It’s that lovely time of year again… tax season.

Whether you’re a business owner, employee, solopreneur or anywhere in between, tax season is something we all have to navigate and everyone’s situation looks different.

Your marital status, charitable donations, business expenses and many other factors can qualify you for legal tax write offs and benefits.

But did you know that investing in multifamily real estate can be one of those factors?

Many times when people think about investing, the primary reason they want to do it is so that they see a much greater return on their investment.

And while yes you want to see a steady cash flow for your investments, there are a few other benefits to consider that shouldn’t be overlooked.

When you invest in multifamily properties, you can usually take advantage of a few tax benefits that you’ll thank yourself for come tax season.

One of the first and major tax benefits you can take advantage of when investing in multifamily real estate are depreciated tax losses against the gains of the property.

Depreciation is the term used in real estate to describe the degrading condition of the property overtime.

Over the years, things will break, go out of date or simply need repaired which means the value of the property can decrease. This is completely normal and expected for any property!

The good news is that the IRS doesn’t hold that against you and instead allows you to use that depreciation amount as a tax deduction year after year for 27.5 years.

Why 27.5 years? This is the amount of time that the government rules a multifamily property to be profitable.

This means that as long as your money is invested into a property of this sort, you can reap this benefit for almost 30 years and that’s hard to find anywhere else!

Another option that investors can take advantage of when it comes to taxes is utilizing cost segregation which goes hand in hand with depreciation.

Essentially what this does is accelerate the depreciation of certain aspects of the property, such as appliances, cabinets, etc. inside of the units so that you qualify for a greater depreciation deduction in a single year.

The only caveat with utilizing a cost segregation study is that it only benefits you during your ownership period.

Because of this, when you decide to sell or pull your investment from the property, you can be faced with a higher tax bill… but don’t let that scare you away!

There’s another benefit for investors to contrast this and it’s called the 1031 Exchange.

A 1031 exchange is an investing tool that allows you to defer your capital gains taxes by reinvesting the funds you pull out of a property and put them into another investment property of like kind.

This means that the new property must be of the same nature as the previous.

For example, if you pull your investment from an apartment complex, you can reinvest those funds into a different apartment complex and utilize the 1031 Exchange benefit in order to avoid that higher tax bill.

This will ensure that you continue to reap the Depreciation and Cost Segregation benefits year after year!

Lastly, one of the greatest tax benefits that investors can take advantage of involves passive income.

As an investor of a multifamily property, you receive what is known as passive income. The IRS sometimes refers to this type of income as unearned income.

For a multifamily investor, your earnings come from your investments in rental properties.

Just like active income, which is money received from your job or business in which you are actively involved, passive income is also taxable, but it’s treated much differently.

To qualify for passive income tax benefits, you have to spend less than 500 hours on the business. As an investor, this is usually the case which is good news for you during tax season!

Instead of being involved in the day-to-day operations, you simply invest your money with a trusted group of professionals and they take care of the hands-on work.

This allows you to qualify for huge tax breaks that you typically wouldn’t receive through traditional investing.

It’s for this reason alone that many people choose to work with investment groups like XSITE Capital so that they can trust they will see an ROI, while also benefiting in other ways without having to do a lot of extra work.

If you’re looking to increase your tax benefits for 2023, investing in multifamily real estate could be an option for you! To learn more about the process of getting involved, click here to connect.

– The XSITE Capital Team

Did you know that 66% of Americans set new years goals that are directly related to their finances?

Whether it’s paying off debt, generating more savings, implementing a budget or investing, more than half of the U.S. population have made plans to adjust their finances in the new year.

A recent study has shown that even though these financial goals are still being set in 2023, 81% of people believe that inflation and the overall state of the economy will make it much harder to meet these goals.

As you set your own goals for the new year, maybe you can relate.

You might wonder how you’re going to generate extra money to pay off debt. You may worry that you won’t be able to stay within your budget due to the high costs of everyday living.

You might think that investing isn’t an option because you need every extra dollar after expenses to go towards your savings. Or you might just be overwhelmed with finances in general and aren’t sure which actions to even take.

If this is you, you’re in the right place! At XSITE Capital, our mission is to educate and encourage people to make decisions that are best for them, specifically when it comes to multifamily real estate investing.

We believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

Last month on the blog, we addressed how interest rates, inflation and a possible recession can impact your commercial real estate investments so you can know what to expect with the ongoing economic changes.

With that, we also want to share three main reasons why commercial real estate IS still a good investment in 2023 so that you can take confident action as you work toward your financial goals this year!

The talk of a recession has been going on for a few months now and with a recession people tend to become very cautious about where they put their money.

This is totally understandable because you want to make sure you’re putting your money somewhere that is safe and will produce a quality return for you in the future.

While it’s true that a recession can negatively affect your investments, the good news is that when you invest in multifamily properties, you can rest easy knowing that your investment is protected.

Historically, multifamily assets have shown to be recession resistant because, at the end of the day, people always need a place to stay.

When a recession hits, there’s typically an influx of people selling their homes that they can no longer afford, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

This is good news for you as an investor in multifamily properties as this can boost the cash flow that you receive thanks to more tenants occupying the property.

Whether or not a recession will actually hit in 2023, we aren’t sure, but what we do know is that people are already taking precautions which means that the demand for rentals is already happening and now is a great time to get involved with investments of this type.

Many times when people think about investing, they jump straight to the stock market because they haven’t been properly educated on how real estate can be a quality investment as well.

The only real problem with solely investing in the stock market is that it can be very unpredictable and can take a massive hit at any given time, especially during economic downturns or world events.

Commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The main reason for this is because housing is and always will be a basic necessity that all people need. Because of this, you can trust that multifamily properties will continue to appreciate in value which ultimately means that you will receive more return on your investment.

This isn’t to say that investing in the stock market is bad. We encourage that too, but more than anything you want to make sure that your investments are diversified – meaning you have money in multiple places – so that if one takes a negative hit, you have the other to fall back on.

One of the biggest challenges that people often face in real estate in general is the ability to receive the funds they need to purchase or invest in a property.

This can become even more difficult when the economy is in a downturn because banks become more strict with their loan process and have more requirements than you might typically see.

While this can cause difficulty for you if you were to purchase a single-family home, there is a much easier financing process when it comes to commercial real estate.

Banks can confidently predict that the cash flow of a multifamily property with multiple tenants will be consistent and steady versus a property that only houses an individual or one family.

What this means for you as an investor is that the bank doesn’t look at solely your income to grant you the loan. Instead, they will look at the details, history and projections for the property so they can accurately gauge the return.

This is why getting involved in deals that have been thoroughly researched and scouted for you is so important and is the very reason that we take our property selection process so seriously at XSITE Capital.

Linking arms with an investment group that takes the time to ensure a property will be lucrative is your best bet to receive a healthy ROI and that’s exactly what we do through our Investor’s Club!

So, if you have big financial goals in 2023 and are looking for ways to make them come to life with ease, we invite you to join us.

When you join the XSITE Investor’s Club, you will receive:

Overall, we’re here to empower and support you in your personal journey!

Here’s to 2023. 🎉

– The XSITE Capital Team

Many people hear about multi-family investing, but they don’t fully realize the benefits that come with it.

So, let’s breakdown the 6 major benefits of multi-family investing

1. Multi-family real estate is a recession-resilient investment.

Most investors are expecting a recession following the effects of the current pandemic and with stocks soaring, many are also considering whether it’s a bubble.

But one investment that stands the test of time during bear and bull markets is multifamily real estate investments.

So, if you’re looking for an option to round out your investment portfolio, this is a good place to start.

2. Demand for apartment rentals is rising.

According to the Pew Research Center, more households are renting now than at any time in the past 50 years.

Between the 10-year period from 2006 to 2016, the number of households grew, but renters outpaced homeowners in that growth.

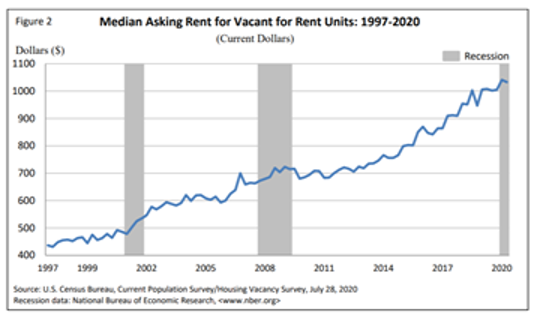

Fast forward 4 years later to 2020, and the US Census Bureau indicates that rental vacancy rates have decreased and median asking rent continues to increase.

The asking price for sale units has also decreased.

While the economic downturn will impact apartment demand, the overall growth rate is sufficient to absorb new supply entering the market.

3. Apartments offer a steady stream of income.

The statistics show that the apartment rental market continues to increase in demand and, therefore, value.

So, you have an opportunity to diversify your investments into an option that delivers a steady income stream which you can expect each month.

Apartment or multifamily units offer better economies of scale and thus higher returns on investment.

As of August 2020, the NCREIF Property Index estimated annualized returns over a 5 year period on real estate investment at 5.79%.

4. They are true passive income sources.

We’re often told that wealth starts with building passive income streams, where your money continues to work for you and nowhere is this more evident than in a multi-family investment.

Without needing to lift a finger to maintain your properties, your investment in a multifamily unit(s) continues to yield income month over month, plus your property continues to appreciate as time goes by.

5. Multifamily investing has many tax benefits.

Multifamily real estate investment offers high tax-advantages that many people don’t know about.

If you use a mortgage to finance your investment (which most savvy investors do) you can take a high mortgage deduction in the first year of ownership.

Then, you can depreciate the property, which means you can set off this depreciation against your rental income.

This alone makes multifamily real estate investing an attractive option, especially for those savvy with the tax laws.

6. There are multiple ways to get involved in multifamily investment.

There are multiple ways to get involved in this type of real estate investment including the most passive route and invest via syndication or you can invest in a multifamily fund or a real estate investment trust (REIT).

If you want to learn more about how to get started in multi-family real estate investing, here are two ways to get started:

1. Join the XSITE Capital Investment Club

2. Attend one of our free Monthly Meetups

3. Dive into our resources including, the XSITE Capital Blog or connect with us on LinkedIn

If you’re like us, learning about the tremendous upside to investing in multi-family properties is exciting.

The reality is it can dramatically increase your passive income streams over the next 2-7 years.

Life is busy though, and sorting through the details can feel overwhelming. To help ease some of that overwhelm, here are a few benefits to consider when considering whether or not to invest in multifamily real estate.

1. Apartment values are based on net income, not market comparables.

This is one of the most impressive benefits of multifamily investing.

Consider that in a 150 unit apartment complex, raising the rent by just $15/month increases the total property value by more than $385,000. [(150 units X $15 X 12 months) / 7% Cap Rate].

Let’s see your Hedge fund manage that!

2. Returns usually beat the stock market.

If you had invested $1 in the stock market in 2002, you’d have about $2 in 2018 (taking inflation into account).

That’s no way to plan for a future of passive income for you and your family.

3. Multifamily syndication loans are NEVER dependent on your income or credit.

Multifamily syndication loans are based on the value of the property, not your own personal assets.

In other words, investment in multifamily syndication allows you to get into a growth position with extremely limited personal liability.

Passive investors do not sign on loans in a multifamily syndication.

4. Multifamily investments are usually LESS VOLATILE than single-family investments.

During recessions, rent typically remains much more stable than home prices.

And as homeowners are displaced due to rising mortgage rates and/or job losses during recessions, they turn to apartments, leaving multifamily values with small declines at worse and thriving at best during flat/negative markets.

5. Multifamily investing is a growing market.

Millennials aren’t buying homes at expected rates and their preference for renting started before the 2008 economic crisis.

Meanwhile, retiring baby boomers are moving to urban apartments, perhaps to be near their children who have opted for city living, or to take advantage of the perks of city life themselves.

Finally, the overall market is shifting to a rental environment.

Homeownership rates are falling, and have been falling for over 12 years. Even the National Association of Realtors has acknowledged this reality – it’s being referred to as the Great Housing Reset.

Even if you’re an inexperienced investor, now is a great time to learn more about investing in multi-family properties!

One of the first things you learn about investing is that diversification is vital.

When you have a diverse portfolio, a negative hit to one of your assets doesn’t drag the remaining assets down.

It’s why we divide our assets between stocks, CDs and property. It’s why we short one company while going long on another. It’s a safety net, and it’s one of the most important components of your investment strategy.

When you invest in traditional single-family real estate, you throw this principle out the window.

Why? Because you put a large chunk of your cash into ONE piece of property.

That piece of property must be purchased (or rented) by ONE family in order for you to turn a profit. In between, you’re subject to the local market, neighborhood comps dragging down your home’s value, and deals that could fall through.

And yet, real estate is a historical winner because, with a few exceptions, real estate assets rise over time.

Short answer: invest in multifamily apartments.

When you invest in multifamily properties, consider that each tenant is just a percentage of your investment.

If one or a few tenants move out, your investment is still strong.

Your management team can cover small losses because the rest of the building’s rental income is stable.

You don’t have to worry as much about factors like the local market or neighborhood comparables because multifamily investing is valued based on the income of the apartment – not comps.

Beyond diversification there are many other benefits of investing in multifamily real estate, including major tax benefits!

Ready to experience these benefits for yourself? Join the XSITE Investment Club to get started.

Did you know that not all apartment investments are created equal?

In this post, we discuss why investing in multifamily apartments is so valuable, but it’s important to know that there are different commercial real estate asset classes and you want to make sure you’re choosing to invest in the class that’s best for YOU specifically!

Keep reading to learn about the different classes of multifamily apartment investments so you can strategically add to your investment portfolio.

Class A apartments are newer (<20 years old) and they offer high-end finishes like granite countertops, stainless steel appliances, and hardwood floors.

With this class of properties, maintenance is also performed immediately.

Class A properties are conveniently located in cities near mass transit or downtown hot spots that typically attract affluent renters with high price tags.

Bottom Line: Class A Properties typically have low cash flow compared to high initial investment. The cash flow is highly sensitive to recessions (when tenants will often move to Class B or Class C Apartments). Traditionally, only accessible to Institutional Buyers.

Class B apartments are between 20-40 years old and offer standard furnishings like laminate countertops and black/white appliances.

With this class of properties, there is often some deferred maintenance.

Bottom Line: Class B Properties typically have Cap Rates of 5%-6% and there’s a higher cash flow than Class A. Open to Private Buyers as well as some Institutional Buyers.

Class C apartments are typically much older than the other two classes – at least 35 years old.

These type of properties are in constant need of maintenance and are often located in less desirable locations.

Bottom Line: Class C properties typically have Cap rates between 6%-8%. With these, there are lots of value-add opportunity for investors and there are high cash flows due to low initial investment, but lower cash flow in the long run.

Note: We do not recommend Class D / Warzone Apartments, which are often risky and have very heavy management load.

Double-digit returns are quite common for multifamily investments, as long as you choose the right opportunity for your liquidity requirements, cash flow needs, and available investment capital. It is important to work with your financial advisors and investing team to make sure potential investments are a good match for you.

Are you ready to join a community of knowledgeable investors? Click here to join the XSITE Investor’s Club!