THE VUE AT ST.ANDREWS

Location: Columbia, SC

Target Returns: 16% to 18% Annually

Actual Returns: 29.97%

Target Hold Period: 5 Years (Sold in 21 months)

LAND BANK LOFTS

Location: Columbia, SC

Target Returns: 18% to 22% Annually

Acquired: April 2022

Target Hold Period: 7 Years

101 ELLWOOD

Location: Baltimore, MD

Target Returns: 18% to 20% Annually

Acquired: December 2022

Target Hold Period: 3-5 Years

ELEVATE ON MAIN

Location: Granger, IN

Target Returns: 17% to 20% Annually

Acquired: July 2021

Target Hold Period: 5 Years

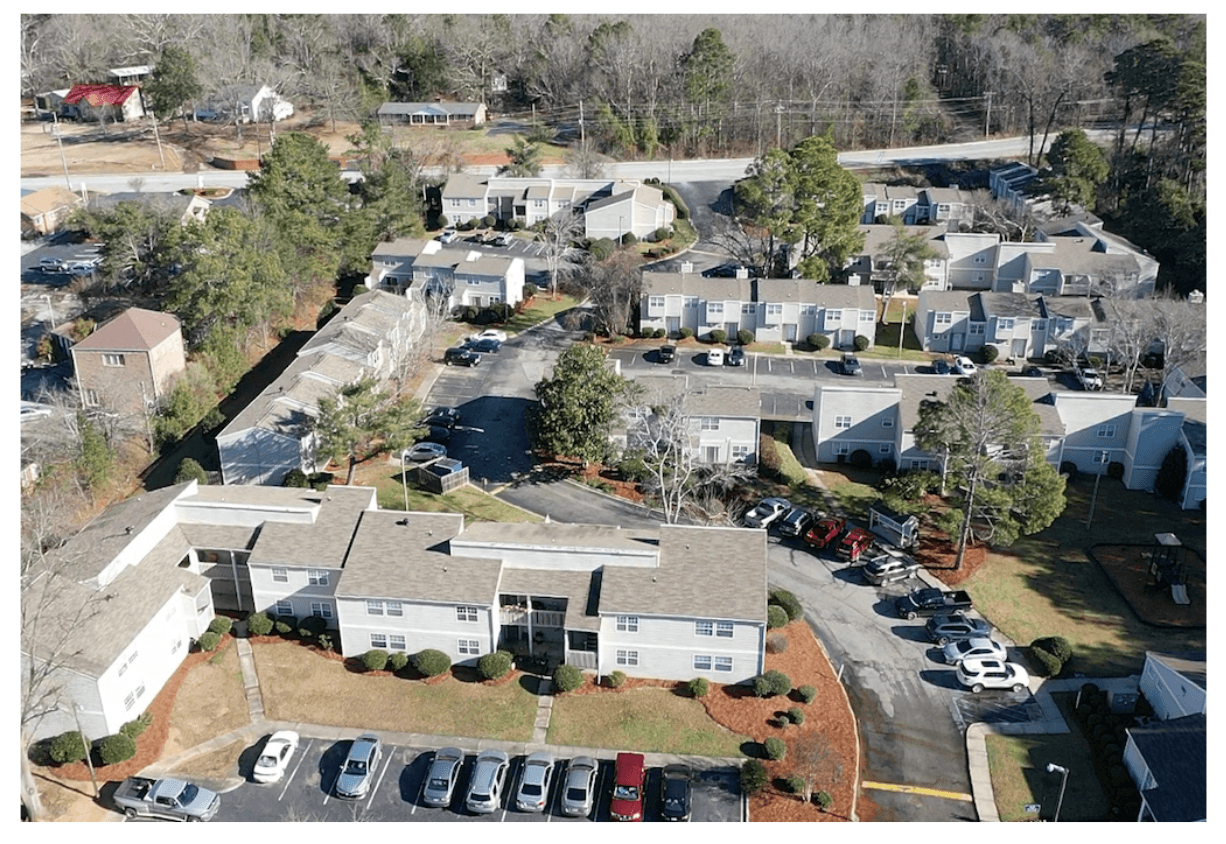

ASCEND

Location: Stone Mountain, GA

Target Returns: 18% to 20% Annually

Acquired: November 2022

Target Hold Period: 5 Years

THE GRIFFIN AT PETWORTH METRO

Location: Washington, D.C

Target Returns: 20% to 25% Annually

Acquired: July 2020

Target Hold Period: 7 Years