Interest rates, inflation and a recession have been the talk of the country for a large portion of 2022 and as a commercial real estate investor, it’s important that you know what each of these economic hits can mean for you and your investments.

As an investor, interest rates, inflation and a recession all play a huge role in your current and future investments so it’s important that you understand the basics of each and how exactly they all work together so you can remain confident in how you handle your money.

First things first, let’s talk about interest rates.

Throughout the year, interest rates have been ebbing and flowing and each week it seems like we’re seeing something different.

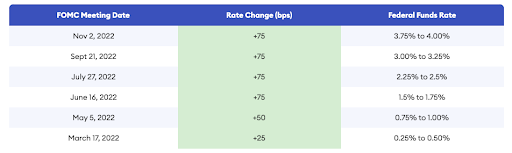

The Fed introduced its first rate hike in March of 2022 and they have continued to raise the rate from there.

As an investor, it’s important to pay attention to interest rates because they directly affect how much money you can borrow and ultimately determine how much you will end up paying back in the future.

Simply put, the interest rate is the amount you are ultimately charged for borrowing money and it’s shown as a percentage of the total amount of the loan.

This is why when interest rates are low, people are typically more quick to invest. When interest rates are high, on the other hand, people tend to become a bit more wary and start to consider if the investment is worth the extra amount of money they’ll owe towards their loans.

So, what exactly causes interest rates to rise?

The main cause of rising interest rates is inflation and inflation happens whenever there’s a high demand for products and services from consumers. This demand causes prices to rise and this concept is commonly referred to as demand-pull.

Another reason that inflation can occur is what they call cost-push. This is when supply costs to create products or deliver services forces prices to rise.

When inflation occurs, we typically see a few things start to happen:

Inflation is also directly linked to a recession, which means that people become very wary of where their money is going.

The good news for you as a commercial real estate investor is that your investment is typically recession resistant in this industry.

The reason being is because one of the main things to go for people during a recession is their expensive mortgage, especially if they’re living far above their means, which means that the demand for apartment rentals or other multifamily properties will see a significant increase.

Additionally, recessions can also make it more difficult for people to receive proper loans that they need to buy a house, so many people will be forced to continue renting.

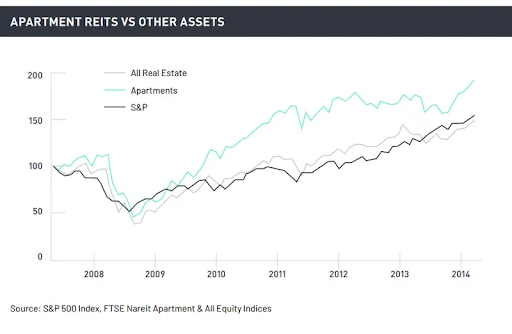

In fact, history has shown that even though the housing market as a whole tends to take a hit during economic downturns, rental markets remain steady and even outperform other investments.

Essentially, rising interest rates, inflation and a recession can actually boost the cash flow that you receive from your current commercial real estate investments thanks to more tenants occupying the property.

So, what does this mean for your future investments?

Now that you know how your current commercial real estate investments can be affected by interest rates, inflation and a recession, you might be wondering how those three things can affect your future investments, as well.

The biggest challenge that high interest rates can cause for new commercial real estate deals is that the supply can decrease during economic downturns.

It’s for this reason that we always encourage investors to join a trusted Investor’s Club like XSITE Capital’s so that you aren’t having to do the up front research for new deals on your own.

Instead, you can sit back and know that other people are doing that work for you so that you can invest your money into a deal that has been heavily researched and you can trust that you will see a healthy ROI.

Another challenge that high interest rates and inflation can present for new investments is that the financing process may be a bit more difficult than usual.

Generally speaking, the financing process for commercial real estate is much more simple than if you were to invest in single-family properties because these investments aren’t as risky for banks.

The reason for this is because banks can confidently predict that the cash flow will be consistent and steady for a property with multiple tenants versus a property that only houses an individual or one family.

However, during economic downturns banks can become a bit more wary with how they loan their money, so you can expect the financing process to be a bit more challenging during tough economic times.

With that, you still have a much greater chance of getting approved for what you need for commercial real estate investments versus single family properties, so don’t let this challenge steer you away.

Overall, investing in commercial real estate specifically during economic downturns is still a smart move.

In fact, it’s been said that most millionaires are MADE during recessions and the reason for that is because when most people become fearful and stop spending their money, other people use this time as an opportunity to invest their money into places that will perform higher when the economy returns to normal.

While investing during economic downturns is encouraged, it’s important to remember that not all investment opportunities are created equal. For example, the stock market can be a bit unpredictable during this time, but commercial real estate on the other hand has proven to be trustworthy decades after decades and remains fairly stable regardless of the economic state.

The reason for this is because housing will always be a basic necessity and properties will continue to appreciate in value. This is great news for you as an investor and can give you peace of mind when it comes to where you’re putting your money.

As you continue to navigate the economic changes, we encourage you to join the XSITE Capital Investors Club so you can be among the first to get access to new commercial real estate deals and be among the few who use this time as an opportunity to thrive rather than just survive.

We’re here to support you along the way!

– The XSITE Capital Team