Did you know that March is National Credit Education Month? Many times people don’t pay enough attention to their credit until they want to make a big investment, such as purchasing a home or a car.

The only problem with not paying attention to your credit score regularly is that it’s not something that’s a quick fix, so if you wait until you want to make a large purchase and your credit score is lower than what it needs to be, you take the risk of delaying the process.

This is why learning about your credit score and working to raise it on a regular basis is so important, especially if you have the goal of investing in commercial real estate.

Similar to that of a regular real estate purchase, such as a single family home, your credit will help determine the loan amount that you qualify for and what kind of interest rate you receive.

To help you understand the ins and outs of your credit score, in this blog we’ll be covering what qualifies as good credit, how to repair bad credit and what role your credit plays in commercial real estate investing.

You probably already know that your credit score is made up of three little numbers that can make or break a lot of things for you in life, such as whether or not you can buy a car, a house, obtain a credit card or be approved for any type of loan.

The number ranges from 300-850 and it’s calculated by three major components, including your payment history, the amount of debt you have and the length of your credit history.

There are different scoring models that may take other information into consideration, but generally speaking, here’s the ranking:

The goal is to get your credit score as high as possible so that it falls into the “very good” or “excellent” range.

With that said, as long as your score is 670 and above, borrowers will typically qualify you as lower-risk and you can still be granted what you’re needing.

Anything below 670 usually shows a red flag for lenders and it may be harder to receive the loan that you’re seeking.

If you find that your credit score is falling below the “good” category, there are a few things you can do to repair your credit and get those numbers rising.

One of the first things you’ll want to do is run a credit report. This will show you everything that is impacting your credit and could even help you identify any errors that might be negatively affecting your score.

If there are no errors, this report will allow you to see exactly where you need to focus in order to get your score on the rise.

Once you know all of the things that are affecting your score, you want to work hard to get the amount that you owe down and usually one of the best ways to do that is to pay off your credit cards.

Credit card debt has a huge impact on your credit score, especially if you’re using a large portion of your available credit. The faster you can get your credit card debt down, the faster you’ll see your score start to rise.

In addition to paying down your credit card debt, you also want to pay your bills on time, every time! This directly impacts your credit because your payment history accounts for 35% of your score.

This is why it’s so important to set up an auto pay or create some sort of automation for yourself so that you never miss a payment and take the risk of lowering your score.

Aside from paying down your debts and paying your bills on time, you also want to consider how often you’re applying for new credit. Many people don’t realize that when you apply for a credit card, attempt to buy a car or even get pre-approved for a home purchase, these are all hard inquiries on your credit.

A hard inquiry is a necessary step from lenders to pull your credit report to evaluate your creditworthiness, but it can also drop your score 5-10 points. Not only that, but it can stay on your report for two years, which means it will have a lasting effect on your credit as a whole.

Now that you know what qualifies good credit and how to repair bad credit, let’s get into how your credit score impacts your ability to invest in commercial real estate.

You might be wondering why your personal credit matters when it comes to investing and the short answer is because your credit essentially tells somehow how creditworthy you are.

And all that means is your credit helps a lender see what kind of reputation you have when it comes to paying back loans.

You see, when you’re investing in commercial real estate, it’s rare that you’re going to have the amount you need to invest sitting in your bank account. Instead, you’re probably going to need some sort of loan so that you can invest a certain amount and eventually receive an ROI.

And while it’s true that the overall financing process is easier when it comes to commercial real estate, due to the fact that these properties are viewed as less risky by banks, you as the borrower still need to meet certain qualifications – and your credit is one of them!

If you have a score that’s on the lower end, your first step is working to raise it to at least 680 or above, so that you can easily get into the commercial real estate game without having to fight high interest rates on your loans.

Overall, your credit matters for so many things in life, including commercial real estate investing, so it’s best to keep an eye on your score on a regular basis and consistently work to keep it in the “very good” or “excellent” range!

– The XSITE Capital Team

P.S. If you have a solid credit score and are looking to get involved with commercial real estate investing, we invite you to join our XSITE Capital Investors Club!

Did you know that 66% of Americans set new years goals that are directly related to their finances?

Whether it’s paying off debt, generating more savings, implementing a budget or investing, more than half of the U.S. population have made plans to adjust their finances in the new year.

A recent study has shown that even though these financial goals are still being set in 2023, 81% of people believe that inflation and the overall state of the economy will make it much harder to meet these goals.

As you set your own goals for the new year, maybe you can relate.

You might wonder how you’re going to generate extra money to pay off debt. You may worry that you won’t be able to stay within your budget due to the high costs of everyday living.

You might think that investing isn’t an option because you need every extra dollar after expenses to go towards your savings. Or you might just be overwhelmed with finances in general and aren’t sure which actions to even take.

If this is you, you’re in the right place! At XSITE Capital, our mission is to educate and encourage people to make decisions that are best for them, specifically when it comes to multifamily real estate investing.

We believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

Last month on the blog, we addressed how interest rates, inflation and a possible recession can impact your commercial real estate investments so you can know what to expect with the ongoing economic changes.

With that, we also want to share three main reasons why commercial real estate IS still a good investment in 2023 so that you can take confident action as you work toward your financial goals this year!

The talk of a recession has been going on for a few months now and with a recession people tend to become very cautious about where they put their money.

This is totally understandable because you want to make sure you’re putting your money somewhere that is safe and will produce a quality return for you in the future.

While it’s true that a recession can negatively affect your investments, the good news is that when you invest in multifamily properties, you can rest easy knowing that your investment is protected.

Historically, multifamily assets have shown to be recession resistant because, at the end of the day, people always need a place to stay.

When a recession hits, there’s typically an influx of people selling their homes that they can no longer afford, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

This is good news for you as an investor in multifamily properties as this can boost the cash flow that you receive thanks to more tenants occupying the property.

Whether or not a recession will actually hit in 2023, we aren’t sure, but what we do know is that people are already taking precautions which means that the demand for rentals is already happening and now is a great time to get involved with investments of this type.

Many times when people think about investing, they jump straight to the stock market because they haven’t been properly educated on how real estate can be a quality investment as well.

The only real problem with solely investing in the stock market is that it can be very unpredictable and can take a massive hit at any given time, especially during economic downturns or world events.

Commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The main reason for this is because housing is and always will be a basic necessity that all people need. Because of this, you can trust that multifamily properties will continue to appreciate in value which ultimately means that you will receive more return on your investment.

This isn’t to say that investing in the stock market is bad. We encourage that too, but more than anything you want to make sure that your investments are diversified – meaning you have money in multiple places – so that if one takes a negative hit, you have the other to fall back on.

One of the biggest challenges that people often face in real estate in general is the ability to receive the funds they need to purchase or invest in a property.

This can become even more difficult when the economy is in a downturn because banks become more strict with their loan process and have more requirements than you might typically see.

While this can cause difficulty for you if you were to purchase a single-family home, there is a much easier financing process when it comes to commercial real estate.

Banks can confidently predict that the cash flow of a multifamily property with multiple tenants will be consistent and steady versus a property that only houses an individual or one family.

What this means for you as an investor is that the bank doesn’t look at solely your income to grant you the loan. Instead, they will look at the details, history and projections for the property so they can accurately gauge the return.

This is why getting involved in deals that have been thoroughly researched and scouted for you is so important and is the very reason that we take our property selection process so seriously at XSITE Capital.

Linking arms with an investment group that takes the time to ensure a property will be lucrative is your best bet to receive a healthy ROI and that’s exactly what we do through our Investor’s Club!

So, if you have big financial goals in 2023 and are looking for ways to make them come to life with ease, we invite you to join us.

When you join the XSITE Investor’s Club, you will receive:

Overall, we’re here to empower and support you in your personal journey!

Here’s to 2023. 🎉

– The XSITE Capital Team

Interest rates, inflation and a recession have been the talk of the country for a large portion of 2022 and as a commercial real estate investor, it’s important that you know what each of these economic hits can mean for you and your investments.

As an investor, interest rates, inflation and a recession all play a huge role in your current and future investments so it’s important that you understand the basics of each and how exactly they all work together so you can remain confident in how you handle your money.

First things first, let’s talk about interest rates.

Throughout the year, interest rates have been ebbing and flowing and each week it seems like we’re seeing something different.

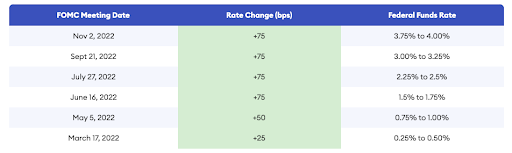

The Fed introduced its first rate hike in March of 2022 and they have continued to raise the rate from there.

As an investor, it’s important to pay attention to interest rates because they directly affect how much money you can borrow and ultimately determine how much you will end up paying back in the future.

Simply put, the interest rate is the amount you are ultimately charged for borrowing money and it’s shown as a percentage of the total amount of the loan.

This is why when interest rates are low, people are typically more quick to invest. When interest rates are high, on the other hand, people tend to become a bit more wary and start to consider if the investment is worth the extra amount of money they’ll owe towards their loans.

So, what exactly causes interest rates to rise?

The main cause of rising interest rates is inflation and inflation happens whenever there’s a high demand for products and services from consumers. This demand causes prices to rise and this concept is commonly referred to as demand-pull.

Another reason that inflation can occur is what they call cost-push. This is when supply costs to create products or deliver services forces prices to rise.

When inflation occurs, we typically see a few things start to happen:

Inflation is also directly linked to a recession, which means that people become very wary of where their money is going.

The good news for you as a commercial real estate investor is that your investment is typically recession resistant in this industry.

The reason being is because one of the main things to go for people during a recession is their expensive mortgage, especially if they’re living far above their means, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

Additionally, recessions can also make it more difficult for people to receive proper loans that they need to buy a house, so many people will be forced to continue renting.

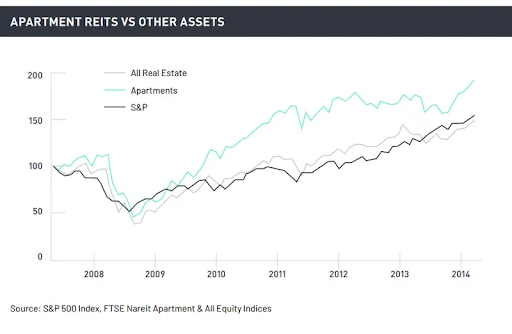

In fact, history has shown that even though the housing market as a whole tends to take a hit during economic downturns, rental markets remain steady and even outperform other investments.

Essentially, rising interest rates, inflation and a recession can actually boost the cash flow that you receive from your current commercial real estate investments thanks to more tenants occupying the property.

So, what does this mean for your future investments?

Now that you know how your current commercial real estate investments can be affected by interest rates, inflation and a recession, you might be wondering how those three things can affect your future investments, as well.

The biggest challenge that high interest rates can cause for new commercial real estate deals is that the supply can decrease during economic downturns.

It’s for this reason that we always encourage investors to join a trusted Investor’s Club like XSITE Capital’s so that you aren’t having to do the up front research for new deals on your own.

Instead, you can sit back and know that other people are doing that work for you so that you can invest your money into a deal that has been heavily researched and you can trust that you will see a healthy ROI.

Another challenge that high interest rates and inflation can present for new investments is that the financing process may be a bit more difficult than usual.

Generally speaking, the financing process for commercial real estate is much more simple than if you were to invest in single-family properties because these investments aren’t as risky for banks.

The reason for this is because banks can confidently predict that the cash flow will be consistent and steady for a property with multiple tenants versus a property that only houses an individual or one family.

However, during economic downturns banks can become a bit more wary with how they loan their money, so you can expect the financing process to be a bit more challenging during tough economic times.

With that, you still have a much greater chance of getting approved for what you need for commercial real estate investments versus single family properties, so don’t let this challenge steer you away.

Overall, investing in commercial real estate specifically during economic downturns is still a smart move.

In fact, it’s been said that most millionaires are MADE during recessions and the reason for that is because when most people become fearful and stop spending their money, other people use this time as an opportunity to invest their money into places that will perform higher when the economy returns to normal.

While investing during economic downturns is encouraged, it’s important to remember that not all investment opportunities are created equal. For example, the stock market can be a bit unpredictable during this time, but commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The reason for this is because housing will always be a basic necessity and properties will continue to appreciate in value. This is great news for you as an investor and can give you peace of mind when it comes to where you’re putting your money.

As you continue to navigate the economic changes, we encourage you to join the XSITE Capital Investors Club so you can be among the first to get access to new commercial real estate deals and be among the few who use this time as an opportunity to thrive rather than just survive.

We’re here to support you along the way!

– The XSITE Capital Team

Did you know that not all apartment investments are created equal?

In this post, we discuss why investing in multifamily apartments is so valuable, but it’s important to know that there are different commercial real estate asset classes and you want to make sure you’re choosing to invest in the class that’s best for YOU specifically!

Keep reading to learn about the different classes of multifamily apartment investments so you can strategically add to your investment portfolio.

Class A apartments are newer (<20 years old) and they offer high-end finishes like granite countertops, stainless steel appliances, and hardwood floors.

With this class of properties, maintenance is also performed immediately.

Class A properties are conveniently located in cities near mass transit or downtown hot spots that typically attract affluent renters with high price tags.

Bottom Line: Class A Properties typically have low cash flow compared to high initial investment. The cash flow is highly sensitive to recessions (when tenants will often move to Class B or Class C Apartments). Traditionally, only accessible to Institutional Buyers.

Class B apartments are between 20-40 years old and offer standard furnishings like laminate countertops and black/white appliances.

With this class of properties, there is often some deferred maintenance.

Bottom Line: Class B Properties typically have Cap Rates of 5%-6% and there’s a higher cash flow than Class A. Open to Private Buyers as well as some Institutional Buyers.

Class C apartments are typically much older than the other two classes – at least 35 years old.

These type of properties are in constant need of maintenance and are often located in less desirable locations.

Bottom Line: Class C properties typically have Cap rates between 6%-8%. With these, there are lots of value-add opportunity for investors and there are high cash flows due to low initial investment, but lower cash flow in the long run.

Note: We do not recommend Class D / Warzone Apartments, which are often risky and have very heavy management load.

Double-digit returns are quite common for multifamily investments, as long as you choose the right opportunity for your liquidity requirements, cash flow needs, and available investment capital. It is important to work with your financial advisors and investing team to make sure potential investments are a good match for you.

Are you ready to join a community of knowledgeable investors? Click here to join the XSITE Investor’s Club!