, the interest rate is the amount you are ultimately charged for borrowing money and it’s shown as a percentage of the total amount of the loan.

This is why when interest rates are low, people are typically more quick to invest. When interest rates are high, on the other hand, people tend to become a bit more wary and start to consider if the investment is worth the extra amount of money they’ll owe towards their loans.

So, what exactly causes interest rates to rise?

The main cause of rising interest rates is inflation and inflation happens whenever there’s a high demand for products and services from consumers. This demand causes prices to rise and this concept is commonly referred to as demand-pull.

Another reason that inflation can occur is what they call cost-push. This is when supply costs to create products or deliver services forces prices to rise.

When inflation occurs, we typically see a few things start to happen:

Inflation is also directly linked to a recession, which means that people become very wary of where their money is going.

The good news for you as a commercial real estate investor is that your investment is typically recession resistant in this industry.

The reason being is because one of the main things to go for people during a recession is their expensive mortgage, especially if they’re living far above their means, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

Additionally, recessions can also make it more difficult for people to receive proper loans that they need to buy a house, so many people will be forced to continue renting.

In fact, history has shown that even though the housing market as a whole tends to take a hit during economic downturns, rental markets remain steady and even outperform other investments.

Essentially, rising interest rates, inflation and a recession can actually boost the cash flow that you receive from your current commercial real estate investments thanks to more tenants occupying the property.

So, what does this mean for your future investments?

Now that you know how your current commercial real estate investments can be affected by interest rates, inflation and a recession, you might be wondering how those three things can affect your future investments, as well.

The biggest challenge that high interest rates can cause for new commercial real estate deals is that the supply can decrease during economic downturns.

It’s for this reason that we always encourage investors to join a trusted Investor’s Club like XSITE Capital’s so that you aren’t having to do the up front research for new deals on your own.

Instead, you can sit back and know that other people are doing that work for you so that you can invest your money into a deal that has been heavily researched and you can trust that you will see a healthy ROI.

Another challenge that high interest rates and inflation can present for new investments is that the financing process may be a bit more difficult than usual.

Generally speaking, the financing process for commercial real estate is much more simple than if you were to invest in single-family properties because these investments aren’t as risky for banks.

The reason for this is because banks can confidently predict that the cash flow will be consistent and steady for a property with multiple tenants versus a property that only houses an individual or one family.

However, during economic downturns banks can become a bit more wary with how they loan their money, so you can expect the financing process to be a bit more challenging during tough economic times.

With that, you still have a much greater chance of getting approved for what you need for commercial real estate investments versus single family properties, so don’t let this challenge steer you away.

Overall, investing in commercial real estate specifically during economic downturns is still a smart move.

In fact, it’s been said that most millionaires are MADE during recessions and the reason for that is because when most people become fearful and stop spending their money, other people use this time as an opportunity to invest their money into places that will perform higher when the economy returns to normal.

While investing during economic downturns is encouraged, it’s important to remember that not all investment opportunities are created equal. For example, the stock market can be a bit unpredictable during this time, but commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The reason for this is because housing will always be a basic necessity and properties will continue to appreciate in value. This is great news for you as an investor and can give you peace of mind when it comes to where you’re putting your money.

As you continue to navigate the economic changes, we encourage you to join the XSITE Capital Investors Club so you can be among the first to get access to new commercial real estate deals and be among the few who use this time as an opportunity to thrive rather than just survive.

We’re here to support you along the way!

– The XSITE Capital Team

Many people hear about multi-family investing, but they don’t fully realize the benefits that come with it.

So, let’s breakdown the 6 major benefits of multi-family investing

1. Multi-family real estate is a recession-resilient investment.

Most investors are expecting a recession following the effects of the current pandemic and with stocks soaring, many are also considering whether it’s a bubble.

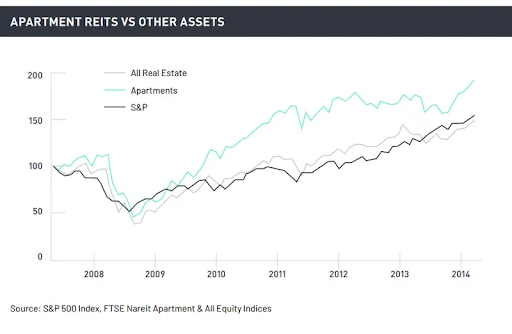

But one investment that stands the test of time during bear and bull markets is multifamily real estate investments.

So, if you’re looking for an option to round out your investment portfolio, this is a good place to start.

2. Demand for apartment rentals is rising.

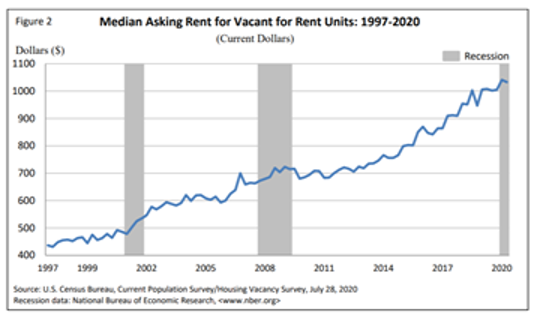

According to the Pew Research Center, more households are renting now than at any time in the past 50 years.

Between the 10-year period from 2006 to 2016, the number of households grew, but renters outpaced homeowners in that growth.

Fast forward 4 years later to 2020, and the US Census Bureau indicates that rental vacancy rates have decreased and median asking rent continues to increase.

The asking price for sale units has also decreased.

While the economic downturn will impact apartment demand, the overall growth rate is sufficient to absorb new supply entering the market.

3. Apartments offer a steady stream of income.

The statistics show that the apartment rental market continues to increase in demand and, therefore, value.

So, you have an opportunity to diversify your investments into an option that delivers a steady income stream which you can expect each month.

Apartment or multifamily units offer better economies of scale and thus higher returns on investment.

As of August 2020, the NCREIF Property Index estimated annualized returns over a 5 year period on real estate investment at 5.79%.

4. They are true passive income sources.

We’re often told that wealth starts with building passive income streams, where your money continues to work for you and nowhere is this more evident than in a multi-family investment.

Without needing to lift a finger to maintain your properties, your investment in a multifamily unit(s) continues to yield income month over month, plus your property continues to appreciate as time goes by.

5. Multifamily investing has many tax benefits.

Multifamily real estate investment offers high tax-advantages that many people don’t know about.

If you use a mortgage to finance your investment (which most savvy investors do) you can take a high mortgage deduction in the first year of ownership.

Then, you can depreciate the property, which means you can set off this depreciation against your rental income.

This alone makes multifamily real estate investing an attractive option, especially for those savvy with the tax laws.

6. There are multiple ways to get involved in multifamily investment.

There are multiple ways to get involved in this type of real estate investment including the most passive route and invest via syndication or you can invest in a multifamily fund or a real estate investment trust (REIT).

If you want to learn more about how to get started in multi-family real estate investing, here are two ways to get started:

1. Join the XSITE Capital Investment Club

2. Attend one of our free Monthly Meetups

3. Dive into our resources including, the XSITE Capital Blog or connect with us on LinkedIn

To become successful at multi-family investing, you need to increase your knowledge and you can start with these top 5 books on multi-family real estate investing.

We’ve also added two bonus books that tackle more of a general mindset.

All these recommendations are beginner friendly.

1. Invest in Apartment Buildings: Profit Without the Pitfalls by Theresa Bradley-Banta

Bradley-Banta quickly dispels the real estate investing misconceptions that most persons have and dives into how to become successful at investing in multifamily buildings.

This book is only if you’re seriously committed to making real estate investment work for you.

2. Best Ever Apartment Syndication Book by Joe Fairless and Theo Hicks

We are big on syndication here at XSITE Capital, so it’s natural that we would recommend a book on the subject.

This book is one of Amazon’s highest-rated real estate investing books based on average customer reviews.

If you’re ready to upgrade your property investment game in a logical step, then this book is an excellent guide.

It’s an in-depth look at building a real estate investment business from concept to execution. It does, however, focus on syndication with an exit in mind, whereas we generally look for permanent holds.

Written by an active real estate investor, this is a detailed guide made with the intention to stop readers from failing at real estate investing.

We advocate for generating wealth using passive income streams, so we appreciate his sections on achieving real estate success “without touching a toilet, paintbrush, or broom.”

Turner also hosts the BiggerPockets Podcast.

4. Mastering the Art of Commercial Real Estate Investing by Doug Marshall

Trying to decide between residential or commercial real estate investing? Marshall’s book looks at the benefits and pitfalls of commercial real estate.

Marshall has extensive experience in the industry and can, therefore, write from a first-hand perspective.

5. The Complete Guide to Buying and Selling Apartment Buildings by Steve Berges

On the other hand, there’s residential multifamily investing, which Berges goes into detail on the topic.

This book is good for beginners and seasoned, professional investors alike. Now in its second edition, it has added information on tax planning and sample forms to help to understand the investment process.

6. Wheelbarrow Profits by Jake Stenziano and Gino Barbaro

We love this book at XSITE Capital and recommend it frequently to our friends, family and new investors.

In this book, the authors explain why multifamily investing is so lucrative and how you as an investor can take advantage of this opportunity.

Even if you’re an experience investor, this book is an excellent resource on understanding your market, finding your niche, and growing your portfolio.

The right mindset is necessary if you want to be successful at real estate investing. That’s why, in addition to the real estate books we’ve listed above, you should make time to read the following.

7. Rich Dad, Poor Dad by Robert T. Kiyosaki

Kiyosaki compares 2 types of dads. The “poor dad” teaches you to follow the traditional viewpoints on money – go to college, get a 9-5 job, work until retirement, while the “rich dad” teaches you to become independently wealthy where you invest and build assets.

8. The Richest Man in Babylon by George S. Clason

This book clearly illustrates many of the principles that underpin multi-family real estate investing:

● Start thy purse to fattening. It is not what you earn; it’s what you keep.

● Make thy gold multiply. Clason here speaks to having more than one income source and that wealth comes from a reliable income stream. Embrace passive income generation and make your money work for you.

● Increase thy ability to earn. Clason encourages you to put yourself in a position to make more money. This means improving your skills and knowledge.

We believe the first step in growing your wealth is growing your mind, so we encourage you to dive into these books above along with various topics on the XSITE Capital blog.

If you’re new to multi-family real estate investing, and you’re looking for resources to help you get started, these are 7 of the top multi-family real estate investing blogs to get you started.

We believe that in order to grow your wealth, you must first grow your mind!

It’s important to read and gather different perspectives. So, while the principles of multi-family investing are the same, each firm’s approach and results are different.

Therefore, it pays to understand the different approaches and your options.

These 7 multi-family investing blogs are solid foundational and intermediate resources to learn multifamily real estate investment.

MultifamilyBiz is an open media platform offering a mixture of multifamily investment, marketing, and current affairs posts.

Similar to the Forbes.com model, most posts are submissions from various experts in the multifamily industry.

With over a million monthly visitors to their blog, they are one of the top online spaces for resources and information on all aspects of multi-family investing.

Like MultifamilyBiz, Multifamily Executive is a blog website featuring posts from various real estate and multifamily investment experts. As such, its posts range from in-depth, granular pieces to shorter, current affairs or news stories.

Some of the topics they look at include Business & Finance, Property Management, and Technology.

Multifamily Partner is a training site with a well thought out blog.

They know their niche and the majority of their posts reflect that – apartment investing. Their focus is on what they term the commercial multifamily investing ecosystem.

A mixture of blog posts and podcast episodes, their multifamily real estate blog focuses on educational and training material for new investors and those looking to scale.

Starting from a conversation between friends, Jake and Gino’s business has morphed into one of the most easily found multifamily investment blogs on the internet.

Headed by a husband and wife duo, Think Multifamily is a multifamily acquisition and education company.

Their multi-family investing blog is intended for two audience types – newbies to multifamily investment, and people looking for investment opportunities. The posts are more of a personal nature written from the perspective of the owners.

Though a general real estate investment blog and not specialized in multifamily investment, Than’s Blog offers applicable resources to help you understand the general real estate industry.

It focuses on both residential and commercial real estate investing, so if you’re interested in one or both, it’s a good place to enhance your online learning experience.

The XSITE Capital multifamily investment blog is one of the more recent blogs to enter the online multifamily investment space. We are now making it a priority to start sharing all we have learned in this business.

We are one of the very few black-owned multifamily investment companies in the U.S.

As a multi-family investment firm in the truest sense of the term, we have built a strong, passive investment portfolio. and focus on investment opportunities as well as multifamily education!

These are by no means the only blogs online that can guide you in your multifamily real estate investment journey, but they are all a great start and can get you up to speed quickly.

Here at XSITE, we update our blog monthly with new posts for you to dive into!

If you’re like us, learning about the tremendous upside to investing in multi-family properties is exciting.

The reality is it can dramatically increase your passive income streams over the next 2-7 years.

Life is busy though, and sorting through the details can feel overwhelming. To help ease some of that overwhelm, here are a few benefits to consider when considering whether or not to invest in multifamily real estate.

1. Apartment values are based on net income, not market comparables.

This is one of the most impressive benefits of multifamily investing.

Consider that in a 150 unit apartment complex, raising the rent by just $15/month increases the total property value by more than $385,000. [(150 units X $15 X 12 months) / 7% Cap Rate].

Let’s see your Hedge fund manage that!

2. Returns usually beat the stock market.

If you had invested $1 in the stock market in 2002, you’d have about $2 in 2018 (taking inflation into account).

That’s no way to plan for a future of passive income for you and your family.

3. Multifamily syndication loans are NEVER dependent on your income or credit.

Multifamily syndication loans are based on the value of the property, not your own personal assets.

In other words, investment in multifamily syndication allows you to get into a growth position with extremely limited personal liability.

Passive investors do not sign on loans in a multifamily syndication.

4. Multifamily investments are usually LESS VOLATILE than single-family investments.

During recessions, rent typically remains much more stable than home prices.

And as homeowners are displaced due to rising mortgage rates and/or job losses during recessions, they turn to apartments, leaving multifamily values with small declines at worse and thriving at best during flat/negative markets.

5. Multifamily investing is a growing market.

Millennials aren’t buying homes at expected rates and their preference for renting started before the 2008 economic crisis.

Meanwhile, retiring baby boomers are moving to urban apartments, perhaps to be near their children who have opted for city living, or to take advantage of the perks of city life themselves.

Finally, the overall market is shifting to a rental environment.

Homeownership rates are falling, and have been falling for over 12 years. Even the National Association of Realtors has acknowledged this reality – it’s being referred to as the Great Housing Reset.

Even if you’re an inexperienced investor, now is a great time to learn more about investing in multi-family properties!