Many people hear about multi-family investing, but they don’t fully realize the benefits that come with it.

So, let’s breakdown the 6 major benefits of multi-family investing

1. Multi-family real estate is a recession-resilient investment.

Most investors are expecting a recession following the effects of the current pandemic and with stocks soaring, many are also considering whether it’s a bubble.

But one investment that stands the test of time during bear and bull markets is multifamily real estate investments.

So, if you’re looking for an option to round out your investment portfolio, this is a good place to start.

2. Demand for apartment rentals is rising.

According to the Pew Research Center, more households are renting now than at any time in the past 50 years.

Between the 10-year period from 2006 to 2016, the number of households grew, but renters outpaced homeowners in that growth.

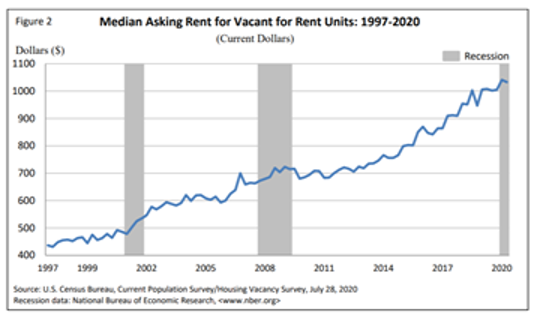

Fast forward 4 years later to 2020, and the US Census Bureau indicates that rental vacancy rates have decreased and median asking rent continues to increase.

The asking price for sale units has also decreased.

While the economic downturn will impact apartment demand, the overall growth rate is sufficient to absorb new supply entering the market.

3. Apartments offer a steady stream of income.

The statistics show that the apartment rental market continues to increase in demand and, therefore, value.

So, you have an opportunity to diversify your investments into an option that delivers a steady income stream which you can expect each month.

Apartment or multifamily units offer better economies of scale and thus higher returns on investment.

As of August 2020, the NCREIF Property Index estimated annualized returns over a 5 year period on real estate investment at 5.79%.

4. They are true passive income sources.

We’re often told that wealth starts with building passive income streams, where your money continues to work for you and nowhere is this more evident than in a multi-family investment.

Without needing to lift a finger to maintain your properties, your investment in a multifamily unit(s) continues to yield income month over month, plus your property continues to appreciate as time goes by.

5. Multifamily investing has many tax benefits.

Multifamily real estate investment offers high tax-advantages that many people don’t know about.

If you use a mortgage to finance your investment (which most savvy investors do) you can take a high mortgage deduction in the first year of ownership.

Then, you can depreciate the property, which means you can set off this depreciation against your rental income.

This alone makes multifamily real estate investing an attractive option, especially for those savvy with the tax laws.

6. There are multiple ways to get involved in multifamily investment.

There are multiple ways to get involved in this type of real estate investment including the most passive route and invest via syndication or you can invest in a multifamily fund or a real estate investment trust (REIT).

If you want to learn more about how to get started in multi-family real estate investing, here are two ways to get started:

1. Join the XSITE Capital Investment Club

2. Attend one of our free Monthly Meetups

3. Dive into our resources including, the XSITE Capital Blog or connect with us on LinkedIn

To become successful at multi-family investing, you need to increase your knowledge and you can start with these top 5 books on multi-family real estate investing.

We’ve also added two bonus books that tackle more of a general mindset.

All these recommendations are beginner friendly.

1. Invest in Apartment Buildings: Profit Without the Pitfalls by Theresa Bradley-Banta

Bradley-Banta quickly dispels the real estate investing misconceptions that most persons have and dives into how to become successful at investing in multifamily buildings.

This book is only if you’re seriously committed to making real estate investment work for you.

2. Best Ever Apartment Syndication Book by Joe Fairless and Theo Hicks

We are big on syndication here at XSITE Capital, so it’s natural that we would recommend a book on the subject.

This book is one of Amazon’s highest-rated real estate investing books based on average customer reviews.

If you’re ready to upgrade your property investment game in a logical step, then this book is an excellent guide.

It’s an in-depth look at building a real estate investment business from concept to execution. It does, however, focus on syndication with an exit in mind, whereas we generally look for permanent holds.

Written by an active real estate investor, this is a detailed guide made with the intention to stop readers from failing at real estate investing.

We advocate for generating wealth using passive income streams, so we appreciate his sections on achieving real estate success “without touching a toilet, paintbrush, or broom.”

Turner also hosts the BiggerPockets Podcast.

4. Mastering the Art of Commercial Real Estate Investing by Doug Marshall

Trying to decide between residential or commercial real estate investing? Marshall’s book looks at the benefits and pitfalls of commercial real estate.

Marshall has extensive experience in the industry and can, therefore, write from a first-hand perspective.

5. The Complete Guide to Buying and Selling Apartment Buildings by Steve Berges

On the other hand, there’s residential multifamily investing, which Berges goes into detail on the topic.

This book is good for beginners and seasoned, professional investors alike. Now in its second edition, it has added information on tax planning and sample forms to help to understand the investment process.

6. Wheelbarrow Profits by Jake Stenziano and Gino Barbaro

We love this book at XSITE Capital and recommend it frequently to our friends, family and new investors.

In this book, the authors explain why multifamily investing is so lucrative and how you as an investor can take advantage of this opportunity.

Even if you’re an experience investor, this book is an excellent resource on understanding your market, finding your niche, and growing your portfolio.

The right mindset is necessary if you want to be successful at real estate investing. That’s why, in addition to the real estate books we’ve listed above, you should make time to read the following.

7. Rich Dad, Poor Dad by Robert T. Kiyosaki

Kiyosaki compares 2 types of dads. The “poor dad” teaches you to follow the traditional viewpoints on money – go to college, get a 9-5 job, work until retirement, while the “rich dad” teaches you to become independently wealthy where you invest and build assets.

8. The Richest Man in Babylon by George S. Clason

This book clearly illustrates many of the principles that underpin multi-family real estate investing:

● Start thy purse to fattening. It is not what you earn; it’s what you keep.

● Make thy gold multiply. Clason here speaks to having more than one income source and that wealth comes from a reliable income stream. Embrace passive income generation and make your money work for you.

● Increase thy ability to earn. Clason encourages you to put yourself in a position to make more money. This means improving your skills and knowledge.

We believe the first step in growing your wealth is growing your mind, so we encourage you to dive into these books above along with various topics on the XSITE Capital blog.

Generating passive wealth – aka making money while you sleep – is a nice idea.

But as a busy professional, most of the passive wealth generation ideas being bandied about aren’t truly passive. Or at least they won’t be truly passive until a few years down the road. Most require your active participation to get them up and running.

Based on your workload now, you just don’t have the time for that.

You don’t need a second job, just additional sources of revenue.

Therefore, you need a truly passive avenue to invest, which offers real returns.

Truly passive wealth means investing in assets that generate income for you, meaning your money works for you, not you working to earn.

The aim of passive wealth generation is to help you eventually replace your earned income to a point where you can choose to work or not.

It frees up your time to take on challenges you want to focus on or spend more time with your family.

For those who successfully achieve true passive wealth generation, they can retire from being “busy professionals”, and start to live life as they see fit.

You will notice that we didn’t use the term passive income, and that’s deliberate.

Wealth creation is a long-term process and will not happen overnight. It also requires the discipline for reinvestment.

With passive wealth, it also means that in addition to your stable, predictable income, you are also enjoying asset appreciation and that primarily comes from investing in real estate.

The typical real estate investment process requires that you essentially become a property manager. You’ll need to manage tenant problems, handle late-night phone calls, management issues – the works. And even if you outsource property management, these are still ultimately your responsibility.

On the other hand, there’s property flipping. This means buying, fixing, and selling a property. This requires your active involvement in all aspects of the process. Hence, this cannot be a source of passive real estate investment.

None of these equate to what we recommend as passive wealth creation through real estate investment. As a busy professional, you do not have the time to dedicate to these types of projects.

The third option is one that we use at XSITE Capital to generate passive wealth for our clients who are often extremely busy professionals. To consider real passive wealth, you need to invest in real estate and the best option for passive real estate investment is by investing in commercial and real estate projects where you won’t need to manage the investment or the properties.

In this option, active ownership of property doesn’t mean ‘landlord’ with the attendant headaches. With passive investment, you allow those with the expertise to generate and manage the property investments on your behalf. You enjoy the returns in terms of income, tax benefits and asset appreciation.

This is often referred to as apartment syndication and is one of the smartest ways for real estate investment.

Building a strong wealth foundation – one that can last through multiple generations – should be your goal for passive wealth generation.

As long as you have the discipline and the right investment partners with you, you can build your passive wealth system.

If you’re interested in learning how to build passive wealth through multifamily real estate investment, click here!

If you’re new to multi-family real estate investing, and you’re looking for resources to help you get started, these are 7 of the top multi-family real estate investing blogs to get you started.

We believe that in order to grow your wealth, you must first grow your mind!

It’s important to read and gather different perspectives. So, while the principles of multi-family investing are the same, each firm’s approach and results are different.

Therefore, it pays to understand the different approaches and your options.

These 7 multi-family investing blogs are solid foundational and intermediate resources to learn multifamily real estate investment.

MultifamilyBiz is an open media platform offering a mixture of multifamily investment, marketing, and current affairs posts.

Similar to the Forbes.com model, most posts are submissions from various experts in the multifamily industry.

With over a million monthly visitors to their blog, they are one of the top online spaces for resources and information on all aspects of multi-family investing.

Like MultifamilyBiz, Multifamily Executive is a blog website featuring posts from various real estate and multifamily investment experts. As such, its posts range from in-depth, granular pieces to shorter, current affairs or news stories.

Some of the topics they look at include Business & Finance, Property Management, and Technology.

Multifamily Partner is a training site with a well thought out blog.

They know their niche and the majority of their posts reflect that – apartment investing. Their focus is on what they term the commercial multifamily investing ecosystem.

A mixture of blog posts and podcast episodes, their multifamily real estate blog focuses on educational and training material for new investors and those looking to scale.

Starting from a conversation between friends, Jake and Gino’s business has morphed into one of the most easily found multifamily investment blogs on the internet.

Headed by a husband and wife duo, Think Multifamily is a multifamily acquisition and education company.

Their multi-family investing blog is intended for two audience types – newbies to multifamily investment, and people looking for investment opportunities. The posts are more of a personal nature written from the perspective of the owners.

Though a general real estate investment blog and not specialized in multifamily investment, Than’s Blog offers applicable resources to help you understand the general real estate industry.

It focuses on both residential and commercial real estate investing, so if you’re interested in one or both, it’s a good place to enhance your online learning experience.

The XSITE Capital multifamily investment blog is one of the more recent blogs to enter the online multifamily investment space. We are now making it a priority to start sharing all we have learned in this business.

We are one of the very few black-owned multifamily investment companies in the U.S.

As a multi-family investment firm in the truest sense of the term, we have built a strong, passive investment portfolio. and focus on investment opportunities as well as multifamily education!

These are by no means the only blogs online that can guide you in your multifamily real estate investment journey, but they are all a great start and can get you up to speed quickly.

Here at XSITE, we update our blog monthly with new posts for you to dive into!

To purchase a home to flip, you’d have to put up all the capital (i.e. risk) yourself. You’d invest time and energy into flipping the house and be 100% responsible for all of the work. At the end of the day, you’ll probably make money, but it’s a one-time gain and is often taxed as ordinary income, not capital gains.

Also, consider that fewer and fewer millennials are buying homes, and boomers are moving into multifamily apartments and retirement communities at a rapid pace.

This means there are fewer buyers on the market and more renters.

What if there was a way to invest in real estate where you’d share the investment, get paid every quarter that cash flow was available AND be responsible for 0% of the effort to manage the property?

That’s what multifamily apartment investing is all about.

You make a one-time investment and get quarterly payments that are based on the building’s income and occupancy – not on neighborhood comps.

A professional team manages the building for you.

Plus, you get a huge tax advantage as a multifamily investor.

Even though you’re only putting down a percentage of the capital, you get pro-rated depreciation benefits on the apartment complex.

American entrepreneur and New York Times bestselling author Grant Cardone got his start with multifamily apartment investing and today he’s one of the most celebrated businessmen in the country.

In Cardone’s own words, “if you go into multifamily the right way, over the next decade it could be the best investment of your lifetime.”

After buying his first multifamily apartment building in the 90s, he learned what we already know so well:

Buying a single-family home is a liability that you pay every month. Buying a multifamily home is an investment that pays YOU every month.

If you’re ready to see what multifamily real estate could mean for you, click here to learn more!

If you’re like us, learning about the tremendous upside to investing in multi-family properties is exciting.

The reality is it can dramatically increase your passive income streams over the next 2-7 years.

Life is busy though, and sorting through the details can feel overwhelming. To help ease some of that overwhelm, here are a few benefits to consider when considering whether or not to invest in multifamily real estate.

1. Apartment values are based on net income, not market comparables.

This is one of the most impressive benefits of multifamily investing.

Consider that in a 150 unit apartment complex, raising the rent by just $15/month increases the total property value by more than $385,000. [(150 units X $15 X 12 months) / 7% Cap Rate].

Let’s see your Hedge fund manage that!

2. Returns usually beat the stock market.

If you had invested $1 in the stock market in 2002, you’d have about $2 in 2018 (taking inflation into account).

That’s no way to plan for a future of passive income for you and your family.

3. Multifamily syndication loans are NEVER dependent on your income or credit.

Multifamily syndication loans are based on the value of the property, not your own personal assets.

In other words, investment in multifamily syndication allows you to get into a growth position with extremely limited personal liability.

Passive investors do not sign on loans in a multifamily syndication.

4. Multifamily investments are usually LESS VOLATILE than single-family investments.

During recessions, rent typically remains much more stable than home prices.

And as homeowners are displaced due to rising mortgage rates and/or job losses during recessions, they turn to apartments, leaving multifamily values with small declines at worse and thriving at best during flat/negative markets.

5. Multifamily investing is a growing market.

Millennials aren’t buying homes at expected rates and their preference for renting started before the 2008 economic crisis.

Meanwhile, retiring baby boomers are moving to urban apartments, perhaps to be near their children who have opted for city living, or to take advantage of the perks of city life themselves.

Finally, the overall market is shifting to a rental environment.

Homeownership rates are falling, and have been falling for over 12 years. Even the National Association of Realtors has acknowledged this reality – it’s being referred to as the Great Housing Reset.

Even if you’re an inexperienced investor, now is a great time to learn more about investing in multi-family properties!

If you’re thinking about investing in multifamily real estate, there are 6 main questions to ask the investment group you’re working with to ensure it’s a good fit.

We ultimately believe that multifamily apartment investing is one of the smartest things you can potentially do with your capital because the properties typically hold their value over time and they usually increase in value based on income (not comparables) while also offering excellent risk-adjusted ROI.

That said, there’s a lot to consider when deciding whether or not to become a multifamily property investor. Here are some important factors to consider:

1. How long does it take to recoup an investment in a multifamily apartment complex?

Typically, you’ll receive quarterly dividends for your investment after an initial stabilization/rehab period.

Additionally, syndication companies such as XSITE Capital project that your investment will double in 5-6 years.

If you’re looking for a highly liquid investment, multifamily investing is likely not for you.

If you’re looking for a comparatively high rate of return via an attractive risk-adjusted investment vehicle however, multifamily investing is one of the best options on the market!

2. Will I have to do any work on the property once I invest?

One of the best things about working with an investment group like XSITE Capital is that we employ a professional team to manage the property.

What means to you as an investor is you can simply invest the initial funds and then watch your investment return dividends and equity gains!

3. How much of the split will I keep as an investor?

The answer to this question will always depend on the property, but it’s a great question to consider before investing.

One of our most recent investment, The Griffin at Petworth in Washington, D.C, offered an 80/20 split for investors.

Others may do 70/30 or 60/40 splits with the most going to investors.

4. What is the minimum investment?

Again, each property is different, but typically there is a $50,000 minimum investment, while some properties may offer $25,000 minimums.

5. What are the tax implications of multifamily investing?

When you invest in multifamily properties, you can typically expect prorated depreciation benefits that can lower your taxes.

We advise that you discuss your specific tax situation with a CPA to learn how your personal finances will be impacted.

For more general tax benefits that you can expect with multifamily investing, click here.

5. How do I choose the right property?

Choosing the right multifamily property depends on your goals.

First, you need to decide whether you’re more focused on short-term or long-term gains.

Class A properties will have more long term gain, while Class C will have more short term gains but a shorter project lifespan. Here’s a breakdown of the differences in each Class type.

Second, decide how much you want to invest and find the right syndication company that will offer a competitive ROI.

It’s best to discuss your options with a professional and we’re always here to help!

Overall, investing in multifamily properties can be a great addition to your portfolio, but doing your due diligence before making that move is advised.

One of the first things you learn about investing is that diversification is vital.

When you have a diverse portfolio, a negative hit to one of your assets doesn’t drag the remaining assets down.

It’s why we divide our assets between stocks, CDs and property. It’s why we short one company while going long on another. It’s a safety net, and it’s one of the most important components of your investment strategy.

When you invest in traditional single-family real estate, you throw this principle out the window.

Why? Because you put a large chunk of your cash into ONE piece of property.

That piece of property must be purchased (or rented) by ONE family in order for you to turn a profit. In between, you’re subject to the local market, neighborhood comps dragging down your home’s value, and deals that could fall through.

And yet, real estate is a historical winner because, with a few exceptions, real estate assets rise over time.

Short answer: invest in multifamily apartments.

When you invest in multifamily properties, consider that each tenant is just a percentage of your investment.

If one or a few tenants move out, your investment is still strong.

Your management team can cover small losses because the rest of the building’s rental income is stable.

You don’t have to worry as much about factors like the local market or neighborhood comparables because multifamily investing is valued based on the income of the apartment – not comps.

Beyond diversification there are many other benefits of investing in multifamily real estate, including major tax benefits!

Ready to experience these benefits for yourself? Join the XSITE Investment Club to get started.

For the first time in history, home ownership is on a steady decline and the number of people who elect to rent is growing. In fact, home ownership is down in 90% of U.S. cities and in 96.2% of cities with more than 1 million residents. Experts are calling it the “Great Housing Reset.”

When you invest in multifamily real estate through syndication, you stake your claim in this booming industry.

Even with all of the uncertainty in the economy, now is an excellent time to diversify your investment portfolio with XSITE Capital Investment.

When you invest with XSITE Capital, you’ll receive a special investment approach that is proven, research-backed and data-driven that aims to identify, acquire, manage, stabilize, optimize and divest various Class B and C properties.

All of our properties come with a 3-7 year exit strategy because we believe you should always know what to expect and when to expect it.

We invest in multifamily projects in emerging markets across the country and before investing we thoroughly research and evaluate different aspects, including the metro location, sub-markets, neighborhoods, target properties, employment trends, sales trends, and other key indicators to choose thriving communities.

It really is an exciting process, and we welcome you to take this journey with us!