As an inspiring investor, one of the greatest things that you can do for yourself to succeed in your investment journey is to commit to learning from those ahead of you.

This really goes for anything in life, but especially investing!

When you pay attention to those who have gone before you and continue to be successful in their journeys, you can potentially avoid some of the mistakes they made, implement some of the things that they wish they would’ve done, and ultimately reach your desired goals even faster than imagined.

Here at XSITE Capital, we took it upon ourselves to gather what some may consider to be million dollar advice, so that YOU can learn it and soak it in too… all for free!

We asked 10 real estate/wealth professionals the same question:

”What 1 tip would you give to your younger self before jumping into your investor’s journey?”

But before we give you that advice, we must warn you: it might not be as groundbreaking as you might expect.

Oftentimes in life, it’s tempting to breeze past all of the simple advice out there because we’re more interested in the advice that seems more complex or “more important.”

The reality, however, is that the simple advice is usually the BEST advice.

As humans, we love to complicate things and we often convince ourselves that in order to achieve our desired results, something has to be difficult, challenging, or time consuming.

What we’ve personally learned and have seen to be true from other experts in the field, is that the simple things actually add up the most.

So, take this as your sign to stop overlooking the seemingly simple pieces of advice and embrace them for what they are: impactful and important.

Now, back to that million dollar advice we promised ⬇️

Out of all of this advice, we identified two main themes: relationships and knowledge.

As investors ourselves, we can confidently say that those two things really are the key to a successful investor journey!

In our experience, the numbers (aka your results) always follow the relationships.

Can you succeed on your own? Sure.

But as the wise African proverb says, “If you want to go fast, go alone, but if you want to go FAR, go together.”

And additionally, the knowledge that you hold – both personally and professionally – can really dictate your outcomes… IF you put that knowledge into action.

You can know something, but doing it is another story.

This is why at XSITE Capital we’re so passionate about locking arms with investors to not only help them learn the ins and outs of multi-family investing, but also put that work into real action and get you on track to building your wealth.

That’s what we’re all about!

In addition to all of this amazing advice, we’re committed to making sure you have everything you need to get started with ease and confidence.

If you’re interested in more investing resources (that are also completely free), we invite you to:

➡️ Read more on the XSITE Capital Blog

The Grow Your Mind Blog is your go-to place for all things multi-family real estate education, information and resources to help you navigate your own personal journey of investing.

Each month you’ll find a new blog post, featuring content like: Why Diversifying Your Investments is a Good Thing, How Cash Flow Distributions Work, The 5 Phases of a Multi-family Deal, and much more!

➡️ Join our next Monthly Meetup

At this monthly event, we have four main goals:

While the meetup will have a specific concentration on multi-family, investors from all asset classes are welcome to attend!

➡️ Download the 2023 XSITE E-book

At XSITE Capital, we always share how real estate investing can truly change your life, but we want to show you a real life example of what’s possible.

In this e-book, you’ll learn 7 Ways Real Estate Investing Changed Dr. Kola Johnson’s Life!

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

A few months ago our Co-Founder and Director of Operations, Leslie Awasom, had the amazing opportunity to speak at The Multifamily Investor Network Conference hosted by PassiveInvesting.com.

He was able to share his insights on The Power of Passive Income and talk about Why Busy Professionals are Turning to Multifamily Real Estate Investing as their investment mode of choice.

A key topic of his presentation was based around the fact that you can’t save your way to wealth.

This concept comes from the powerful book by Zeb and Colleen Tsikira and is something that we 100% believe here at XSITE Capital.

Growing up, many of us were taught to save our money. It’s a concept that often starts as early as toddlerhood with a piggy bank and grows into adulthood with a savings account.

We’re taught to save for the dream car that we want, save for our college fund or save for that nice pair of shoes we want that all of our friends have.

Saving money is a simple concept and it can be a great thing when you’re saving for something specific… but the only thing you can’t save your way to is overall wealth.

A savings account today isn’t what it once was, thanks to rising interest rates and inflation.

Today, the average savings account interest rate is 0.39% which means it would take almost 150 years (or more) to double your money.

If you really want your money to GROW and become something that you can truly use in the future, you must invest it wisely.

In this blog post, you’ll learn the vast difference between saving versus investing, so you can have a better understanding between the two and make choices with your money wisely!

Saving and investing money are two very different things and if you’ve never delved into the world of investing, you may not fully understand the differences between the two.

So, let’s start with the more well known concept of saving.

Saving involves setting aside a portion of your income in a safe and easily accessible account, such as a savings account or a certificate of deposit (CD).

The primary goal with saving money is to preserve it and potentially build an emergency fund for unexpected expenses or short-term financial goals.

When it comes to your savings, there are three main things to know:

Investing, on the other hand, involves putting your money to work in assets or ventures with the expectation of generating a return on your investment over the long term.

Investments can encompass a wide array of options, including stocks, bonds, real estate, and businesses.

When it comes to your investments, there are also a few main things to know:

While it’s clear that savings does have advantages of its own, you have to consider the long term reward that’s possible with an investing approach.

There is of course a time and place for saving your money, but there’s also a time and place for investing, which is why knowing the key differences between the two is the first step.

Next, is knowing WHY investing is a smart choice and fully understanding when it may be time to shift your focus.

As mentioned earlier, you can’t save your way to wealth, but you CAN invest your way there.

This is one of the most compelling reasons to choose investing over saving, especially when you choose to invest your money into something such as multifamily real estate.

When you invest in multifamily properties, you tap into the dual benefits of rental income and property appreciation. Over time, this can lead to substantial wealth accumulation, surpassing the growth of a traditional savings account.

Inflation erodes the purchasing power of your money over time, which means that saving alone will likely not produce the returns that you ultimately hope for.

Real estate investments, on the other hand, often appreciate in value, providing a hedge against inflation and preserving your wealth.

Have you ever heard someone say, “don’t put all of your eggs in one basket” when it comes to investing your money? What they mean by that is DIVERSIFY your investments!

A common diversified investment portfolio typically includes a mix of real estate, bonds, stocks, fixed income, etc.

The reason it’s important to make sure that your money is being invested into different options is because all of these assets will respond differently to the same economic event, so you’re actively setting yourself up for less risk overtime.

Investments, including multifamily properties, can generate passive income streams, meaning you get to do LESS work and reap MORE reward!

Rental income from multifamily units can provide a consistent cash flow, helping you meet your financial goals, whether it’s funding your retirement or achieving financial freedom.

Another huge draw for investing is that it often comes with major tax advantages that you aren’t eligible for otherwise, such as deductions for mortgage interest, property taxes, and depreciation.

All of these tax benefits can help optimize your overall financial picture and improve your returns.

If you want a closer look into the tax benefits for investing in multifamily properties, click here!

Now that you know the difference between saving and investing and have a deeper understanding of the benefits of investing, the question may remain: “When should I invest and when should I save?”

This is a great question because, as mentioned earlier, there IS a time and a place for both, so let’s compare.

When To Save:

When To Invest:

At XSITE Capital, we are fully committed to helping you understand the importance of creating multiple streams of passive income and learn how to invest your money in a way that works best for you!

When you learn how to invest your money in a way that grows passive income, you get to experience various benefits that simply saving your money doesn’t offer.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

It’s no secret that investing is one of the best ways to build wealth. Whether you’re planning for retirement, saving for a big purchase or simply looking to grow your wealth for the future, putting your money to work can be an excellent way to achieve your financial goals.

However, one of the big mistakes that people make when investing is putting all of their eggs in one basket, meaning they only make one type of investment.

For your investments to produce the biggest reward, you want to make sure they are diversified!

A common diversified investment portfolio typically includes a mixture of real estate, bonds, stocks, fixed income, etc.

In this blog post, you’ll learn why diversifying your investments is crucial and how it can help you achieve your financial goals!

First things first, let’s clarify what diversification really means.

Put simply, diversification is a strategy that involves spreading out your investments across a variety of asset classes, industries and geographic regions.

The main goal with diversification is to reduce risk by allocating your funds to a mix of assets, instead of concentrating all of them in a single stock, sector or region.

Ultimately, having a diversified portfolio will benefit you greatly in the instance of one investment underperforming, because the overall impact on your portfolio will be minimized.

As mentioned, one of the primary reasons to diversify your investments is risk management.

All investments carry some level of risk, whether it’s market risk, industry-specific risk or company-specific risk, but you can reduce the impact of these risks on your overall investment performance by diversifying your portfolio.

For example, let’s say you are heavily invested in a single technology company, such as Apple, and that company suddenly faces financial difficulties or a sudden decline in its stock price. In this instance, your entire portfolio could suffer significant losses.

On the flipside, if you spread your investments across different sectors, including technology, healthcare and real estate, a setback in one sector would have a less detrimental effect on your overall portfolio.

Next, you want to consider market volatility, which refers to how the prices of financial assets, such as stocks, bonds, commodities or currencies, fluctuate within a specific period of time.

Fluctuations occur based on economic, political or global events, such as the COVID-19 pandemic, for example, where all travel industries were majorly impacted.

When you have a diversified portfolio, you’re able to more successfully weather these market storms and reduce the amount of loss on your assets, because when one asset class experiences a downturn, another may be performing well.

This balance can help stabilize your portfolio’s overall returns and reduce the emotional stress that often comes with investing.

Although risk management is a huge reason we push for diversification, it’s not the only reason. Diversification is also a strategy for long-term growth!

Different asset classes have varying risk-return profiles, so you want to consider each of these when choosing where to invest your funds.

For example, stocks tend to offer higher potential returns over the long run, but they also come with greater volatility. Bonds, on the other hand, tend to be more stable, but offer lower returns.

By combining these asset classes and potentially including alternative investments like real estate, you can create a diversified portfolio that allows for steady growth for the long term, while also managing risk.

Overall, diversification encourages a more disciplined approach to investing. When you have a well-structured and diversified portfolio, you’re less likely to react emotionally to short-term market fluctuations and can instead stay focused on your long-term investment strategy and financial goals.

Historically, diversified portfolios have shown a tendency to provide more consistent returns over time compared to portfolios concentrated in a single asset class. This consistency is essential for investors looking to build wealth steadily and achieve their financial goals!

Always remember: successful investing is not about timing the market or picking individual stocks perfectly – it’s about creating a well-balanced and diversified portfolio that aligns with YOUR financial goals.

So, whether you’re a seasoned investor or you’re just starting your investment journey, remember the power of diversification and make it a cornerstone of your investment strategy.

It’s a tried and true approach that can help you achieve financial security and peace of mind in an ever-changing financial world.

At XSITE Capital, we believe that investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

You hear us talk a lot about how multi-family investing is a great source of passive income. This is one of the largest benefits of investing in multi-family properties compared to single family homes.

We go more in depth to all of the pros and cons of multi-family investing in this blog post, but one thing that people always wonder after learning about the amazing benefits is HOW the distributions actually work.

And that’s such a great question!

As an investor in a multi-family real estate syndication, you can expect to receive periodic payments based on the income that the property generates.

So that you can have a better understanding of what this looks like, keep reading to learn how cash flow distribution works!

Investing in a multi-family property is a BIG deal and you can expect to reap massive benefits along the way. But too often, it’s unclear what that process looks like.

At XSITE Capital, we aim to help you understand every step of the investment process, so you can confidently take action and trust that your investment is in good hands.

For a closer look into the 5 phases of a multi-family investment deal, click here, but for now we’re going to focus on what happens after you invest!

Once all capital is raised for a specific deal, the syndicator then transitions into the property management and value-add creation phase.

During this stage, the syndicator oversees the day-to-day operations of the property, including tenant management, maintenance, rent collection and expense optimization.

In addition to the day-to-day operations of the property, syndicators also typically implement a value-add strategy, such as property renovations, amenity enhancements or operational improvements to increase the property’s value and rental income.

The syndicator’s goal during this phase is to enhance the property’s performance and generate attractive returns for all investors involved.

This work directly impacts YOU as an investor, because the greater the property is, the greater results you can typically expect to receive.

Throughout the entire syndication, you will receive ongoing communication and regular updates, so that you are fully aware of what’s happening with the property and how it’s performing.

When you partner with an investment group like XSITE Capital, you can expect consistent communication that includes details about property performance, financial statements, occupancy rates and any significant developments or challenges.

In addition to regular updates about the property performance, you can also expect to start receiving regular cash flow distributions, which typically happen on a quarterly basis.

And remember: all of those distributions are a direct source of passive income for you, meaning you don’t have to be included in any of the nitty gritty, day-to-day work of the property.

That’s the beauty of multi-family real estate!

While all of this sounds great, you might be wondering… “where exactly does the money come from?”

And that’s another great question, so let’s break it down.

The primary source of income in a multi-family investment comes from the rental payments made by tenants who occupy the units within the property. Typically, multi-family properties are apartment buildings or similar entities where there are multiple tenants on-site.

This rental income, along with any other sources of payment, such as laundry facilities, parking fees, etc., forms the basis for the cash flow of the property.

Before calculating cash flow, the operating expenses related to the property must be deducted from the total income. These expenses include property management fees, maintenance and repairs, property taxes, insurance, utilities, marketing costs and any other overhead expenses associated with property upkeep and management.

The remaining amount after deducting operating expenses from the total income is referred to as the Net Operating Income (NOI), which is a key financial metric that reflects the property’s profitability before considering mortgage payments and other financing costs.

If the property was financed with a mortgage or other loans, a portion of the NOI is allocated to pay off these financing obligations and includes both principal repayments and interest payments.

Once operating expenses and debts are accounted for, the remaining amount is the potential cash flow available for distribution to all investors involved in the property.

This cash flow is divided among the investors according to the terms outlined in the investment agreement.

The distribution of cash flow looks different for every investment deal and is dependent on the structure of the deal.

Investors’ ownership percentages and the terms dictate how the cash flow is distributed. As mentioned earlier, you can typically expect to see distributions quarterly.

Some investment deals may have a preferred return, which is a predetermined rate of return that certain investors receive before the remaining cash flow is distributed to other investors.

Once any preferred returns are given, the remaining cash flow is typically distributed among the investors based on their ownership percentages in the property.

For example, if an investor owns 30% of the property, they would receive 30% of the available cash flow.

It’s important to note that the actual cash flow received by investors can vary due to changes in rental occupancy rates, fluctuations in expenses, unexpected repairs and other factors.

This is why it’s important to work with an investment group that values transparency and always communicates with you so you know what to expect at all times!

Hopefully now you have a better understanding of how cash flow distributions work once you have committed to investing in a multi-family real estate deal.

At XSITE Capital, we believe that investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

When you first learn about multi-family real estate syndications and the beauty of passive income, you might start to wonder if there’s a catch.

Making money without having to do any of the intense work yourself might sound a bit too good to be true and like any smart investor, we understand that you might have questions.

We would never expect you to blindly jump into multi-family real estate without first fully understanding the process and knowing the pros and cons of this type of investing.

To make sure you fully understand how this works and are aware of the potential risks versus rewards, this blog post will provide further insight so you can confidently determine if multi-family investing is a good fit for you.

One of the biggest differences between multi-family versus single-family properties is that there’s a decreased risk of losing cash flow.

This is due to the fact that with multi-family properties, you have multiple units and multiple tenants, which means you have multiple forms of income each month.

If you lose one tenant in a multi-family property, you still have stable cash flow since there are multiple tenants on property.

With single-family units, on the other hand, if you lose one tenant you would be stuck with a property with 100% vacancy, which means no cash flow.

Overall, you can count on numerous occupied units with multi-family properties to contribute to a positive cash flow for you on a consistent basis.

Additionally, you don’t have to worry about as many economic losses as the need and demand for multi-family properties stays fairly high regardless of what the economy looks like.

When it comes to real estate, one of the things that scares people off the most is the preparation for all of the things that goes into it.

You have your loan applications, down payment savings, closing costs, inspections, appraisals, the list goes on.

While all of those things can seem like a massive headache, one of the best parts about multi-family investing specifically is that there is a much easier financing process and more simplicity.

This is thanks to the fact that multi-family properties aren’t as risky for banks.

Generally speaking, banks can confidently predict that the cash flow of a multi-family property with multiple tenants will be consistent and steady versus a property that only houses an individual or one family.

What this means for you as an investor is that the bank doesn’t look at solely your income to grant you the loan. Instead, they will look at the details, history and projections for the property so they can accurately gauge the return.

The real value in this is that you can typically very easily get approved for the loan you need without jumping through hoops or needing multiple loans.

You know that old saying, “don’t put all of your eggs in one basket?” That rings true for many things in life, but especially when it comes to investing your money!

Essentially what this means is that you want to diversify your investments to make sure that all of your funds aren’t wrapped up into one single strategy.

A common diversified investment portfolio includes: real estate, bonds, stocks, fixed income, etc.

The reason it’s important to make sure that your money is being invested into different options is because all of these assets will respond differently to the same economic event, so you’re essentially setting yourself up for less risk.

For example, if you invest the majority of your money into stocks associated with the travel industry, such as airlines, without also investing in real estate or other stock options, you’re risking a drop in your investment value if bad news affects the travel industry.

This most recently happened with the onset of the COVID-19 pandemic where all travel industries were majorly impacted, so you can see how having other investments in place to counteract the risk of others is a good move.

Aside from specific industries, it’s also smart to diversify the geographical locations that you’re investing in and one of the easiest ways to do this is through multi-family properties.

When it comes to investing, you typically want to make sure you’re putting your money into a place that is going to benefit you in multiple ways.

Aside from a stable cash flow and a solid return on your investment, you also want to consider how your investments can positively impact other parts of your life.

In addition to cash flow, easy financing processes and diversification, another huge reason that people choose to invest in multi-family properties is because of the tax benefits that come along with this investment choice.

There are four major tax benefits that you can expect from multi-family investment, including depreciation, cost segregation, 1031 exchange and passive income tax benefits – we discuss the specifics of each of these in THIS blog post!

With any pro comes a con and multi-family real estate is no different!

While we are huge advocates of getting involved with multi-family investing, we also want to be up front and make sure you’re fully aware of both sides.

When you think about the differences between multi-family properties and single-family homes, one of the largest and most obvious differentiators is that there will almost always be a greater initial investment needed for multi-family properties.

That’s because you’re putting your money towards a much larger complex that will house far more tenants than a single home. The upside to this is that the greater investment = greater reward!

The initial investment will always vary depending on the location of the property, but you can almost always expect to need at least a 20% down payment of the property price.

With that said, we try to make our process at XSITE Capital as smooth and simple as possible, so our investors can typically invest as little as $50,000 in most projects.

Overall, if you have the cash and the ability to make the greater initial investment, you can confidently expect that it will pay off in the long run.

When people learn about the tax benefits and the ROI of multi-family investing, they typically start scooping up the best of the best deals very quickly.

This can be challenging for those who aren’t as experienced in this type of investing and it can feel frustrating when you aren’t able to jump into the deals that you really want.

This is why building relationships with quality investment groups is so key. Here at XSITE Capital, we make it easy for our investors to get first access to the deals that are appealing to them through our Investor’s Community!

Unlike that of single-family properties, you can’t hop on Zillow and expect to be flooded with large amounts of multi-family properties to invest in.

Sure, you might find a duplex here and there, but it’s rare that a large complex will be at the tip of your fingers from a quick search.

It’s for this reason that being involved with an investment group can be so valuable! Investment groups do the hard work for you by building relationships with trusted brokers, scouting out the best markets and finding deals that will produce the best results.

Lastly, one of the biggest challenges for multi-family investing is knowing that you’re investing in the right markets. Not all properties are created equal and you want to make sure that you’re putting your money into a good pool so that you truly do benefit from it.

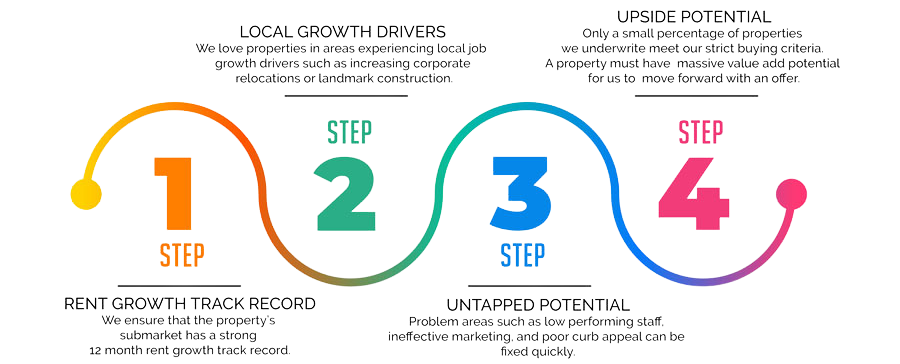

If you’re interested in a multi-family deal, but you aren’t sure if it’s a good move, make sure you consider 4 main factors before jumping in, including::

We provide more insight for each of these categories in THIS blog post!

Overall, this is yet another reason that linking arms with an investment group is a good idea so that you can trust that the market has been thoroughly researched and that the properties chosen are lucrative.

At XSITE Capital, we take our market research very seriously by looking at:

Here’s a closer look at our own market and property selection process:

If you’ve been learning about multi-family real estate investing and are ready to take the plunge further into your investment journey, we are here for you!

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!

At XSITE Capital, we believe that investing in multifamily properties can be one of the greatest wealth building tools, but we also recognize that one of the main things that holds people back is knowing where to start.

Choosing to invest in a multifamily property is a huge decision that can impact your wealth – both positively or negatively depending on your choice – which is why it’s so important to do your due diligence before committing to an investment.

Investing in multifamily properties can be a lucrative opportunity for both new and seasoned investors when done correctly, so to help you grow the confidence you need for selecting properties to invest in, this blog breaks down 4 important factors to consider when choosing an investment.

The location of a multifamily property is crucial to its success because you want to ensure the property is situated in a desirable and safe neighborhood that has potential for growth.

It’s important for multifamily properties to be in areas with quality transportation, access to amenities, low crime rates and a strong job market.

When most of these boxes are checked, you can generally expect for the property to do well for years to come and that the tenant demand will remain high throughout the duration of your investment.

Additionally, when your investment property is located in a desirable area, you can typically expect rent prices to rise year after year, which means you could potentially earn even more than initially expected on your investment, which is a huge win!

In addition to location, the condition of the property is another important factor to consider when choosing which multifamily property to invest in.

If you choose a property that requires a ton of updates or maintenance, there’s a chance that your return on investment (ROI) will decrease due to the financial requirements of the updates needed.

When initially inspecting a property, you typically want to consider:

When you examine each of these areas, you’ll be able to determine if they are a one time fix or if they will require continual maintenance year after year.

From there, you can weigh the risk versus reward and clearly determine if the property is a good fit for your investment portfolio.

The entire point of investing is to put your money into a place where you will see an even greater return, but in order for that to happen, you must choose avenues that are able to provide you with that outcome.

Generally speaking, multifamily investing is able to do that! That’s why we are huge advocates of this type of investing here at XSITE Capital.

With that, however, we also recognize that not all investments are created equal and before choosing to invest in a multifamily property you need to know the financial facts, which involves the history of the property AND the forecasted income for the future.

To get a solid understanding of a property’s financial history, you want to make sure that you review the property’s past income and expenses. This will give you a great snapshot of what the property is capable of.

After that, it’s important to also consider the potential for growth!

Oftentimes, investment companies (such as us here at XSITE Capital) will buy properties with the help of investors and create a value add plan that increases the desirability of the property, thus increasing the potential for growth.

With these considerations, you can better determine your ROI and ultimately decide if the property is a good fit for you!

Next, you want to consider the vacancy rates and number of units, since these two items directly impact your ROI as an investor.

As an investor, you likely want to invest in a property that has a higher number of units so that you can expect a greater return.

It looks like this:

The higher number of units = the higher number of tenants = higher income from rent = greater return for YOU!

In addition to the number of units, you also want to explore the past vacancy rates of a property in order to understand the history of how the property has performed in the past.

Past rates can sometimes be a good indicator of the overall desirability of a property.

When investing, you typically want to be involved with a property with low vacancy because, again that means higher profits for you as an investor.

Something to remember, however, is that if a property has high vacancy rates that could be due to mismanagement, poor maintenance, outdated features, etc. and oftentimes this can be fixed with a new value add plan that new owners propose.

Because of this, sometimes you have to use your best judgment and decide for yourself if the property has potential for growth and if it does, the reward might outweigh the risk in the end!

Conducting this research on your own can be overwhelming, which is why investors often prefer to join forces with investment groups that take the guesswork of this process.

At XSITE Capital, we do just that and take our market research very seriously when choosing a property!

When choosing a multifamily property to add to our portfolio, we specifically look at:

Here’s a closer look at our market and property selection process:

We won’t move forward with a deal if it doesn’t meet our standards because we know our investors are counting on us!

Overall, investing in multifamily properties can be a great way to generate passive income and build wealth, but it’s always important to carefully consider these four factors before making any investment decisions.

By doing so, you can increase your chances of success and minimize potential risks!

At the end of the day, we believe that when you have the proper education and support, you can confidently start your own multifamily investment journey.

If you’re looking to start your investment journey and have the right people on your side along the way, we’re here for you.

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!

Did you know that March is National Credit Education Month? Many times people don’t pay enough attention to their credit until they want to make a big investment, such as purchasing a home or a car.

The only problem with not paying attention to your credit score regularly is that it’s not something that’s a quick fix, so if you wait until you want to make a large purchase and your credit score is lower than what it needs to be, you take the risk of delaying the process.

This is why learning about your credit score and working to raise it on a regular basis is so important, especially if you have the goal of investing in commercial real estate.

Similar to that of a regular real estate purchase, such as a single family home, your credit will help determine the loan amount that you qualify for and what kind of interest rate you receive.

To help you understand the ins and outs of your credit score, in this blog we’ll be covering what qualifies as good credit, how to repair bad credit and what role your credit plays in commercial real estate investing.

You probably already know that your credit score is made up of three little numbers that can make or break a lot of things for you in life, such as whether or not you can buy a car, a house, obtain a credit card or be approved for any type of loan.

The number ranges from 300-850 and it’s calculated by three major components, including your payment history, the amount of debt you have and the length of your credit history.

There are different scoring models that may take other information into consideration, but generally speaking, here’s the ranking:

The goal is to get your credit score as high as possible so that it falls into the “very good” or “excellent” range.

With that said, as long as your score is 670 and above, borrowers will typically qualify you as lower-risk and you can still be granted what you’re needing.

Anything below 670 usually shows a red flag for lenders and it may be harder to receive the loan that you’re seeking.

If you find that your credit score is falling below the “good” category, there are a few things you can do to repair your credit and get those numbers rising.

One of the first things you’ll want to do is run a credit report. This will show you everything that is impacting your credit and could even help you identify any errors that might be negatively affecting your score.

If there are no errors, this report will allow you to see exactly where you need to focus in order to get your score on the rise.

Once you know all of the things that are affecting your score, you want to work hard to get the amount that you owe down and usually one of the best ways to do that is to pay off your credit cards.

Credit card debt has a huge impact on your credit score, especially if you’re using a large portion of your available credit. The faster you can get your credit card debt down, the faster you’ll see your score start to rise.

In addition to paying down your credit card debt, you also want to pay your bills on time, every time! This directly impacts your credit because your payment history accounts for 35% of your score.

This is why it’s so important to set up an auto pay or create some sort of automation for yourself so that you never miss a payment and take the risk of lowering your score.

Aside from paying down your debts and paying your bills on time, you also want to consider how often you’re applying for new credit. Many people don’t realize that when you apply for a credit card, attempt to buy a car or even get pre-approved for a home purchase, these are all hard inquiries on your credit.

A hard inquiry is a necessary step from lenders to pull your credit report to evaluate your creditworthiness, but it can also drop your score 5-10 points. Not only that, but it can stay on your report for two years, which means it will have a lasting effect on your credit as a whole.

Now that you know what qualifies good credit and how to repair bad credit, let’s get into how your credit score impacts your ability to invest in commercial real estate.

You might be wondering why your personal credit matters when it comes to investing and the short answer is because your credit essentially tells somehow how creditworthy you are.

And all that means is your credit helps a lender see what kind of reputation you have when it comes to paying back loans.

You see, when you’re investing in commercial real estate, it’s rare that you’re going to have the amount you need to invest sitting in your bank account. Instead, you’re probably going to need some sort of loan so that you can invest a certain amount and eventually receive an ROI.

And while it’s true that the overall financing process is easier when it comes to commercial real estate, due to the fact that these properties are viewed as less risky by banks, you as the borrower still need to meet certain qualifications – and your credit is one of them!

If you have a score that’s on the lower end, your first step is working to raise it to at least 680 or above, so that you can easily get into the commercial real estate game without having to fight high interest rates on your loans.

Overall, your credit matters for so many things in life, including commercial real estate investing, so it’s best to keep an eye on your score on a regular basis and consistently work to keep it in the “very good” or “excellent” range!

– The XSITE Capital Team

P.S. If you have a solid credit score and are looking to get involved with commercial real estate investing, we invite you to join our XSITE Capital Investors Club!

It’s that lovely time of year again… tax season.

Whether you’re a business owner, employee, solopreneur or anywhere in between, tax season is something we all have to navigate and everyone’s situation looks different.

Your marital status, charitable donations, business expenses and many other factors can qualify you for legal tax write offs and benefits.

But did you know that investing in multifamily real estate can be one of those factors?

Many times when people think about investing, the primary reason they want to do it is so that they see a much greater return on their investment.

And while yes you want to see a steady cash flow for your investments, there are a few other benefits to consider that shouldn’t be overlooked.

When you invest in multifamily properties, you can usually take advantage of a few tax benefits that you’ll thank yourself for come tax season.

One of the first and major tax benefits you can take advantage of when investing in multifamily real estate are depreciated tax losses against the gains of the property.

Depreciation is the term used in real estate to describe the degrading condition of the property overtime.

Over the years, things will break, go out of date or simply need repaired which means the value of the property can decrease. This is completely normal and expected for any property!

The good news is that the IRS doesn’t hold that against you and instead allows you to use that depreciation amount as a tax deduction year after year for 27.5 years.

Why 27.5 years? This is the amount of time that the government rules a multifamily property to be profitable.

This means that as long as your money is invested into a property of this sort, you can reap this benefit for almost 30 years and that’s hard to find anywhere else!

Another option that investors can take advantage of when it comes to taxes is utilizing cost segregation which goes hand in hand with depreciation.

Essentially what this does is accelerate the depreciation of certain aspects of the property, such as appliances, cabinets, etc. inside of the units so that you qualify for a greater depreciation deduction in a single year.

The only caveat with utilizing a cost segregation study is that it only benefits you during your ownership period.

Because of this, when you decide to sell or pull your investment from the property, you can be faced with a higher tax bill… but don’t let that scare you away!

There’s another benefit for investors to contrast this and it’s called the 1031 Exchange.

A 1031 exchange is an investing tool that allows you to defer your capital gains taxes by reinvesting the funds you pull out of a property and put them into another investment property of like kind.

This means that the new property must be of the same nature as the previous.

For example, if you pull your investment from an apartment complex, you can reinvest those funds into a different apartment complex and utilize the 1031 Exchange benefit in order to avoid that higher tax bill.

This will ensure that you continue to reap the Depreciation and Cost Segregation benefits year after year!

Lastly, one of the greatest tax benefits that investors can take advantage of involves passive income.

As an investor of a multifamily property, you receive what is known as passive income. The IRS sometimes refers to this type of income as unearned income.

For a multifamily investor, your earnings come from your investments in rental properties.

Just like active income, which is money received from your job or business in which you are actively involved, passive income is also taxable, but it’s treated much differently.

To qualify for passive income tax benefits, you have to spend less than 500 hours on the business. As an investor, this is usually the case which is good news for you during tax season!

Instead of being involved in the day-to-day operations, you simply invest your money with a trusted group of professionals and they take care of the hands-on work.

This allows you to qualify for huge tax breaks that you typically wouldn’t receive through traditional investing.

It’s for this reason alone that many people choose to work with investment groups like XSITE Capital so that they can trust they will see an ROI, while also benefiting in other ways without having to do a lot of extra work.

If you’re looking to increase your tax benefits for 2023, investing in multifamily real estate could be an option for you! To learn more about the process of getting involved, click here to connect.

– The XSITE Capital Team

Did you know that 66% of Americans set new years goals that are directly related to their finances?

Whether it’s paying off debt, generating more savings, implementing a budget or investing, more than half of the U.S. population have made plans to adjust their finances in the new year.

A recent study has shown that even though these financial goals are still being set in 2023, 81% of people believe that inflation and the overall state of the economy will make it much harder to meet these goals.

As you set your own goals for the new year, maybe you can relate.

You might wonder how you’re going to generate extra money to pay off debt. You may worry that you won’t be able to stay within your budget due to the high costs of everyday living.

You might think that investing isn’t an option because you need every extra dollar after expenses to go towards your savings. Or you might just be overwhelmed with finances in general and aren’t sure which actions to even take.

If this is you, you’re in the right place! At XSITE Capital, our mission is to educate and encourage people to make decisions that are best for them, specifically when it comes to multifamily real estate investing.

We believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

Last month on the blog, we addressed how interest rates, inflation and a possible recession can impact your commercial real estate investments so you can know what to expect with the ongoing economic changes.

With that, we also want to share three main reasons why commercial real estate IS still a good investment in 2023 so that you can take confident action as you work toward your financial goals this year!

The talk of a recession has been going on for a few months now and with a recession people tend to become very cautious about where they put their money.

This is totally understandable because you want to make sure you’re putting your money somewhere that is safe and will produce a quality return for you in the future.

While it’s true that a recession can negatively affect your investments, the good news is that when you invest in multifamily properties, you can rest easy knowing that your investment is protected.

Historically, multifamily assets have shown to be recession resistant because, at the end of the day, people always need a place to stay.

When a recession hits, there’s typically an influx of people selling their homes that they can no longer afford, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

This is good news for you as an investor in multifamily properties as this can boost the cash flow that you receive thanks to more tenants occupying the property.

Whether or not a recession will actually hit in 2023, we aren’t sure, but what we do know is that people are already taking precautions which means that the demand for rentals is already happening and now is a great time to get involved with investments of this type.

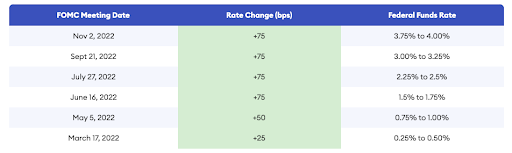

Many times when people think about investing, they jump straight to the stock market because they haven’t been properly educated on how real estate can be a quality investment as well.

The only real problem with solely investing in the stock market is that it can be very unpredictable and can take a massive hit at any given time, especially during economic downturns or world events.

Commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The main reason for this is because housing is and always will be a basic necessity that all people need. Because of this, you can trust that multifamily properties will continue to appreciate in value which ultimately means that you will receive more return on your investment.

This isn’t to say that investing in the stock market is bad. We encourage that too, but more than anything you want to make sure that your investments are diversified – meaning you have money in multiple places – so that if one takes a negative hit, you have the other to fall back on.

One of the biggest challenges that people often face in real estate in general is the ability to receive the funds they need to purchase or invest in a property.

This can become even more difficult when the economy is in a downturn because banks become more strict with their loan process and have more requirements than you might typically see.

While this can cause difficulty for you if you were to purchase a single-family home, there is a much easier financing process when it comes to commercial real estate.

Banks can confidently predict that the cash flow of a multifamily property with multiple tenants will be consistent and steady versus a property that only houses an individual or one family.

What this means for you as an investor is that the bank doesn’t look at solely your income to grant you the loan. Instead, they will look at the details, history and projections for the property so they can accurately gauge the return.

This is why getting involved in deals that have been thoroughly researched and scouted for you is so important and is the very reason that we take our property selection process so seriously at XSITE Capital.

Linking arms with an investment group that takes the time to ensure a property will be lucrative is your best bet to receive a healthy ROI and that’s exactly what we do through our Investor’s Club!

So, if you have big financial goals in 2023 and are looking for ways to make them come to life with ease, we invite you to join us.

When you join the XSITE Investor’s Club, you will receive:

Overall, we’re here to empower and support you in your personal journey!

Here’s to 2023. 🎉

– The XSITE Capital Team

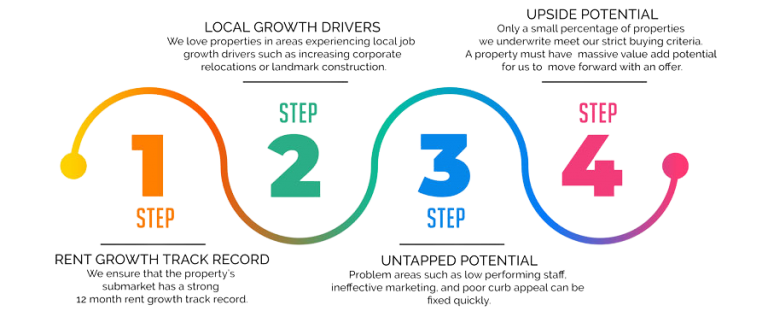

Interest rates, inflation and a recession have been the talk of the country for a large portion of 2022 and as a commercial real estate investor, it’s important that you know what each of these economic hits can mean for you and your investments.

As an investor, interest rates, inflation and a recession all play a huge role in your current and future investments so it’s important that you understand the basics of each and how exactly they all work together so you can remain confident in how you handle your money.

First things first, let’s talk about interest rates.

Throughout the year, interest rates have been ebbing and flowing and each week it seems like we’re seeing something different.

The Fed introduced its first rate hike in March of 2022 and they have continued to raise the rate from there.

As an investor, it’s important to pay attention to interest rates because they directly affect how much money you can borrow and ultimately determine how much you will end up paying back in the future.

Simply put, the interest rate is the amount you are ultimately charged for borrowing money and it’s shown as a percentage of the total amount of the loan.

This is why when interest rates are low, people are typically more quick to invest. When interest rates are high, on the other hand, people tend to become a bit more wary and start to consider if the investment is worth the extra amount of money they’ll owe towards their loans.

So, what exactly causes interest rates to rise?

The main cause of rising interest rates is inflation and inflation happens whenever there’s a high demand for products and services from consumers. This demand causes prices to rise and this concept is commonly referred to as demand-pull.

Another reason that inflation can occur is what they call cost-push. This is when supply costs to create products or deliver services forces prices to rise.

When inflation occurs, we typically see a few things start to happen:

Inflation is also directly linked to a recession, which means that people become very wary of where their money is going.

The good news for you as a commercial real estate investor is that your investment is typically recession resistant in this industry.

The reason being is because one of the main things to go for people during a recession is their expensive mortgage, especially if they’re living far above their means, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

Additionally, recessions can also make it more difficult for people to receive proper loans that they need to buy a house, so many people will be forced to continue renting.

In fact, history has shown that even though the housing market as a whole tends to take a hit during economic downturns, rental markets remain steady and even outperform other investments.

Essentially, rising interest rates, inflation and a recession can actually boost the cash flow that you receive from your current commercial real estate investments thanks to more tenants occupying the property.

So, what does this mean for your future investments?

Now that you know how your current commercial real estate investments can be affected by interest rates, inflation and a recession, you might be wondering how those three things can affect your future investments, as well.

The biggest challenge that high interest rates can cause for new commercial real estate deals is that the supply can decrease during economic downturns.

It’s for this reason that we always encourage investors to join a trusted Investor’s Club like XSITE Capital’s so that you aren’t having to do the up front research for new deals on your own.

Instead, you can sit back and know that other people are doing that work for you so that you can invest your money into a deal that has been heavily researched and you can trust that you will see a healthy ROI.

Another challenge that high interest rates and inflation can present for new investments is that the financing process may be a bit more difficult than usual.

Generally speaking, the financing process for commercial real estate is much more simple than if you were to invest in single-family properties because these investments aren’t as risky for banks.

The reason for this is because banks can confidently predict that the cash flow will be consistent and steady for a property with multiple tenants versus a property that only houses an individual or one family.

However, during economic downturns banks can become a bit more wary with how they loan their money, so you can expect the financing process to be a bit more challenging during tough economic times.

With that, you still have a much greater chance of getting approved for what you need for commercial real estate investments versus single family properties, so don’t let this challenge steer you away.

Overall, investing in commercial real estate specifically during economic downturns is still a smart move.

In fact, it’s been said that most millionaires are MADE during recessions and the reason for that is because when most people become fearful and stop spending their money, other people use this time as an opportunity to invest their money into places that will perform higher when the economy returns to normal.

While investing during economic downturns is encouraged, it’s important to remember that not all investment opportunities are created equal. For example, the stock market can be a bit unpredictable during this time, but commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The reason for this is because housing will always be a basic necessity and properties will continue to appreciate in value. This is great news for you as an investor and can give you peace of mind when it comes to where you’re putting your money.

As you continue to navigate the economic changes, we encourage you to join the XSITE Capital Investors Club so you can be among the first to get access to new commercial real estate deals and be among the few who use this time as an opportunity to thrive rather than just survive.

We’re here to support you along the way!

– The XSITE Capital Team