When you first learn about multi-family real estate syndications and the beauty of passive income, you might start to wonder if there’s a catch.

Making money without having to do any of the intense work yourself might sound a bit too good to be true and like any smart investor, we understand that you might have questions.

We would never expect you to blindly jump into multi-family real estate without first fully understanding the process and knowing the pros and cons of this type of investing.

To make sure you fully understand how this works and are aware of the potential risks versus rewards, this blog post will provide further insight so you can confidently determine if multi-family investing is a good fit for you.

One of the biggest differences between multi-family versus single-family properties is that there’s a decreased risk of losing cash flow.

This is due to the fact that with multi-family properties, you have multiple units and multiple tenants, which means you have multiple forms of income each month.

If you lose one tenant in a multi-family property, you still have stable cash flow since there are multiple tenants on property.

With single-family units, on the other hand, if you lose one tenant you would be stuck with a property with 100% vacancy, which means no cash flow.

Overall, you can count on numerous occupied units with multi-family properties to contribute to a positive cash flow for you on a consistent basis.

Additionally, you don’t have to worry about as many economic losses as the need and demand for multi-family properties stays fairly high regardless of what the economy looks like.

When it comes to real estate, one of the things that scares people off the most is the preparation for all of the things that goes into it.

You have your loan applications, down payment savings, closing costs, inspections, appraisals, the list goes on.

While all of those things can seem like a massive headache, one of the best parts about multi-family investing specifically is that there is a much easier financing process and more simplicity.

This is thanks to the fact that multi-family properties aren’t as risky for banks.

Generally speaking, banks can confidently predict that the cash flow of a multi-family property with multiple tenants will be consistent and steady versus a property that only houses an individual or one family.

What this means for you as an investor is that the bank doesn’t look at solely your income to grant you the loan. Instead, they will look at the details, history and projections for the property so they can accurately gauge the return.

The real value in this is that you can typically very easily get approved for the loan you need without jumping through hoops or needing multiple loans.

You know that old saying, “don’t put all of your eggs in one basket?” That rings true for many things in life, but especially when it comes to investing your money!

Essentially what this means is that you want to diversify your investments to make sure that all of your funds aren’t wrapped up into one single strategy.

A common diversified investment portfolio includes: real estate, bonds, stocks, fixed income, etc.

The reason it’s important to make sure that your money is being invested into different options is because all of these assets will respond differently to the same economic event, so you’re essentially setting yourself up for less risk.

For example, if you invest the majority of your money into stocks associated with the travel industry, such as airlines, without also investing in real estate or other stock options, you’re risking a drop in your investment value if bad news affects the travel industry.

This most recently happened with the onset of the COVID-19 pandemic where all travel industries were majorly impacted, so you can see how having other investments in place to counteract the risk of others is a good move.

Aside from specific industries, it’s also smart to diversify the geographical locations that you’re investing in and one of the easiest ways to do this is through multi-family properties.

When it comes to investing, you typically want to make sure you’re putting your money into a place that is going to benefit you in multiple ways.

Aside from a stable cash flow and a solid return on your investment, you also want to consider how your investments can positively impact other parts of your life.

In addition to cash flow, easy financing processes and diversification, another huge reason that people choose to invest in multi-family properties is because of the tax benefits that come along with this investment choice.

There are four major tax benefits that you can expect from multi-family investment, including depreciation, cost segregation, 1031 exchange and passive income tax benefits – we discuss the specifics of each of these in THIS blog post!

With any pro comes a con and multi-family real estate is no different!

While we are huge advocates of getting involved with multi-family investing, we also want to be up front and make sure you’re fully aware of both sides.

When you think about the differences between multi-family properties and single-family homes, one of the largest and most obvious differentiators is that there will almost always be a greater initial investment needed for multi-family properties.

That’s because you’re putting your money towards a much larger complex that will house far more tenants than a single home. The upside to this is that the greater investment = greater reward!

The initial investment will always vary depending on the location of the property, but you can almost always expect to need at least a 20% down payment of the property price.

With that said, we try to make our process at XSITE Capital as smooth and simple as possible, so our investors can typically invest as little as $50,000 in most projects.

Overall, if you have the cash and the ability to make the greater initial investment, you can confidently expect that it will pay off in the long run.

When people learn about the tax benefits and the ROI of multi-family investing, they typically start scooping up the best of the best deals very quickly.

This can be challenging for those who aren’t as experienced in this type of investing and it can feel frustrating when you aren’t able to jump into the deals that you really want.

This is why building relationships with quality investment groups is so key. Here at XSITE Capital, we make it easy for our investors to get first access to the deals that are appealing to them through our Investor’s Community!

Unlike that of single-family properties, you can’t hop on Zillow and expect to be flooded with large amounts of multi-family properties to invest in.

Sure, you might find a duplex here and there, but it’s rare that a large complex will be at the tip of your fingers from a quick search.

It’s for this reason that being involved with an investment group can be so valuable! Investment groups do the hard work for you by building relationships with trusted brokers, scouting out the best markets and finding deals that will produce the best results.

Lastly, one of the biggest challenges for multi-family investing is knowing that you’re investing in the right markets. Not all properties are created equal and you want to make sure that you’re putting your money into a good pool so that you truly do benefit from it.

If you’re interested in a multi-family deal, but you aren’t sure if it’s a good move, make sure you consider 4 main factors before jumping in, including::

We provide more insight for each of these categories in THIS blog post!

Overall, this is yet another reason that linking arms with an investment group is a good idea so that you can trust that the market has been thoroughly researched and that the properties chosen are lucrative.

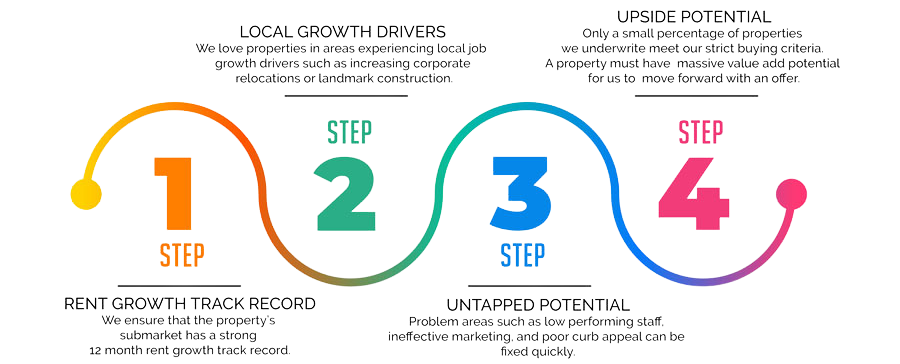

At XSITE Capital, we take our market research very seriously by looking at:

Here’s a closer look at our own market and property selection process:

If you’ve been learning about multi-family real estate investing and are ready to take the plunge further into your investment journey, we are here for you!

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!