For months now, we’ve been hearing the talk of a possible recession thanks to the current state of the market with high interest rates and inflation.

The word “recession” always tends to set off red alarms inside people’s heads making them ultra aware of where their money is going.

With price increases all across the board, including gas, groceries and of course real estate, some people are drawing back their spending, even in the realm of investing.

While we understand that everyone’s financial situation is different and making decisions that work best for you and your family is key, we also believe that uncertain times (such as a recession or an economic downturn) can be viewed as an opportunity.

It’s been said that more millionaires have been made in recessions and the reason for that is because there’s two types of people when things get tough:

Those who simply try to survive are the ones who let fear control their actions. They’re controlled by the thoughts of “what if ___ happens.” They cut back expenses, reminisce on the “better days” and go about each day just hoping for things to go back to “normal” without making any real changes.

But those who are determined to thrive see things as opportunities. They evaluate ways they can pivot to still see positive results. They don’t let the thought of how things used to be done drive their current actions. And most importantly, they accept that things are changing and fully embrace it.

None of this is to say that recessions and downturns aren’t devastating. History has shown that they are and it can absolutely take a toll on everyone, regardless of your situation.

The key, however, is that you get in the driver’s seat and decide how you’re going to let the inevitable affect you. No, you can’t control the market or the economy. But you CAN control your outlook, perspective, mindset and decisions that you make daily.

While we never fully know what to expect during times like this, here’s what we do know: recessions don’t last forever.

But your investments in the right things do.

As mentioned, when recessions and downturns strike, people start paying closer attention to their money and where it’s going.

The “survivors” might start to draw back in order to save what they have and “thrivers” typically start looking for opportunities to put their money into assets that will continue to work for them even after the downturn is over.

If you want to be among those “thrivers,” we encourage you to do the same!

With that said, a word of caution is necessary: not all investments are created equal.

Being able to discern which investments will have a positive impact for you is key and solid opportunities can usually be found when you:

When fear and uncertainty start to take over, a large majority of people will start running from certain things. And those things are what you want to pay attention to.

For example, a major thing that people press pause on during a recession is real estate. “It’s too risky,” they’ll say.

When that starts to happen, recognize that as a red flag and do your own research. Is it actually risky or are they simply letting fear control their thoughts and actions?

This isn’t the first time the world has experienced a recession or downturn. History has and will continue to repeat itself and this is good news for you because you have the opportunity to learn from it.

Do your research, look at numbers and determine what the outcomes were when it happened before. Let those facts help you make your decisions versus the opinions of people in the media.

The truth is that everyone will have a different point of view about what’s going to happen and what the outcome will be, but no one really knows. The best thing you can do is educate yourself based on your personal situation and make your decisions based on that and that alone

Similar to point 1, you not only want to pay attention to what people are running from, but also to what they’re running towards.

There will always be a new, trendy thing that promises the results you’re looking for that will grab hold of a group of people very quickly.

What comes to mind most recently are things like Crypto and Bitcoin. These concepts promised an easy way to invest and make money and ultimately didn’t provide the outcome that people were promised.

In situations like this, you’re typically better off with timeless options that have a track record of success, such as real estate and more traditional investing methods.

Historically, multifamily assets have shown to be recession resistant because, at the end of the day, people always need a place to stay.

When a recession hits, you often see that people start selling certain assets in order to boost their income and save cash.

Many times, one of the main things to go for people during a recession is their expensive mortgage, especially if they’re living above their means. When this starts to happen, the demand for apartment rentals or other multifamily properties tend to see a significant increase.

Additionally, recessions can make it more difficult for people to receive proper loans that they need to buy a house, so many people will be forced to continue renting.

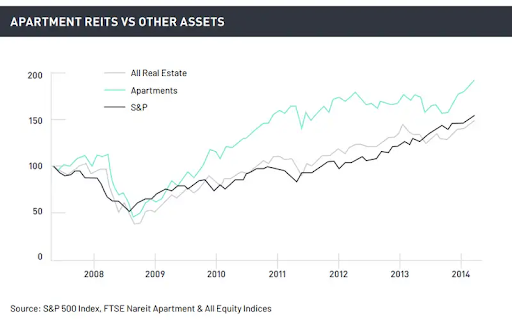

In fact, history has shown that even though the housing market overall tends to take a hit during economic downturns, rental markets remain steady and even outperform other investments.

While this may not be the ideal situation for the general population, this is good news for you if you choose to become a multifamily investor.

When you invest in anything, you want to know that you’re going to see a positive ROI and many people are shocked to hear that a recession can actually boost your cash flow.

Overall, a recession isn’t something that anyone wants to deal with, but it is in fact a reality that we all must face.

You get to choose how you approach it and our hope is that you see how it is possible to come out on the other side positively!

At XSITE Capital, we are here to help you navigate times like these and become a part of the group of people who thrive instead of just survive.

We’d love to connect with you and invite you into our community of investors who choose to see the good and take action towards the right things.

– The XSITE Capital Team