It’s no secret that investing is one of the best ways to build wealth. Whether you’re planning for retirement, saving for a big purchase or simply looking to grow your wealth for the future, putting your money to work can be an excellent way to achieve your financial goals.

However, one of the big mistakes that people make when investing is putting all of their eggs in one basket, meaning they only make one type of investment.

For your investments to produce the biggest reward, you want to make sure they are diversified!

A common diversified investment portfolio typically includes a mixture of real estate, bonds, stocks, fixed income, etc.

In this blog post, you’ll learn why diversifying your investments is crucial and how it can help you achieve your financial goals!

First things first, let’s clarify what diversification really means.

Put simply, diversification is a strategy that involves spreading out your investments across a variety of asset classes, industries and geographic regions.

The main goal with diversification is to reduce risk by allocating your funds to a mix of assets, instead of concentrating all of them in a single stock, sector or region.

Ultimately, having a diversified portfolio will benefit you greatly in the instance of one investment underperforming, because the overall impact on your portfolio will be minimized.

As mentioned, one of the primary reasons to diversify your investments is risk management.

All investments carry some level of risk, whether it’s market risk, industry-specific risk or company-specific risk, but you can reduce the impact of these risks on your overall investment performance by diversifying your portfolio.

For example, let’s say you are heavily invested in a single technology company, such as Apple, and that company suddenly faces financial difficulties or a sudden decline in its stock price. In this instance, your entire portfolio could suffer significant losses.

On the flipside, if you spread your investments across different sectors, including technology, healthcare and real estate, a setback in one sector would have a less detrimental effect on your overall portfolio.

Next, you want to consider market volatility, which refers to how the prices of financial assets, such as stocks, bonds, commodities or currencies, fluctuate within a specific period of time.

Fluctuations occur based on economic, political or global events, such as the COVID-19 pandemic, for example, where all travel industries were majorly impacted.

When you have a diversified portfolio, you’re able to more successfully weather these market storms and reduce the amount of loss on your assets, because when one asset class experiences a downturn, another may be performing well.

This balance can help stabilize your portfolio’s overall returns and reduce the emotional stress that often comes with investing.

Although risk management is a huge reason we push for diversification, it’s not the only reason. Diversification is also a strategy for long-term growth!

Different asset classes have varying risk-return profiles, so you want to consider each of these when choosing where to invest your funds.

For example, stocks tend to offer higher potential returns over the long run, but they also come with greater volatility. Bonds, on the other hand, tend to be more stable, but offer lower returns.

By combining these asset classes and potentially including alternative investments like real estate, you can create a diversified portfolio that allows for steady growth for the long term, while also managing risk.

Overall, diversification encourages a more disciplined approach to investing. When you have a well-structured and diversified portfolio, you’re less likely to react emotionally to short-term market fluctuations and can instead stay focused on your long-term investment strategy and financial goals.

Historically, diversified portfolios have shown a tendency to provide more consistent returns over time compared to portfolios concentrated in a single asset class. This consistency is essential for investors looking to build wealth steadily and achieve their financial goals!

Always remember: successful investing is not about timing the market or picking individual stocks perfectly – it’s about creating a well-balanced and diversified portfolio that aligns with YOUR financial goals.

So, whether you’re a seasoned investor or you’re just starting your investment journey, remember the power of diversification and make it a cornerstone of your investment strategy.

It’s a tried and true approach that can help you achieve financial security and peace of mind in an ever-changing financial world.

At XSITE Capital, we believe that investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

You hear us talk a lot about how multi-family investing is a great source of passive income. This is one of the largest benefits of investing in multi-family properties compared to single family homes.

We go more in depth to all of the pros and cons of multi-family investing in this blog post, but one thing that people always wonder after learning about the amazing benefits is HOW the distributions actually work.

And that’s such a great question!

As an investor in a multi-family real estate syndication, you can expect to receive periodic payments based on the income that the property generates.

So that you can have a better understanding of what this looks like, keep reading to learn how cash flow distribution works!

Investing in a multi-family property is a BIG deal and you can expect to reap massive benefits along the way. But too often, it’s unclear what that process looks like.

At XSITE Capital, we aim to help you understand every step of the investment process, so you can confidently take action and trust that your investment is in good hands.

For a closer look into the 5 phases of a multi-family investment deal, click here, but for now we’re going to focus on what happens after you invest!

Once all capital is raised for a specific deal, the syndicator then transitions into the property management and value-add creation phase.

During this stage, the syndicator oversees the day-to-day operations of the property, including tenant management, maintenance, rent collection and expense optimization.

In addition to the day-to-day operations of the property, syndicators also typically implement a value-add strategy, such as property renovations, amenity enhancements or operational improvements to increase the property’s value and rental income.

The syndicator’s goal during this phase is to enhance the property’s performance and generate attractive returns for all investors involved.

This work directly impacts YOU as an investor, because the greater the property is, the greater results you can typically expect to receive.

Throughout the entire syndication, you will receive ongoing communication and regular updates, so that you are fully aware of what’s happening with the property and how it’s performing.

When you partner with an investment group like XSITE Capital, you can expect consistent communication that includes details about property performance, financial statements, occupancy rates and any significant developments or challenges.

In addition to regular updates about the property performance, you can also expect to start receiving regular cash flow distributions, which typically happen on a quarterly basis.

And remember: all of those distributions are a direct source of passive income for you, meaning you don’t have to be included in any of the nitty gritty, day-to-day work of the property.

That’s the beauty of multi-family real estate!

While all of this sounds great, you might be wondering… “where exactly does the money come from?”

And that’s another great question, so let’s break it down.

The primary source of income in a multi-family investment comes from the rental payments made by tenants who occupy the units within the property. Typically, multi-family properties are apartment buildings or similar entities where there are multiple tenants on-site.

This rental income, along with any other sources of payment, such as laundry facilities, parking fees, etc., forms the basis for the cash flow of the property.

Before calculating cash flow, the operating expenses related to the property must be deducted from the total income. These expenses include property management fees, maintenance and repairs, property taxes, insurance, utilities, marketing costs and any other overhead expenses associated with property upkeep and management.

The remaining amount after deducting operating expenses from the total income is referred to as the Net Operating Income (NOI), which is a key financial metric that reflects the property’s profitability before considering mortgage payments and other financing costs.

If the property was financed with a mortgage or other loans, a portion of the NOI is allocated to pay off these financing obligations and includes both principal repayments and interest payments.

Once operating expenses and debts are accounted for, the remaining amount is the potential cash flow available for distribution to all investors involved in the property.

This cash flow is divided among the investors according to the terms outlined in the investment agreement.

The distribution of cash flow looks different for every investment deal and is dependent on the structure of the deal.

Investors’ ownership percentages and the terms dictate how the cash flow is distributed. As mentioned earlier, you can typically expect to see distributions quarterly.

Some investment deals may have a preferred return, which is a predetermined rate of return that certain investors receive before the remaining cash flow is distributed to other investors.

Once any preferred returns are given, the remaining cash flow is typically distributed among the investors based on their ownership percentages in the property.

For example, if an investor owns 30% of the property, they would receive 30% of the available cash flow.

It’s important to note that the actual cash flow received by investors can vary due to changes in rental occupancy rates, fluctuations in expenses, unexpected repairs and other factors.

This is why it’s important to work with an investment group that values transparency and always communicates with you so you know what to expect at all times!

Hopefully now you have a better understanding of how cash flow distributions work once you have committed to investing in a multi-family real estate deal.

At XSITE Capital, we believe that investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators like us, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

At XSITE Capital, we believe that investing in multifamily properties can be one of the greatest wealth building tools, but we also recognize that one of the main things that holds people back is knowing where to start.

Choosing to invest in a multifamily property is a huge decision that can impact your wealth – both positively or negatively depending on your choice – which is why it’s so important to do your due diligence before committing to an investment.

Investing in multifamily properties can be a lucrative opportunity for both new and seasoned investors when done correctly, so to help you grow the confidence you need for selecting properties to invest in, this blog breaks down 4 important factors to consider when choosing an investment.

The location of a multifamily property is crucial to its success because you want to ensure the property is situated in a desirable and safe neighborhood that has potential for growth.

It’s important for multifamily properties to be in areas with quality transportation, access to amenities, low crime rates and a strong job market.

When most of these boxes are checked, you can generally expect for the property to do well for years to come and that the tenant demand will remain high throughout the duration of your investment.

Additionally, when your investment property is located in a desirable area, you can typically expect rent prices to rise year after year, which means you could potentially earn even more than initially expected on your investment, which is a huge win!

In addition to location, the condition of the property is another important factor to consider when choosing which multifamily property to invest in.

If you choose a property that requires a ton of updates or maintenance, there’s a chance that your return on investment (ROI) will decrease due to the financial requirements of the updates needed.

When initially inspecting a property, you typically want to consider:

When you examine each of these areas, you’ll be able to determine if they are a one time fix or if they will require continual maintenance year after year.

From there, you can weigh the risk versus reward and clearly determine if the property is a good fit for your investment portfolio.

The entire point of investing is to put your money into a place where you will see an even greater return, but in order for that to happen, you must choose avenues that are able to provide you with that outcome.

Generally speaking, multifamily investing is able to do that! That’s why we are huge advocates of this type of investing here at XSITE Capital.

With that, however, we also recognize that not all investments are created equal and before choosing to invest in a multifamily property you need to know the financial facts, which involves the history of the property AND the forecasted income for the future.

To get a solid understanding of a property’s financial history, you want to make sure that you review the property’s past income and expenses. This will give you a great snapshot of what the property is capable of.

After that, it’s important to also consider the potential for growth!

Oftentimes, investment companies (such as us here at XSITE Capital) will buy properties with the help of investors and create a value add plan that increases the desirability of the property, thus increasing the potential for growth.

With these considerations, you can better determine your ROI and ultimately decide if the property is a good fit for you!

Next, you want to consider the vacancy rates and number of units, since these two items directly impact your ROI as an investor.

As an investor, you likely want to invest in a property that has a higher number of units so that you can expect a greater return.

It looks like this:

The higher number of units = the higher number of tenants = higher income from rent = greater return for YOU!

In addition to the number of units, you also want to explore the past vacancy rates of a property in order to understand the history of how the property has performed in the past.

Past rates can sometimes be a good indicator of the overall desirability of a property.

When investing, you typically want to be involved with a property with low vacancy because, again that means higher profits for you as an investor.

Something to remember, however, is that if a property has high vacancy rates that could be due to mismanagement, poor maintenance, outdated features, etc. and oftentimes this can be fixed with a new value add plan that new owners propose.

Because of this, sometimes you have to use your best judgment and decide for yourself if the property has potential for growth and if it does, the reward might outweigh the risk in the end!

Conducting this research on your own can be overwhelming, which is why investors often prefer to join forces with investment groups that take the guesswork of this process.

At XSITE Capital, we do just that and take our market research very seriously when choosing a property!

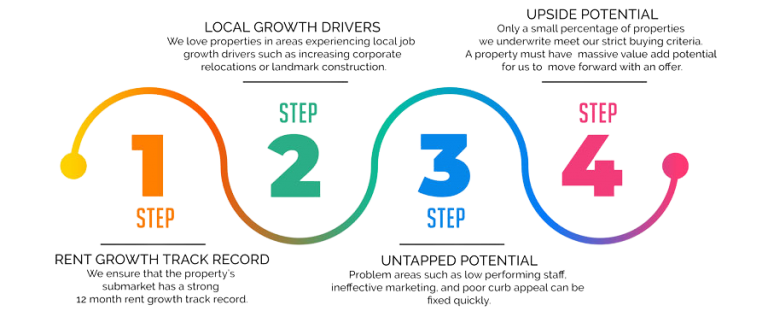

When choosing a multifamily property to add to our portfolio, we specifically look at:

Here’s a closer look at our market and property selection process:

We won’t move forward with a deal if it doesn’t meet our standards because we know our investors are counting on us!

Overall, investing in multifamily properties can be a great way to generate passive income and build wealth, but it’s always important to carefully consider these four factors before making any investment decisions.

By doing so, you can increase your chances of success and minimize potential risks!

At the end of the day, we believe that when you have the proper education and support, you can confidently start your own multifamily investment journey.

If you’re looking to start your investment journey and have the right people on your side along the way, we’re here for you.

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors daily and would love to welcome you!

It’s that lovely time of year again… tax season.

Whether you’re a business owner, employee, solopreneur or anywhere in between, tax season is something we all have to navigate and everyone’s situation looks different.

Your marital status, charitable donations, business expenses and many other factors can qualify you for legal tax write offs and benefits.

But did you know that investing in multifamily real estate can be one of those factors?

Many times when people think about investing, the primary reason they want to do it is so that they see a much greater return on their investment.

And while yes you want to see a steady cash flow for your investments, there are a few other benefits to consider that shouldn’t be overlooked.

When you invest in multifamily properties, you can usually take advantage of a few tax benefits that you’ll thank yourself for come tax season.

One of the first and major tax benefits you can take advantage of when investing in multifamily real estate are depreciated tax losses against the gains of the property.

Depreciation is the term used in real estate to describe the degrading condition of the property overtime.

Over the years, things will break, go out of date or simply need repaired which means the value of the property can decrease. This is completely normal and expected for any property!

The good news is that the IRS doesn’t hold that against you and instead allows you to use that depreciation amount as a tax deduction year after year for 27.5 years.

Why 27.5 years? This is the amount of time that the government rules a multifamily property to be profitable.

This means that as long as your money is invested into a property of this sort, you can reap this benefit for almost 30 years and that’s hard to find anywhere else!

Another option that investors can take advantage of when it comes to taxes is utilizing cost segregation which goes hand in hand with depreciation.

Essentially what this does is accelerate the depreciation of certain aspects of the property, such as appliances, cabinets, etc. inside of the units so that you qualify for a greater depreciation deduction in a single year.

The only caveat with utilizing a cost segregation study is that it only benefits you during your ownership period.

Because of this, when you decide to sell or pull your investment from the property, you can be faced with a higher tax bill… but don’t let that scare you away!

There’s another benefit for investors to contrast this and it’s called the 1031 Exchange.

A 1031 exchange is an investing tool that allows you to defer your capital gains taxes by reinvesting the funds you pull out of a property and put them into another investment property of like kind.

This means that the new property must be of the same nature as the previous.

For example, if you pull your investment from an apartment complex, you can reinvest those funds into a different apartment complex and utilize the 1031 Exchange benefit in order to avoid that higher tax bill.

This will ensure that you continue to reap the Depreciation and Cost Segregation benefits year after year!

Lastly, one of the greatest tax benefits that investors can take advantage of involves passive income.

As an investor of a multifamily property, you receive what is known as passive income. The IRS sometimes refers to this type of income as unearned income.

For a multifamily investor, your earnings come from your investments in rental properties.

Just like active income, which is money received from your job or business in which you are actively involved, passive income is also taxable, but it’s treated much differently.

To qualify for passive income tax benefits, you have to spend less than 500 hours on the business. As an investor, this is usually the case which is good news for you during tax season!

Instead of being involved in the day-to-day operations, you simply invest your money with a trusted group of professionals and they take care of the hands-on work.

This allows you to qualify for huge tax breaks that you typically wouldn’t receive through traditional investing.

It’s for this reason alone that many people choose to work with investment groups like XSITE Capital so that they can trust they will see an ROI, while also benefiting in other ways without having to do a lot of extra work.

If you’re looking to increase your tax benefits for 2023, investing in multifamily real estate could be an option for you! To learn more about the process of getting involved, click here to connect.

– The XSITE Capital Team

Did you know that 90% of the world’s millionaires have built their wealth by investing in real estate?

At some point in your life, you’ve probably heard it said that real estate is one of the best things to invest in because on both sides, commercial and residential, you’re investing in something with the confident expectation that you will receive more money back later down the road.

While it’s true that real estate can be one of the best ways to grow your wealth, the problem is that many people are missing the information and education to really do it well.

And that’s where we come in! Our mission at XSITE Capital is to educate and encourage all who qualify to passively invest in multifamily real estate so they can take advantage of the benefits that this asset has to offer.

Regardless of your race, current resources or access, we believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

We ultimately believe that through proper education, exposure and encouragement, our investors will have an equal opportunity to grow their mind and grow their wealth, which will positively impact generations to come.

Wherever you come from, you are welcome here!

Like anything in life, you want to make sure you’re learning from people who yes, have knowledge and expertise in the area, but also from those who continue to practice what they preach.

That’s what truly makes the XSITE Capital team so special and is why you can trust that the education you receive is coming from a place of knowledge, experience and current practice.

Our Co-Founders, Julius Oni, Leslie Awasom and Tenny Tolofari joined their passions together to help busy professionals like them reach financial freedom by investing in multifamily real estate.

Julius is the CEO and Co-Founder and primarily focuses on Investor Relations. Prior to XSITE Capital, Julius’ investment focus was single family real estate and angel investing. Over the past several years, Julius has invested in over 50 start-ups, and currently sits on the advisory board of four healthcare-related start-ups.

Within the last 2 years, Julius led the acquisition of XSITE Capital’s fast-growing portfolio of more than $100M. He was also acknowledged as a Forbes Business Council member in 2021.

Leslie is the Director of Operations and Co-founder who manages the company operations, market/data analysis, cash flow and budget analysis. In 2017, Leslie bought his first investment property and transitioned to multifamily investing in 2019.

Lastly, Tenny is the Director of Acquisition and Co-founder. Prior to forming XSITE Capital, Tenny spent several years leading a major sales team in one of the fastest growing financial services companies in America. He is also a Global Cyber Security professional, supporting the likes of Boeing and Deloitte.

The three of them together host a rapidly growing multifamily-focused meetup in Maryland where they provide resources and add value to individuals interested in growing their wealth and changing their financial future.

On a daily basis, Julius, Leslie and Tenny strive to provide the information and education that they believe everyone should have access to in order to grow their mind and simultaneously grow their wealth.

To ensure that you receive the information and education that you need to feel confident about taking action on a real estate endeavor, our team at XSITE Capital makes it a priority for you to have a constant line up of opportunities to choose from.

Here’s what those opportunities look like:

Every month on the blog, you can find a new blog post that answers the questions that many people don’t talk about when it comes to investing in commercial real estate. Our goal is to make things as simple as possible for you so that you can easily understand the benefits waiting for you on the other side.

Upcoming blog topics include:

In addition to the blog posts each month, we like to get face to face with you and provide valuable, free education. Monthly meetups feature talks from the XSITE founders in addition to other trusted and highly sought after industry leaders to educate on various topics.

Past meetup topics have included:

All monthly meetups are totally free and anyone is welcome to join! For all monthly meetup information, join the XSITE Investors Club!

We treat all Investor Club members like insiders which means you get the closest look into what’s going on at XSITE Capital, including what the team is working on and new deals that are available to you.

Just like we encourage you to consistently be learning, we do the same. We firmly believe that knowledge is a key part of wealth, so each month we share articles, books and research that we’re currently reading that’s relevant to real estate, investing and personal growth.

Our annual e-book is another free resource that all Investor Club members receive that aims to dive deeper into one topic regarding investing in commercial real estate.

The 2022 annual e-book is coming soon, so make sure you join the club so you don’t miss out!

Overall, we are committed to providing relevant and valuable information and education for those who are interested in experiencing financial freedom and creating legacy wealth through multifamily real estate investing.

We are glad you’re here!

– The XSITE Capital Team

Many people hear about multi-family investing, but they don’t fully realize the benefits that come with it.

So, let’s breakdown the 6 major benefits of multi-family investing

1. Multi-family real estate is a recession-resilient investment.

Most investors are expecting a recession following the effects of the current pandemic and with stocks soaring, many are also considering whether it’s a bubble.

But one investment that stands the test of time during bear and bull markets is multifamily real estate investments.

So, if you’re looking for an option to round out your investment portfolio, this is a good place to start.

2. Demand for apartment rentals is rising.

According to the Pew Research Center, more households are renting now than at any time in the past 50 years.

Between the 10-year period from 2006 to 2016, the number of households grew, but renters outpaced homeowners in that growth.

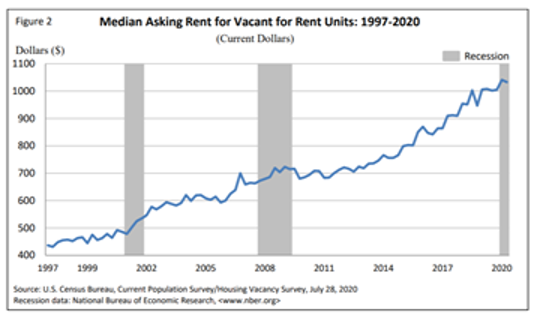

Fast forward 4 years later to 2020, and the US Census Bureau indicates that rental vacancy rates have decreased and median asking rent continues to increase.

The asking price for sale units has also decreased.

While the economic downturn will impact apartment demand, the overall growth rate is sufficient to absorb new supply entering the market.

3. Apartments offer a steady stream of income.

The statistics show that the apartment rental market continues to increase in demand and, therefore, value.

So, you have an opportunity to diversify your investments into an option that delivers a steady income stream which you can expect each month.

Apartment or multifamily units offer better economies of scale and thus higher returns on investment.

As of August 2020, the NCREIF Property Index estimated annualized returns over a 5 year period on real estate investment at 5.79%.

4. They are true passive income sources.

We’re often told that wealth starts with building passive income streams, where your money continues to work for you and nowhere is this more evident than in a multi-family investment.

Without needing to lift a finger to maintain your properties, your investment in a multifamily unit(s) continues to yield income month over month, plus your property continues to appreciate as time goes by.

5. Multifamily investing has many tax benefits.

Multifamily real estate investment offers high tax-advantages that many people don’t know about.

If you use a mortgage to finance your investment (which most savvy investors do) you can take a high mortgage deduction in the first year of ownership.

Then, you can depreciate the property, which means you can set off this depreciation against your rental income.

This alone makes multifamily real estate investing an attractive option, especially for those savvy with the tax laws.

6. There are multiple ways to get involved in multifamily investment.

There are multiple ways to get involved in this type of real estate investment including the most passive route and invest via syndication or you can invest in a multifamily fund or a real estate investment trust (REIT).

If you want to learn more about how to get started in multi-family real estate investing, here are two ways to get started:

1. Join the XSITE Capital Investment Club

2. Attend one of our free Monthly Meetups

3. Dive into our resources including, the XSITE Capital Blog or connect with us on LinkedIn

Generating passive wealth – aka making money while you sleep – is a nice idea.

But as a busy professional, most of the passive wealth generation ideas being bandied about aren’t truly passive. Or at least they won’t be truly passive until a few years down the road. Most require your active participation to get them up and running.

Based on your workload now, you just don’t have the time for that.

You don’t need a second job, just additional sources of revenue.

Therefore, you need a truly passive avenue to invest, which offers real returns.

Truly passive wealth means investing in assets that generate income for you, meaning your money works for you, not you working to earn.

The aim of passive wealth generation is to help you eventually replace your earned income to a point where you can choose to work or not.

It frees up your time to take on challenges you want to focus on or spend more time with your family.

For those who successfully achieve true passive wealth generation, they can retire from being “busy professionals”, and start to live life as they see fit.

You will notice that we didn’t use the term passive income, and that’s deliberate.

Wealth creation is a long-term process and will not happen overnight. It also requires the discipline for reinvestment.

With passive wealth, it also means that in addition to your stable, predictable income, you are also enjoying asset appreciation and that primarily comes from investing in real estate.

The typical real estate investment process requires that you essentially become a property manager. You’ll need to manage tenant problems, handle late-night phone calls, management issues – the works. And even if you outsource property management, these are still ultimately your responsibility.

On the other hand, there’s property flipping. This means buying, fixing, and selling a property. This requires your active involvement in all aspects of the process. Hence, this cannot be a source of passive real estate investment.

None of these equate to what we recommend as passive wealth creation through real estate investment. As a busy professional, you do not have the time to dedicate to these types of projects.

The third option is one that we use at XSITE Capital to generate passive wealth for our clients who are often extremely busy professionals. To consider real passive wealth, you need to invest in real estate and the best option for passive real estate investment is by investing in commercial and real estate projects where you won’t need to manage the investment or the properties.

In this option, active ownership of property doesn’t mean ‘landlord’ with the attendant headaches. With passive investment, you allow those with the expertise to generate and manage the property investments on your behalf. You enjoy the returns in terms of income, tax benefits and asset appreciation.

This is often referred to as apartment syndication and is one of the smartest ways for real estate investment.

Building a strong wealth foundation – one that can last through multiple generations – should be your goal for passive wealth generation.

As long as you have the discipline and the right investment partners with you, you can build your passive wealth system.

If you’re interested in learning how to build passive wealth through multifamily real estate investment, click here!

If you’re new to multi-family real estate investing, and you’re looking for resources to help you get started, these are 7 of the top multi-family real estate investing blogs to get you started.

We believe that in order to grow your wealth, you must first grow your mind!

It’s important to read and gather different perspectives. So, while the principles of multi-family investing are the same, each firm’s approach and results are different.

Therefore, it pays to understand the different approaches and your options.

These 7 multi-family investing blogs are solid foundational and intermediate resources to learn multifamily real estate investment.

MultifamilyBiz is an open media platform offering a mixture of multifamily investment, marketing, and current affairs posts.

Similar to the Forbes.com model, most posts are submissions from various experts in the multifamily industry.

With over a million monthly visitors to their blog, they are one of the top online spaces for resources and information on all aspects of multi-family investing.

Like MultifamilyBiz, Multifamily Executive is a blog website featuring posts from various real estate and multifamily investment experts. As such, its posts range from in-depth, granular pieces to shorter, current affairs or news stories.

Some of the topics they look at include Business & Finance, Property Management, and Technology.

Multifamily Partner is a training site with a well thought out blog.

They know their niche and the majority of their posts reflect that – apartment investing. Their focus is on what they term the commercial multifamily investing ecosystem.

A mixture of blog posts and podcast episodes, their multifamily real estate blog focuses on educational and training material for new investors and those looking to scale.

Starting from a conversation between friends, Jake and Gino’s business has morphed into one of the most easily found multifamily investment blogs on the internet.

Headed by a husband and wife duo, Think Multifamily is a multifamily acquisition and education company.

Their multi-family investing blog is intended for two audience types – newbies to multifamily investment, and people looking for investment opportunities. The posts are more of a personal nature written from the perspective of the owners.

Though a general real estate investment blog and not specialized in multifamily investment, Than’s Blog offers applicable resources to help you understand the general real estate industry.

It focuses on both residential and commercial real estate investing, so if you’re interested in one or both, it’s a good place to enhance your online learning experience.

The XSITE Capital multifamily investment blog is one of the more recent blogs to enter the online multifamily investment space. We are now making it a priority to start sharing all we have learned in this business.

We are one of the very few black-owned multifamily investment companies in the U.S.

As a multi-family investment firm in the truest sense of the term, we have built a strong, passive investment portfolio. and focus on investment opportunities as well as multifamily education!

These are by no means the only blogs online that can guide you in your multifamily real estate investment journey, but they are all a great start and can get you up to speed quickly.

Here at XSITE, we update our blog monthly with new posts for you to dive into!

There are many ways to build wealth and achieve financial freedom with real estate investing being just one of those many methods.

According to a Forbes magazine article “how the world’s billionaires got so rich”, real estate investing was one of the top 3 industries that have produced the most billionaires.

The real estate industry has been a great source of wealth for many generations prior, and that hasn’t changed in today’s reality.

For new and seasoned investors alike, multifamily investing is an excellent addition to your portfolio, and multifamily investing is a great way to build generational wealth.

“Multifamily” simply means multiple families dwelling in one building, such as apartment buildings.

Individuals, families and organizations can build generational wealth by investing in multifamily properties.

There are many benefits to investing in multifamily properties, especially considering:

There are many ways to invest in multifamily properties, including active investing, passive investing and debt investing.

An active investor goes out, sources great deals and purchases them.

A passive investor provides funds towards the purchase of the property and receives an ownership share of the building.

Finally, a debt investor provides the funds necessary for the purchase of a building as a loan over a defined period of time and receives interest payments.

As an active investor, you are responsible for identifying the right market and suitable properties in which you would like to invest.

The active investor also has to build the team necessary for the management of these big assets.

In a syndication model, the active investor:

Active investors are also responsible for making sure investors receive their promised returns.

The active investor typically owns 20-40% of the deal, and they receive a share of the cash flow from the building and any profits on exit based on their ownership share.

The passive investor is not involved in the day to day management of the asset.

Being a passive investor is ideal for busy professionals who are looking for stable alternative methods of investing.

Typically, passive investing works for investors who like the stability of real estate, but do not have the time to deal with the day to day management of big real estate assets.

The passive investor contributes money towards the purchase of these assets and receives a share of the entity which owns the asset.

As the income of the property grows, so does your investment. That’s because the value of these properties is based on income.

As a passive investor, it is not usual to earn 10-20% annual returns on your investment. In addition, you also receive multiple tax benefits derived from cost segregation studies and bonus depreciation. This can help erase any tax liabilities from all your passive real estate income.

Other savvy investors build and maintain generational wealth by being debt investors in multifamily properties.

Many savvy investors love multifamily assets because of the stability they can provide.

As a debt investor, you provide anywhere from 60 – 90% of the funds necessary for the purchase of multifamily assets as a loan, and receive an interest on the funds provided.

One huge advantage of being a debt investor is you occupy the first position on the capital stack, which means if something were to go wrong with the property, you are in the first position to get your money back.

This is usually done through family offices which are in charge of managing the wealth of wealthy families. Family offices love this type of investing because it is a good hedge against inflation as rent goes up with inflation, and the interest they receive helps their money grow.

Depending on what your goals are and where you are on your financial journey, you can use either one of these methods to grow and maintain generational wealth.

As the economy changes due to the COVID-19 pandemic, many other real estate classes are feeling the pinch but multifamily investing still remains strong.

This is consistent with what was seen in the 2008 recession as well. If you are looking for a great way to grow your wealth, multifamily investing is definitely one you should consider.

A word of caution however: it takes time to build generational wealth.

Multifamily investing is not a get rich quick scheme, so don’t expect to become a billionaire after your first investment. But due diligence coupled with hard work over time will produce exciting results.

If you’re ready to start investing in multifamily properties and grow your investment portfolio, click here to learn more about the process with XSITE Capital.

To purchase a home to flip, you’d have to put up all the capital (i.e. risk) yourself. You’d invest time and energy into flipping the house and be 100% responsible for all of the work. At the end of the day, you’ll probably make money, but it’s a one-time gain and is often taxed as ordinary income, not capital gains.

Also, consider that fewer and fewer millennials are buying homes, and boomers are moving into multifamily apartments and retirement communities at a rapid pace.

This means there are fewer buyers on the market and more renters.

What if there was a way to invest in real estate where you’d share the investment, get paid every quarter that cash flow was available AND be responsible for 0% of the effort to manage the property?

That’s what multifamily apartment investing is all about.

You make a one-time investment and get quarterly payments that are based on the building’s income and occupancy – not on neighborhood comps.

A professional team manages the building for you.

Plus, you get a huge tax advantage as a multifamily investor.

Even though you’re only putting down a percentage of the capital, you get pro-rated depreciation benefits on the apartment complex.

American entrepreneur and New York Times bestselling author Grant Cardone got his start with multifamily apartment investing and today he’s one of the most celebrated businessmen in the country.

In Cardone’s own words, “if you go into multifamily the right way, over the next decade it could be the best investment of your lifetime.”

After buying his first multifamily apartment building in the 90s, he learned what we already know so well:

Buying a single-family home is a liability that you pay every month. Buying a multifamily home is an investment that pays YOU every month.

If you’re ready to see what multifamily real estate could mean for you, click here to learn more!