Did you know that 90% of the world’s millionaires have built their wealth by investing in real estate?

At some point in your life, you’ve probably heard it said that real estate is one of the best things to invest in because on both sides, commercial and residential, you’re investing in something with the confident expectation that you will receive more money back later down the road.

While it’s true that real estate can be one of the best ways to grow your wealth, the problem is that many people are missing the information and education to really do it well.

And that’s where we come in!

Our mission at XSITE Capital is to educate and encourage all who qualify to passively invest in multifamily real estate so they can take advantage of the benefits that this asset has to offer.

Regardless of your race, current resources or access, we believe that everyone deserves the opportunity to learn and take action on the things that will better their present life and future dreams.

We ultimately believe that through proper education, exposure and encouragement, our investors will have an equal opportunity to grow their mind and grow their wealth, which will positively impact generations to come.

Wherever you come from, you are welcome here!

With that said, over the years we’ve adopted 5 principles that guide us forward as a team and help form long-term relationships with our investors.

Both of these principles combined make up the foundation of how we work!

We believe these two things are truly the cornerstone of any successful business and we’re committed to upholding the highest standards of honesty and integrity in all our dealings.

Honesty involves transparency and truthfulness in all interactions, from communication with customers to internal operations as a team. It establishes trust and fosters long-term relationships.

Meanwhile, integrity involves upholding strong moral principles, ensuring that actions align with ethical standards, and taking responsibility for decisions and their consequences.

Together, these principles create a foundation of credibility, reliability, and respect within the business, forming the basis for a solid reputation and sustainable success.

In business, there are of course going to be challenges that come your way.

But instead of viewing challenges as setbacks, we choose to see them as opportunities and stepping stones for the growth that we ultimately desire.

Growth mindset involves the belief that abilities and intelligence can be developed through dedication and hard work, fostering a passion for learning and resilience in the face of challenges.

Additionally, abundance mindset focuses on the belief that opportunities and resources are not finite, encouraging a mentality of collaboration, sharing, and a proactive approach to creating new possibilities.

Together, these mindsets fuel a culture of continuous improvement, adaptability, and a proactive outlook that empowers individuals and the business to thrive in a rapidly changing landscape.

We’ll be honest and say it: real estate isn’t for the faint of heart.

It requires hard work, dedication, and the motivation to KEEP GOING even when times feel hard or confusing.

At XSITE Capital, we don’t let any of those things scare us away and even in the hard times we stay on mission and laser focused with the bigger picture in mind.

That’s what it means to have tenacity. It’s about relentless determination and perseverance to pursue goals despite obstacles or setbacks.

It’s the unwavering commitment to pushing forward, adapting strategies, and remaining resilient in the face of challenges.

Tenacity is the driving force that propels individuals and businesses toward their objectives, even when the path is fraught with difficulties.

It fuels the willingness to learn from failures, adjust approaches, and keep moving forward, ultimately leading to success through persistence and resilience.

We stay the course, steadfast in our commitment to achieving our goals.

In business, when you start experiencing success, it can be easy to get caught up in your wins and forget what got you there.

At XSITE Capital, despite our achievements, we remain grounded. We listen, we learn, and we evolve. This is what it means to keep humility at the center of who you are.

Humility involves a genuine recognition of one’s limitations, an openness to learning from others, and a willingness to acknowledge and value different perspectives.

It fosters a collaborative and inclusive environment, where individuals are receptive to feedback, open to new ideas, and willing to work cooperatively towards common goals.

It’s the quality that keeps egos in check and allows for continuous improvement, making it an essential trait for building strong relationships and a healthy work culture!

And lastly, at XSITE Capital, we’re not afraid to break the mold!

We’re innovators, trendsetters, and completely unafraid to stand out in the crowd.

We constantly strive to bring fresh, innovative approaches to the table, challenging the status quo in pursuit of excellence.

In the world of business, there are a lot of people out there doing the same or very similar things to us – and that’s okay.

But we’re dedicated to doing it OUR way, in a way that serves our community of investors like never before.

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

Here are a few ways you can learn and connect with us:

Every month on the blog, you can find a new blog post that answers the questions that many people don’t talk about when it comes to investing in commercial real estate.

Our goal is to make things as simple as possible for you so that you can easily understand the benefits waiting for you on the other side.

In addition to the blog posts each month, we like to get face to face with you and provide valuable, free education.

Monthly meetups feature talks from the XSITE founders in addition to other trusted and highly sought after industry leaders to educate on various topics.

Past meetup topics have included:

All monthly meetups are totally free and anyone is welcome to join!

For all monthly meetup information, CLICK HERE.

Are you struggling with underwriting deals and evaluating potential investments? This bi-weekly underwriting class event hosted at 8pm EST on Tuesday evenings is just what you need to take your skills to the next level. Led by XSITE team member, Emanuel Awasom, this event will provide a comprehensive deep-dive into underwriting, from the basics to the most advanced techniques.

Investors of all levels are encouraged to join, from beginners looking to build a strong foundation to experienced investors seeking to refine their underwriting skills.

To register for the Underwriting Class, CLICK HERE.

Looking for more personal and professional development?

Subscribe to our exclusive LinkedIn newsletter featuring monthly stories and strategies for personal and professional growth.

Our annual e-book is another free resource that anyone can download that aims to dive deeper into one topic regarding investing in commercial real estate.

CLICK HERE to grab the 2023 copy!

We’re excited to announce the launch of ‘Multifamily 101’, our latest initiative designed to guide you from being a beginner investor to mastering the art of managing a $168 million real estate portfolio.

Multifamily 101: Your Pathway to Mastery in Real Estate Investment

‘Multifamily 101’ is not just a course; it’s a comprehensive system that provides the knowledge and tools necessary for acquiring real estate properties with ease and maximizing returns. We’re offering this transformative experience in three distinct formats:

1:1 Mentorship: Dive deep into the world of real estate investment with personalized guidance from the XSITE Capital founders themselves. Tailored to meet your individual needs, this mentorship is an opportunity to gain insights from seasoned professionals and accelerate your growth.

Group Coaching (Starting January): Join a community of like-minded individuals and learn together. Our group coaching sessions are interactive, collaborative, and focused on shared learning and growth in the realm of real estate investment.

Self-Paced Digital Course: Prefer learning at your own pace? Our digital course covers everything you need to know about multifamily real estate investing. It’s comprehensive, accessible, and designed to fit into your busy schedule.

We have a few exclusive spots remaining for our 1:1 mentorship and group coaching programs. Don’t miss this unique opportunity to learn directly from the founders of XSITE Capital and significantly accelerate your path to financial success in real estate.

Overall, we are committed to providing relevant and valuable information and education for those who are interested in experiencing financial freedom and creating legacy wealth through multifamily real estate investing.

We are glad you’re here!

– The XSITE Capital Team

Multifamily real estate syndication is an investment strategy that allows individual investors to pool their resources and collectively invest in larger-scale multifamily properties.

Through this investment strategy, you can diversify your investment portfolio and earn passive income along the way.

The multifamily syndication process involves five key phases, from initial acquisition to the eventual exit strategy.

To help you fully understand the entire multifamily syndication process, this blog post will explore each phase in detail!

The first phase of any multifamily syndication is deal sourcing and acquisition.

At XSITE Capital, we use a strategic process to find the best properties within the best markets. This process includes examining the rent growth in the area, sales trends, employment opportunities and the supply to ensure that the market would be lucrative.

During this phase, our team conducts thorough market research to analyze various conditions so that we can fully assess and properly ensure that the property has positive financial ability.

Once a suitable property is identified and researched, we begin negotiating the purchase price, securing financing and finalizing the acquisition.

Once we acquire the property, that’s where our investors come in!

In this stage, the syndicator, like XSITE Capital for example, presents the investment opportunity to their investor community by outlining the property’s key details, financial projections and expected returns.

Interested investors can then commit capital to the syndication, becoming limited partners in the venture.

As investors choose to be involved with the deal, the syndicator ensures proper legal documentation, subscription agreements and investor communications are in place before accepting capital contributions.

Once all capital is raised for that specific deal, the syndicator can then transition into the property management and value-add creation phase.

During this stage, the syndicator oversees the day-to-day operations of the property, including tenant management, maintenance, rent collection and expense optimization.

This is one of the largest benefits for investors in multifamily deals because as an investor, you don’t have to be directly involved with any day-to-day operations when you partner with an investment group.

Instead, you invest your capital front, trust that the rest is taken care of for you and still get to reap the passive benefits.

In addition to the day-to-day operations of the property, syndicators also typically implement a value-add strategy, such as property renovations, amenity enhancements or operational improvements to increase the property’s value and rental income.

The syndicator’s goal during this phase is to enhance the property’s performance and generate attractive returns for all investors involved.

Throughout the entire syndication, investors will receive ongoing communication and regular updates so that they are fully aware of what’s happening with the property and how it’s performing.

When you partner with an investment group like XSITE Capital, you can expect consistent communication that includes details about property performance, financial statements, occupancy rates and any significant developments or challenges.

The final phase of a multifamily syndication is the exit strategy and capital distribution.

This stage involves carefully planning and executing the syndicator’s strategy for selling the property and distributing profits.

The exit strategy may include selling the property outright, refinancing to access equity or executing a 1031 exchange to defer capital gains taxes.

Once the property is sold, the syndicator distributes the profits to the investors according to the terms outlined in the syndication agreement.

This phase marks the close of the investment and investors can choose to reinvest their returns into subsequent syndications or pursue other investment opportunities.

Investing in multifamily real estate is one of the best ways to diversify your investment portfolio and earn passive income.

When you partner with experienced syndicators, such as XSITE Capital, you can trust that the market research is carefully considered and that your money is going toward investments that will produce positive returns.

If you’re unsure of how to get started with multifamily real estate investing, click here to view our process!

The XSITE Investors Community is for accredited investors where you can receive:

Today, XSITE Capital currently has over $168 million portfolio value, has helped empower and grow over 1,000 minds and proudly has over 800 doors under management.

We welcome new investors into our community each week and would love to have you.

For months now, we’ve been hearing the talk of a possible recession thanks to the current state of the market with high interest rates and inflation.

The word “recession” always tends to set off red alarms inside people’s heads making them ultra aware of where their money is going.

With price increases all across the board, including gas, groceries and of course real estate, some people are drawing back their spending, even in the realm of investing.

While we understand that everyone’s financial situation is different and making decisions that work best for you and your family is key, we also believe that uncertain times (such as a recession or an economic downturn) can be viewed as an opportunity.

It’s been said that more millionaires have been made in recessions and the reason for that is because there’s two types of people when things get tough:

Those who simply try to survive are the ones who let fear control their actions. They’re controlled by the thoughts of “what if ___ happens.” They cut back expenses, reminisce on the “better days” and go about each day just hoping for things to go back to “normal” without making any real changes.

But those who are determined to thrive see things as opportunities. They evaluate ways they can pivot to still see positive results. They don’t let the thought of how things used to be done drive their current actions. And most importantly, they accept that things are changing and fully embrace it.

None of this is to say that recessions and downturns aren’t devastating. History has shown that they are and it can absolutely take a toll on everyone, regardless of your situation.

The key, however, is that you get in the driver’s seat and decide how you’re going to let the inevitable affect you. No, you can’t control the market or the economy. But you CAN control your outlook, perspective, mindset and decisions that you make daily.

While we never fully know what to expect during times like this, here’s what we do know: recessions don’t last forever.

But your investments in the right things do.

As mentioned, when recessions and downturns strike, people start paying closer attention to their money and where it’s going.

The “survivors” might start to draw back in order to save what they have and “thrivers” typically start looking for opportunities to put their money into assets that will continue to work for them even after the downturn is over.

If you want to be among those “thrivers,” we encourage you to do the same!

With that said, a word of caution is necessary: not all investments are created equal.

Being able to discern which investments will have a positive impact for you is key and solid opportunities can usually be found when you:

When fear and uncertainty start to take over, a large majority of people will start running from certain things. And those things are what you want to pay attention to.

For example, a major thing that people press pause on during a recession is real estate. “It’s too risky,” they’ll say.

When that starts to happen, recognize that as a red flag and do your own research. Is it actually risky or are they simply letting fear control their thoughts and actions?

This isn’t the first time the world has experienced a recession or downturn. History has and will continue to repeat itself and this is good news for you because you have the opportunity to learn from it.

Do your research, look at numbers and determine what the outcomes were when it happened before. Let those facts help you make your decisions versus the opinions of people in the media.

The truth is that everyone will have a different point of view about what’s going to happen and what the outcome will be, but no one really knows. The best thing you can do is educate yourself based on your personal situation and make your decisions based on that and that alone

Similar to point 1, you not only want to pay attention to what people are running from, but also to what they’re running towards.

There will always be a new, trendy thing that promises the results you’re looking for that will grab hold of a group of people very quickly.

What comes to mind most recently are things like Crypto and Bitcoin. These concepts promised an easy way to invest and make money and ultimately didn’t provide the outcome that people were promised.

In situations like this, you’re typically better off with timeless options that have a track record of success, such as real estate and more traditional investing methods.

Historically, multifamily assets have shown to be recession resistant because, at the end of the day, people always need a place to stay.

When a recession hits, you often see that people start selling certain assets in order to boost their income and save cash.

Many times, one of the main things to go for people during a recession is their expensive mortgage, especially if they’re living above their means. When this starts to happen, the demand for apartment rentals or other multifamily properties tend to see a significant increase.

Additionally, recessions can make it more difficult for people to receive proper loans that they need to buy a house, so many people will be forced to continue renting.

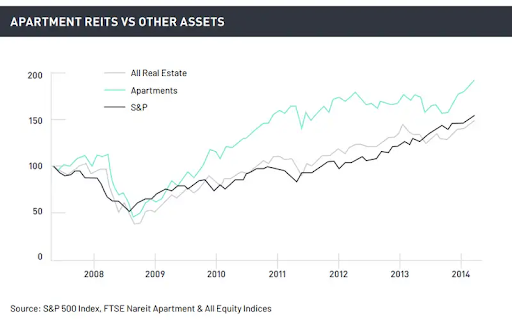

In fact, history has shown that even though the housing market overall tends to take a hit during economic downturns, rental markets remain steady and even outperform other investments.

While this may not be the ideal situation for the general population, this is good news for you if you choose to become a multifamily investor.

When you invest in anything, you want to know that you’re going to see a positive ROI and many people are shocked to hear that a recession can actually boost your cash flow.

Overall, a recession isn’t something that anyone wants to deal with, but it is in fact a reality that we all must face.

You get to choose how you approach it and our hope is that you see how it is possible to come out on the other side positively!

At XSITE Capital, we are here to help you navigate times like these and become a part of the group of people who thrive instead of just survive.

We’d love to connect with you and invite you into our community of investors who choose to see the good and take action towards the right things.

– The XSITE Capital Team