At XSITE Capital, we believe that investing in multifamily properties can be one of the greatest wealth building tools, but we also recognize that one of the main things that holds people back is knowing where to start.

Choosing to invest in a multifamily property is a huge decision that can impact your wealth – both positively or negatively depending on your choice – which is why it’s so important to do your due diligence before committing to an investment.

Investing in multifamily properties can be a lucrative opportunity for both new and seasoned investors when done correctly, so to help you grow the confidence you need for selecting properties to invest in, this blog breaks down 4 important factors to consider when choosing an investment.

- Location

The location of a multifamily property is crucial to its success because you want to ensure the property is situated in a desirable and safe neighborhood that has potential for growth.

It’s important for multifamily properties to be in areas with quality transportation, access to amenities, low crime rates and a strong job market.

When most of these boxes are checked, you can generally expect for the property to do well for years to come and that the tenant demand will remain high throughout the duration of your investment.

Additionally, when your investment property is located in a desirable area, you can typically expect rent prices to rise year after year, which means you could potentially earn even more than initially expected on your investment, which is a huge win!

- Property Condition

In addition to location, the condition of the property is another important factor to consider when choosing which multifamily property to invest in.

If you choose a property that requires a ton of updates or maintenance, there’s a chance that your return on investment (ROI) will decrease due to the financial requirements of the updates needed.

When initially inspecting a property, you typically want to consider:

- Age of the roof

- State and age of appliances

- Foundation

- Plumbing

- Electricals

- Hot water system

When you examine each of these areas, you’ll be able to determine if they are a one time fix or if they will require continual maintenance year after year.

From there, you can weigh the risk versus reward and clearly determine if the property is a good fit for your investment portfolio.

- Past Financials and Forecasted Income

The entire point of investing is to put your money into a place where you will see an even greater return, but in order for that to happen, you must choose avenues that are able to provide you with that outcome.

Generally speaking, multifamily investing is able to do that! That’s why we are huge advocates of this type of investing here at XSITE Capital.

With that, however, we also recognize that not all investments are created equal and before choosing to invest in a multifamily property you need to know the financial facts, which involves the history of the property AND the forecasted income for the future.

To get a solid understanding of a property’s financial history, you want to make sure that you review the property’s past income and expenses. This will give you a great snapshot of what the property is capable of.

After that, it’s important to also consider the potential for growth!

Oftentimes, investment companies (such as us here at XSITE Capital) will buy properties with the help of investors and create a value add plan that increases the desirability of the property, thus increasing the potential for growth.

With these considerations, you can better determine your ROI and ultimately decide if the property is a good fit for you!

- Vacancy Rates and Number of Units

Next, you want to consider the vacancy rates and number of units, since these two items directly impact your ROI as an investor.

As an investor, you likely want to invest in a property that has a higher number of units so that you can expect a greater return.

It looks like this:

The higher number of units = the higher number of tenants = higher income from rent = greater return for YOU!

In addition to the number of units, you also want to explore the past vacancy rates of a property in order to understand the history of how the property has performed in the past.

Past rates can sometimes be a good indicator of the overall desirability of a property.

When investing, you typically want to be involved with a property with low vacancy because, again that means higher profits for you as an investor.

Something to remember, however, is that if a property has high vacancy rates that could be due to mismanagement, poor maintenance, outdated features, etc. and oftentimes this can be fixed with a new value add plan that new owners propose.

Because of this, sometimes you have to use your best judgment and decide for yourself if the property has potential for growth and if it does, the reward might outweigh the risk in the end!

Conducting this research on your own can be overwhelming, which is why investors often prefer to join forces with investment groups that take the guesswork of this process.

At XSITE Capital, we do just that and take our market research very seriously when choosing a property!

How We Conduct Market Research at XSITE Capital

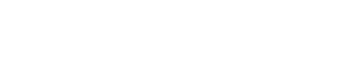

When choosing a multifamily property to add to our portfolio, we specifically look at:

- the 5 year rent growth forecast

- metro and submarkets that have a significant opportunity for high paying employment

- local sales trends to compute cap rates and determine whether our cap rates are on target to reach our projections

- the supply of local units to ensure it will not spike vacancy rates and negatively impact rents

Here’s a closer look at our market and property selection process:

We won’t move forward with a deal if it doesn’t meet our standards because we know our investors are counting on us!

Overall, investing in multifamily properties can be a great way to generate passive income and build wealth, but it’s always important to carefully consider these four factors before making any investment decisions.

By doing so, you can increase your chances of success and minimize potential risks!

How You Can Start Growing Your Wealth Through Multifamily Investing Today

At the end of the day, we believe that when you have the proper education and support, you can confidently start your own multifamily investment journey.

If you’re looking to start your investment journey and have the right people on your side along the way, we’re here for you.

The XSITE Investors Community is for accredited investors where you can receive:

- Monthly meetup replays from all months prior (so you can continue growing your mind while growing your wealth)

- Invites to in-person meetups (because there’s nothing like being in true community together!)

- 30 minute 1:1 calls with our Investor Relations team (so you can get your questions answered and feel empowered to take action)

- First look at new investment opportunities (so you can beat the competition and easily jump into the deals that are a good fit for you)

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!