At XSITE Capital, we believe that investing in multifamily properties can be one of the greatest wealth building tools, but we also recognize that one of the main things that holds people back is knowing where to start.

Choosing to invest in a multifamily property is a huge decision that can impact your wealth – both positively or negatively depending on your choice – which is why it’s so important to do your due diligence before committing to an investment.

Investing in multifamily properties can be a lucrative opportunity for both new and seasoned investors when done correctly, so to help you grow the confidence you need for selecting properties to invest in, this blog breaks down 4 important factors to consider when choosing an investment.

The location of a multifamily property is crucial to its success because you want to ensure the property is situated in a desirable and safe neighborhood that has potential for growth.

It’s important for multifamily properties to be in areas with quality transportation, access to amenities, low crime rates and a strong job market.

When most of these boxes are checked, you can generally expect for the property to do well for years to come and that the tenant demand will remain high throughout the duration of your investment.

Additionally, when your investment property is located in a desirable area, you can typically expect rent prices to rise year after year, which means you could potentially earn even more than initially expected on your investment, which is a huge win!

In addition to location, the condition of the property is another important factor to consider when choosing which multifamily property to invest in.

If you choose a property that requires a ton of updates or maintenance, there’s a chance that your return on investment (ROI) will decrease due to the financial requirements of the updates needed.

When initially inspecting a property, you typically want to consider:

When you examine each of these areas, you’ll be able to determine if they are a one time fix or if they will require continual maintenance year after year.

From there, you can weigh the risk versus reward and clearly determine if the property is a good fit for your investment portfolio.

The entire point of investing is to put your money into a place where you will see an even greater return, but in order for that to happen, you must choose avenues that are able to provide you with that outcome.

Generally speaking, multifamily investing is able to do that! That’s why we are huge advocates of this type of investing here at XSITE Capital.

With that, however, we also recognize that not all investments are created equal and before choosing to invest in a multifamily property you need to know the financial facts, which involves the history of the property AND the forecasted income for the future.

To get a solid understanding of a property’s financial history, you want to make sure that you review the property’s past income and expenses. This will give you a great snapshot of what the property is capable of.

After that, it’s important to also consider the potential for growth!

Oftentimes, investment companies (such as us here at XSITE Capital) will buy properties with the help of investors and create a value add plan that increases the desirability of the property, thus increasing the potential for growth.

With these considerations, you can better determine your ROI and ultimately decide if the property is a good fit for you!

Next, you want to consider the vacancy rates and number of units, since these two items directly impact your ROI as an investor.

As an investor, you likely want to invest in a property that has a higher number of units so that you can expect a greater return.

It looks like this:

The higher number of units = the higher number of tenants = higher income from rent = greater return for YOU!

In addition to the number of units, you also want to explore the past vacancy rates of a property in order to understand the history of how the property has performed in the past.

Past rates can sometimes be a good indicator of the overall desirability of a property.

When investing, you typically want to be involved with a property with low vacancy because, again that means higher profits for you as an investor.

Something to remember, however, is that if a property has high vacancy rates that could be due to mismanagement, poor maintenance, outdated features, etc. and oftentimes this can be fixed with a new value add plan that new owners propose.

Because of this, sometimes you have to use your best judgment and decide for yourself if the property has potential for growth and if it does, the reward might outweigh the risk in the end!

Conducting this research on your own can be overwhelming, which is why investors often prefer to join forces with investment groups that take the guesswork of this process.

At XSITE Capital, we do just that and take our market research very seriously when choosing a property!

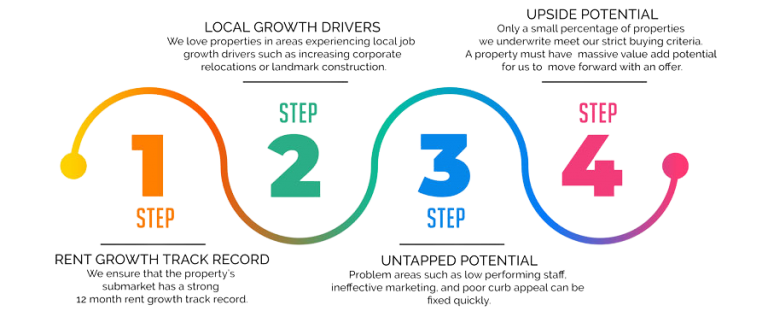

When choosing a multifamily property to add to our portfolio, we specifically look at:

Here’s a closer look at our market and property selection process:

We won’t move forward with a deal if it doesn’t meet our standards because we know our investors are counting on us!

Overall, investing in multifamily properties can be a great way to generate passive income and build wealth, but it’s always important to carefully consider these four factors before making any investment decisions.

By doing so, you can increase your chances of success and minimize potential risks!

At the end of the day, we believe that when you have the proper education and support, you can confidently start your own multifamily investment journey.

If you’re looking to start your investment journey and have the right people on your side along the way, we’re here for you.

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!

Did you know that 90% of the world’s millionaires have built their wealth by investing in real estate?

At some point in your life, you’ve probably heard it said that real estate is one of the best things to invest in because on both sides, commercial and residential, you’re investing in something with the confident expectation that you will receive more money back later down the road.

While it’s true that real estate can be one of the best ways to grow your wealth, the problem is that many people are missing the information and education to really do it well.

And that’s where we come in! Our mission at XSITE Capital is to educate and encourage all who qualify to passively invest in multifamily real estate so they can take advantage of the benefits that this asset has to offer.

Regardless of your race, current resources or access, we believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

We ultimately believe that through proper education, exposure and encouragement, our investors will have an equal opportunity to grow their mind and grow their wealth, which will positively impact generations to come.

Wherever you come from, you are welcome here!

Like anything in life, you want to make sure you’re learning from people who yes, have knowledge and expertise in the area, but also from those who continue to practice what they preach.

That’s what truly makes the XSITE Capital team so special and is why you can trust that the education you receive is coming from a place of knowledge, experience and current practice.

Our Co-Founders, Julius Oni, Leslie Awasom and Tenny Tolofari joined their passions together to help busy professionals like them reach financial freedom by investing in multifamily real estate.

Julius is the CEO and Co-Founder and primarily focuses on Investor Relations. Prior to XSITE Capital, Julius’ investment focus was single family real estate and angel investing. Over the past several years, Julius has invested in over 50 start-ups, and currently sits on the advisory board of four healthcare-related start-ups.

Within the last 2 years, Julius led the acquisition of XSITE Capital’s fast-growing portfolio of more than $100M. He was also acknowledged as a Forbes Business Council member in 2021.

Leslie is the Director of Operations and Co-founder who manages the company operations, market/data analysis, cash flow and budget analysis. In 2017, Leslie bought his first investment property and transitioned to multifamily investing in 2019.

Lastly, Tenny is the Director of Acquisition and Co-founder. Prior to forming XSITE Capital, Tenny spent several years leading a major sales team in one of the fastest growing financial services companies in America. He is also a Global Cyber Security professional, supporting the likes of Boeing and Deloitte.

The three of them together host a rapidly growing multifamily-focused meetup in Maryland where they provide resources and add value to individuals interested in growing their wealth and changing their financial future.

On a daily basis, Julius, Leslie and Tenny strive to provide the information and education that they believe everyone should have access to in order to grow their mind and simultaneously grow their wealth.

To ensure that you receive the information and education that you need to feel confident about taking action on a real estate endeavor, our team at XSITE Capital makes it a priority for you to have a constant line up of opportunities to choose from.

Here’s what those opportunities look like:

Every month on the blog, you can find a new blog post that answers the questions that many people don’t talk about when it comes to investing in commercial real estate. Our goal is to make things as simple as possible for you so that you can easily understand the benefits waiting for you on the other side.

Upcoming blog topics include:

In addition to the blog posts each month, we like to get face to face with you and provide valuable, free education. Monthly meetups feature talks from the XSITE founders in addition to other trusted and highly sought after industry leaders to educate on various topics.

Past meetup topics have included:

All monthly meetups are totally free and anyone is welcome to join! For all monthly meetup information, join the XSITE Investors Club!

We treat all Investor Club members like insiders which means you get the closest look into what’s going on at XSITE Capital, including what the team is working on and new deals that are available to you.

Just like we encourage you to consistently be learning, we do the same. We firmly believe that knowledge is a key part of wealth, so each month we share articles, books and research that we’re currently reading that’s relevant to real estate, investing and personal growth.

Our annual e-book is another free resource that all Investor Club members receive that aims to dive deeper into one topic regarding investing in commercial real estate.

The 2022 annual e-book is coming soon, so make sure you join the club so you don’t miss out!

Overall, we are committed to providing relevant and valuable information and education for those who are interested in experiencing financial freedom and creating legacy wealth through multifamily real estate investing.

We are glad you’re here!

– The XSITE Capital Team

Many people hear about multi-family investing, but they don’t fully realize the benefits that come with it.

So, let’s breakdown the 6 major benefits of multi-family investing

1. Multi-family real estate is a recession-resilient investment.

Most investors are expecting a recession following the effects of the current pandemic and with stocks soaring, many are also considering whether it’s a bubble.

But one investment that stands the test of time during bear and bull markets is multifamily real estate investments.

So, if you’re looking for an option to round out your investment portfolio, this is a good place to start.

2. Demand for apartment rentals is rising.

According to the Pew Research Center, more households are renting now than at any time in the past 50 years.

Between the 10-year period from 2006 to 2016, the number of households grew, but renters outpaced homeowners in that growth.

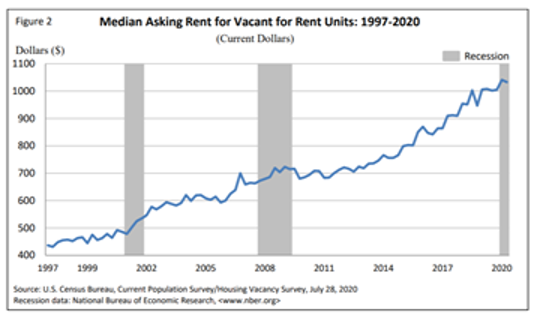

Fast forward 4 years later to 2020, and the US Census Bureau indicates that rental vacancy rates have decreased and median asking rent continues to increase.

The asking price for sale units has also decreased.

While the economic downturn will impact apartment demand, the overall growth rate is sufficient to absorb new supply entering the market.

3. Apartments offer a steady stream of income.

The statistics show that the apartment rental market continues to increase in demand and, therefore, value.

So, you have an opportunity to diversify your investments into an option that delivers a steady income stream which you can expect each month.

Apartment or multifamily units offer better economies of scale and thus higher returns on investment.

As of August 2020, the NCREIF Property Index estimated annualized returns over a 5 year period on real estate investment at 5.79%.

4. They are true passive income sources.

We’re often told that wealth starts with building passive income streams, where your money continues to work for you and nowhere is this more evident than in a multi-family investment.

Without needing to lift a finger to maintain your properties, your investment in a multifamily unit(s) continues to yield income month over month, plus your property continues to appreciate as time goes by.

5. Multifamily investing has many tax benefits.

Multifamily real estate investment offers high tax-advantages that many people don’t know about.

If you use a mortgage to finance your investment (which most savvy investors do) you can take a high mortgage deduction in the first year of ownership.

Then, you can depreciate the property, which means you can set off this depreciation against your rental income.

This alone makes multifamily real estate investing an attractive option, especially for those savvy with the tax laws.

6. There are multiple ways to get involved in multifamily investment.

There are multiple ways to get involved in this type of real estate investment including the most passive route and invest via syndication or you can invest in a multifamily fund or a real estate investment trust (REIT).

If you want to learn more about how to get started in multi-family real estate investing, here are two ways to get started:

1. Join the XSITE Capital Investment Club

2. Attend one of our free Monthly Meetups

3. Dive into our resources including, the XSITE Capital Blog or connect with us on LinkedIn

If you’re like us, learning about the tremendous upside to investing in multi-family properties is exciting.

The reality is it can dramatically increase your passive income streams over the next 2-7 years.

Life is busy though, and sorting through the details can feel overwhelming. To help ease some of that overwhelm, here are a few benefits to consider when considering whether or not to invest in multifamily real estate.

1. Apartment values are based on net income, not market comparables.

This is one of the most impressive benefits of multifamily investing.

Consider that in a 150 unit apartment complex, raising the rent by just $15/month increases the total property value by more than $385,000. [(150 units X $15 X 12 months) / 7% Cap Rate].

Let’s see your Hedge fund manage that!

2. Returns usually beat the stock market.

If you had invested $1 in the stock market in 2002, you’d have about $2 in 2018 (taking inflation into account).

That’s no way to plan for a future of passive income for you and your family.

3. Multifamily syndication loans are NEVER dependent on your income or credit.

Multifamily syndication loans are based on the value of the property, not your own personal assets.

In other words, investment in multifamily syndication allows you to get into a growth position with extremely limited personal liability.

Passive investors do not sign on loans in a multifamily syndication.

4. Multifamily investments are usually LESS VOLATILE than single-family investments.

During recessions, rent typically remains much more stable than home prices.

And as homeowners are displaced due to rising mortgage rates and/or job losses during recessions, they turn to apartments, leaving multifamily values with small declines at worse and thriving at best during flat/negative markets.

5. Multifamily investing is a growing market.

Millennials aren’t buying homes at expected rates and their preference for renting started before the 2008 economic crisis.

Meanwhile, retiring baby boomers are moving to urban apartments, perhaps to be near their children who have opted for city living, or to take advantage of the perks of city life themselves.

Finally, the overall market is shifting to a rental environment.

Homeownership rates are falling, and have been falling for over 12 years. Even the National Association of Realtors has acknowledged this reality – it’s being referred to as the Great Housing Reset.

Even if you’re an inexperienced investor, now is a great time to learn more about investing in multi-family properties!

If you’re thinking about investing in multifamily real estate, there are 6 main questions to ask the investment group you’re working with to ensure it’s a good fit.

We ultimately believe that multifamily apartment investing is one of the smartest things you can potentially do with your capital because the properties typically hold their value over time and they usually increase in value based on income (not comparables) while also offering excellent risk-adjusted ROI.

That said, there’s a lot to consider when deciding whether or not to become a multifamily property investor. Here are some important factors to consider:

1. How long does it take to recoup an investment in a multifamily apartment complex?

Typically, you’ll receive quarterly dividends for your investment after an initial stabilization/rehab period.

Additionally, syndication companies such as XSITE Capital project that your investment will double in 5-6 years.

If you’re looking for a highly liquid investment, multifamily investing is likely not for you.

If you’re looking for a comparatively high rate of return via an attractive risk-adjusted investment vehicle however, multifamily investing is one of the best options on the market!

2. Will I have to do any work on the property once I invest?

One of the best things about working with an investment group like XSITE Capital is that we employ a professional team to manage the property.

What means to you as an investor is you can simply invest the initial funds and then watch your investment return dividends and equity gains!

3. How much of the split will I keep as an investor?

The answer to this question will always depend on the property, but it’s a great question to consider before investing.

One of our most recent investment, The Griffin at Petworth in Washington, D.C, offered an 80/20 split for investors.

Others may do 70/30 or 60/40 splits with the most going to investors.

4. What is the minimum investment?

Again, each property is different, but typically there is a $50,000 minimum investment, while some properties may offer $25,000 minimums.

5. What are the tax implications of multifamily investing?

When you invest in multifamily properties, you can typically expect prorated depreciation benefits that can lower your taxes.

We advise that you discuss your specific tax situation with a CPA to learn how your personal finances will be impacted.

For more general tax benefits that you can expect with multifamily investing, click here.

5. How do I choose the right property?

Choosing the right multifamily property depends on your goals.

First, you need to decide whether you’re more focused on short-term or long-term gains.

Class A properties will have more long term gain, while Class C will have more short term gains but a shorter project lifespan. Here’s a breakdown of the differences in each Class type.

Second, decide how much you want to invest and find the right syndication company that will offer a competitive ROI.

It’s best to discuss your options with a professional and we’re always here to help!

Overall, investing in multifamily properties can be a great addition to your portfolio, but doing your due diligence before making that move is advised.